With each worm of dollar that wriggles free of the Ghana’s debt can of worms, which currently lies open at the mercy of creditor nations, the average Ghanaian agonize in extreme poverty and despair.

Accumulation of excessive debt is the genesis of Ghana’s economic woes which has torn apart the citizenry and jeopardized many dreams of Ghanaians and further extended the poverty line. However, in the midst of this glaring consequences of irresponsible debt accumulation, President Nana Addo and the finance minister Ken Ofori-Atta turned deaf ears to the warnings as they continue to pile the country’s debt stock.

Just in four months, Ghana’s public debt increased by a fifth, driven partly by the inclusion of short-term loans from the central bank to the state.

According to the Bank of Ghana (BoG), Ghana’s public debt, which excludes state-owned enterprises obligations, rose to 569.3 billion cedis ($49.7 billion) at the end of April. The figure was adjusted to include the central bank’s overdraft to the government, which was securitized in December 2022.

The debt figure as of December rose to 473.2 billion cedis after the adjustment, from an earlier estimate of 434.6 billion cedis, according to the central bank’s summary of economic and financial data. Obligations as a ratio of gross domestic product declined to 71.1% in April from 77.5% in December.

The situation is dire because of the huge interest rate that comes with each millions of dollars or cedis borrowed.

Recently, leaders of several global financial bodies warned that rising interest rates are increasing pressure on low-income developing countries, with Ghana inclusive, around 60% of which are now in or at high risk of debt distress.

Of course, public debt burdens in the country has been exacerbated in recent years by back-to-back global crises, with Russia’s invasion of Ukraine coming on the heels of the Covid-19 pandemic, while many heavily-indebted nations are also dealing with idiosyncratic pressures from climate events or conflict.

Aggressive Monetary Policy By BoG

The Central Bank of Ghana has tightened monetary policy aggressively over the past year in order to rein in soaring inflation. A lot of the debt accrued by Ghana is due and others over the next couple of years, however, the rising interest rates mean the country will find it increasingly difficult to meet its repayments, hence the debt restructuring idea.

Ghana, which defaulted on a eurobond payment earlier this year, is restructuring most of its debt to make it sustainable under a $3 billion International Monetary Fund program, which was approved in May.

The country completed the first part of a domestic debt exchange in February, with investors exchanging 87.8 billion cedis in obligations for new securities that paid as little as 8.35%, versus an average of 19% on the old notes.

Investors also face reduced coupons as restructuring of $1.5 billion domestic dollar bonds and cocoa bills started on July 14. The country is still in talks with local pension funds to revamp their 29 billion-cedi government bond holdings aside ongoing discussions with bilateral and eurobond holders to reorganize obligations.

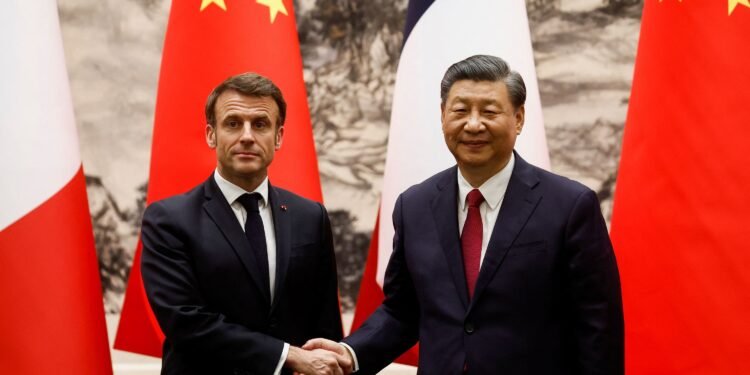

Meanwhile the G-20 Common Framework, an initiative endorsed by the Paris Club — the group of officials from major lending countries tasked with finding solutions for debtor countries, was established in late 2020 to offer additional support in the form of grants to countries with unsustainable debt.

Ghana in January became the fourth country to seek debt treatment under the Common Framework, alongside Chad, Ethiopia and Zambia.

Yet the implementation, in practical terms, has not been smooth. Zambia, which also became the first African country to default in 2020 after the onset of the pandemic, complained earlier that it was being “punished” in the debt restructuring process because its two main creditors, international bondholders and China, had failed to reach an agreement.

After the bouts of restructuring, there was some sort of breathing space as the budget deficit in the first five months of the year dropped to 1.8% of GDP from 4.2% a year ago; the primary balance improved to a deficit of 0.7% of GDP from 1.2% deficit.

However, with the economic managers refusing to learn their lessons and bent on borrowing more and more for consumption instead of capital goods, the country will continue to wallow in cyclical debt spiral.

READ ALSO: Akufo-Addo Endorses Cecilia Dapaah’s Act Of Corruption- Bawah Mogtar