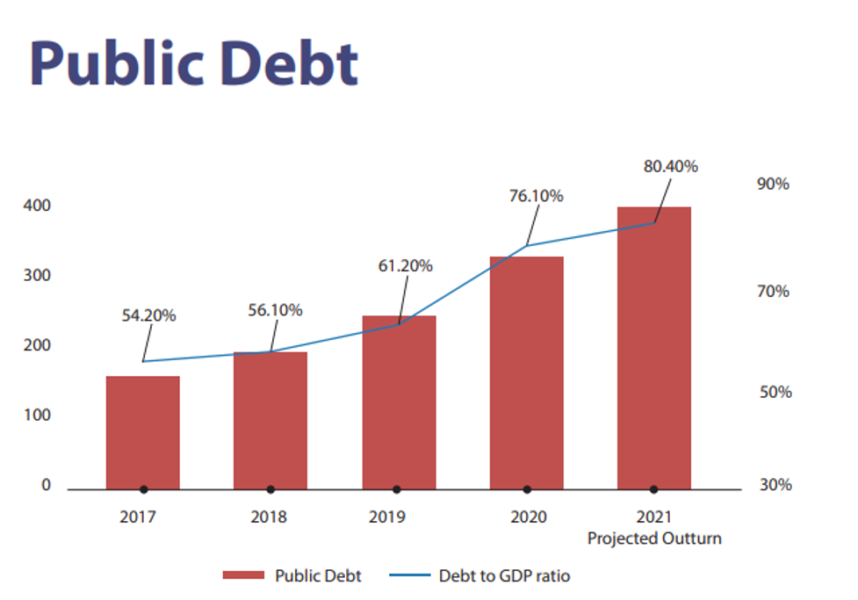

Asset management company, Tesah Capital, has expressed concerns over Ghana’s bulging public debt stock which it expects to continue its elevated path until the end of the year.

Tesah Capital expects public debt as a ratio of GDP to hit 80.4 percent by the end of 2021, up from its current level of GH¢341.8 billion, pegged at 77.8 percent of the country’s total output at the end of September 2021.

Of the total debt, Tesah Capital disclosed that domestic debt will amount to GH¢185 billion, representing 52.3 percent of GDP while external debt will amount to GH¢169 billion, representing 47.7 percent of GDP.

In its review of the 2022 budget statement and economic policy, Tesah Capital noted that the projected 7.4 percent fiscal deficit for 2022 will further increase the public debt stock.

“The expected fiscal deficit of GH¢35.11 billion will increase the public debt to GH¢395.81 billion. The rising inflationary risk in advanced economies implies that the government will face an increased cost of financing the debt through international debt markets.

“This suggests that the government is likely to continue with the trend of using the domestic debt market to finance a larger portion of the public debt. Increased borrowing in the local debt market could lead to an increase in interest rates and crowd out the private sector from the loan market”.

Tesah Capital

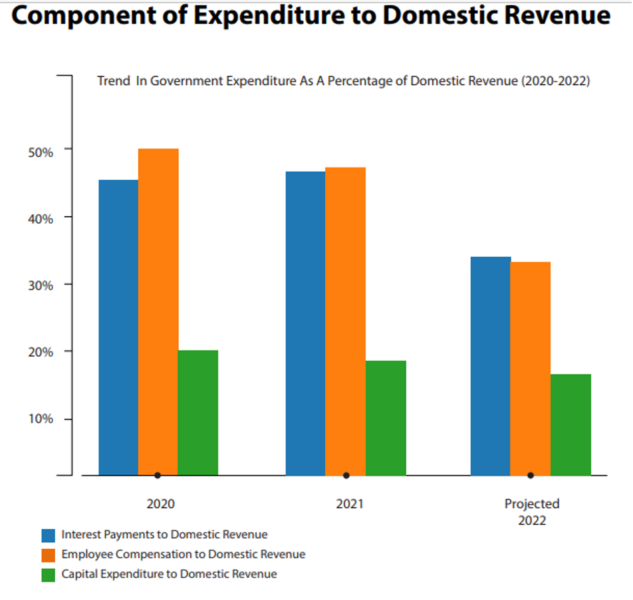

Interest payments and employee compensation to decline

Tesah Capital’s forecasts show that Interest payments, employee compensation and capital expenditure, as components of domestic revenue, will decline marginally in 2022.

According to Tesah Capital, interest payments, employee compensation and capital expenditure over the last three years have been a major drainer of domestic revenue, averaging 43 percent, 45 percent and 19 percent respectively.

“However, their component of domestic revenue is expected to decline from 47%, 48% and 18% in 2021 to 38%, 36% and 16% in 2022 respectively”.

Tesah Capital

The expected marginal decline in these components of government’s expenditure, Tesah Capital said, is as a result of the relatively higher projected growth in domestic revenue (30.5%) compared to projected growth in Interest payments (13.1%), employee compensation (7.9%) and capital expenditure (22.3%).

Projected total expenditure for the 2022 fiscal year (including payments for the clearance of arrears) is GH¢137.5 billion, equivalent to 27.4 percent of GDP.

The expenditure estimate for the 2022 fiscal year represents a growth of 23.2 percent above the projected outturn of GH¢111.6 billion, equivalent to 25.3 percent of GDP for 2021.

Key drivers of expenditure growth in 2022 include capital expenditure, funding of key government flagship programmes, wage bill and interest payments.

Projected 42.9% increment in revenue necessary for debt sustainability

Regarding the government’s revenue expectations for the coming year, the Asset Management Company (AMC), described as “bold and necessary for debt sustainability”, government’s plan to raise GH¢100.5 billion as total revenue for the 2022 fiscal year.

According to Tesah Capital, the projected revenue which represents a 42.9 percentage points increment (GH¢30.5 billion) on the 2021 revenue outturn of GH¢70.34 billion, will increase the revenue generation capacity of the country.

The projected revenue increment, the company believes, is necessary given that the country has long suffered from narrow revenue mobilization due to the existence of a large informal sector.

“The country depends largely on indirect taxes and import income from few primary commodities; though direct taxes as a share of total taxes witnessed some improvement from 42% in 2017 to 50% in 2020. Revenue targets have been missed for most of the years, from 2017 to 2020, highlighting the weakness in revenue forecasting capacity”.

Tesah Capital

The government is hoping to achieve its projected 42.9 percent revenue increment through the introduction of the electronic transaction levy (E-Levy), the 15 percent increment in government services, reintroduction of the 3 percent Flat Levy, and improved collection of property rates. The government’s resolve to pass the tax exemptions bill in 2022 to check revenue leakages is also one of the steps to increase revenues.

READ ALSO: 34 Omicron Variants Cases Detected in Ghana