According to two sources with direct knowledge of the Ghana’s framework talks with the Paris Club of creditors, Ghana’s bilateral lenders are discussing the formation of an official creditor committee, a first step needed to engage in debt relief talks for the crisis-hit West African Country.

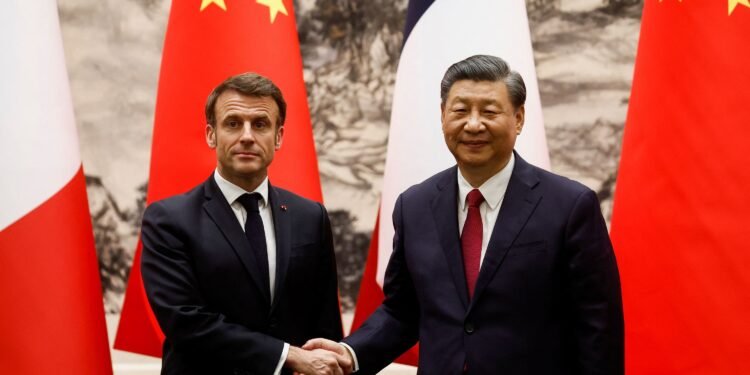

The Paris Club of creditor nations has contacted other bilateral creditors, such as China, to engage on forming the committee and deciding who would chair it, one of the sources said. “Hopefully, it should be resolved soon,” a second source added, without providing detail on the timing.

The West African country in January became the fourth nation to apply to the common framework platform, an initiative of Group of 20 major economies launched in 2020 to streamline debt restructuring efforts for poorer countries.

China is Ghana’s single biggest bilateral creditor with US$1.7 billion of debt, while Ghana owes US$1.9 billion to Paris Club members, according to data from the International Institute of Finance. China represents around 80% of non-Paris Club debt. The country’s total external debt is US$28.4 billion.

Common Framework Talks

An official creditor committee is a key step for Ghana to formally seek financing assurances from bilateral creditors stating they are willing to enter a debt rework process. Without these assurances, the International Monetary Fund’s (IMF) executive board would delay the programme’s approval and, in consequence, money disbursements.

Meanwhile, Ghana’s decision to suspend overseas debt payments in late 2022 reflects the parlous state of its economy, which included the government reaching a US$3 billion staff-level agreement with the IMF.

The Ghanaian government stated that it hopes for a rapid debt overhaul, though other countries undergoing common framework treatment have faced slow progress.

Zambia– Africa’s first COVID-19 pandemic-era sovereign default, requested Common Framework treatment in February 2021 but the committee was only formed last May when the creditors agreed that China and France would co-chair the group. A first meeting of the committee was held in June, though there is still no resolution.

A refusal by bond investors to grant debt relief to the government of Zambia sets the tone for tough restructuring negotiations with a diverse range of creditors from pension funds in Europe to state-owned Chinese banks that Zambia owes almost $12bn.

Chad also became the first country to ask for a debt overhaul under the common framework in January 2021, but a deal was reached only in November 2022 and without providing debt relief. And Ethiopia’s efforts to negotiate its debt with bilateral creditors under the G20 platform have been delayed due to the civil war there, and the country is now engaging with the IMF staff on a formal programme amid a peace deal.

The Paris Club (French: Club de Paris) is a group of officials from major creditor countries whose role is to find co-ordinated and sustainable solutions to the payment difficulties experienced by debtor countries. As debtor countries undertake reforms to stabilize and restore their macroeconomic and financial situation, Paris Club creditors provide an appropriate debt treatment.

The Paris Club has 22 permanent members, including most of the western European and Scandinavian nations, the United States, the United Kingdom, and Japan. The Paris Club stresses the informal nature of its existence. As an informal group, it has no official statutes and no formal inception date, although its first meeting with a debtor nation was in 1956, with Argentina.

READ ALSO: Gains from MTN Ghana and Total Lift the Local Bourse