The impact of the COVID-19 pandemic on various economies will definitely go down in history to have been a period full of economic mysteries than any other period— especially in comparison to the 2007/2008 global financial crisis, although triggered by different proximate causes.

The fast spread of the COVID-19 virus everywhere across the globe, early in 2020 was veiled with a plethora of uncertainties— ranging from the unknown cause of the virus to the unknown means of spread of the virus.

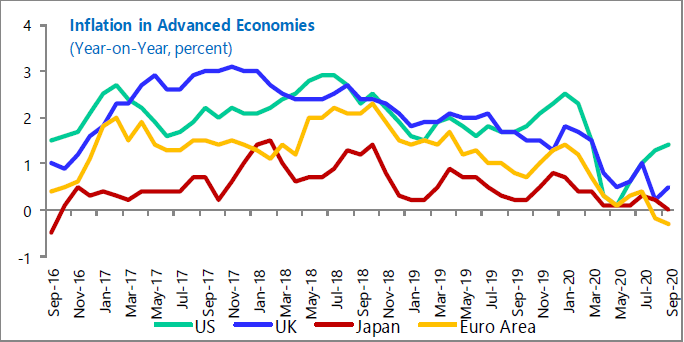

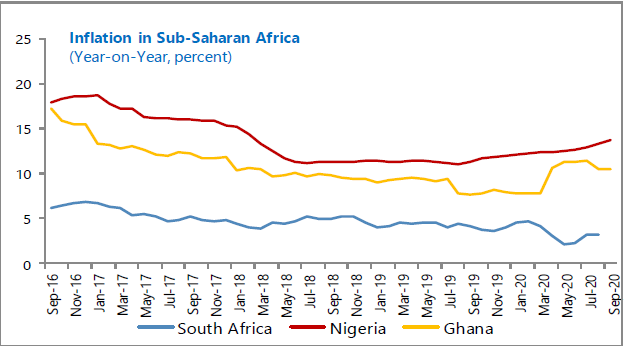

Although, these uncertainties lingered, one thing was certain; the possibilities of a slowdown in economic activity leading to a potential recession. While expectations of a recession in both the developed and developing world occurred as projected, inflation forecasts assumed divergent behaviors (i.e. average inflation rate kept falling below targets in developed economies like the US, and most of Europe and remained consistently above target in developing economies, especially in most sub-Saharan countries like Ghana) from March to September 2020.

Inflation Trends in Advanced Economies

Inflation Trends in Sub-Saharan Africa

Inflation Dynamics

Inflation is said to occur as a result of persistent rise in general price levels within a particular period of time. The pass through effect of price pressures during crisis situations such as this presupposes that, where lockdowns are triggered within countries, inflation is expected to slow down or fall (disinflation) due to the overall decline in economic activity, as consumers keep their wallets closed and the reverse occurs where lockdowns are eased.

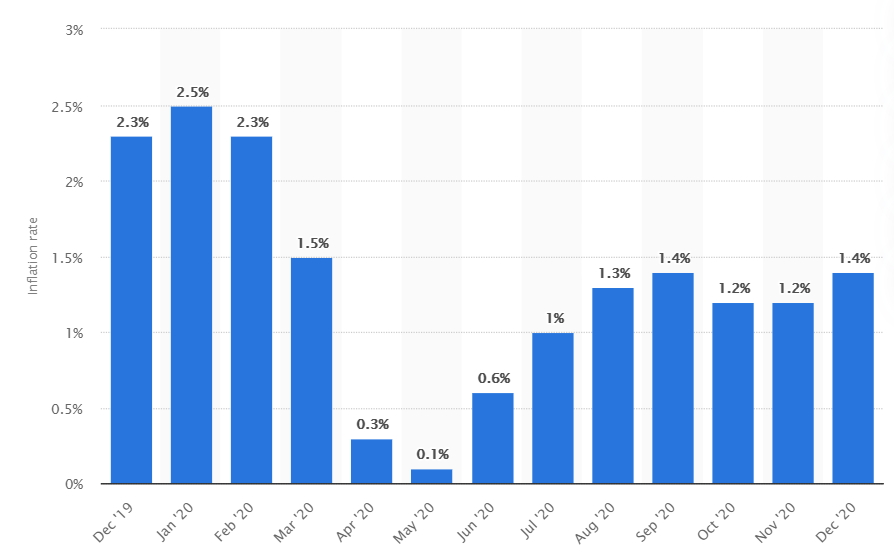

However, inflation kept falling in the US, Japan and Euro area, for example, even to negative rates (deflation) in some months when lockdowns were eased, especially in the Euro Area. US annual inflation rate fell in March 2020 by 1.5 percent and also to a near 0 percent in May 2020. Average inflation rate between March 2020 and September 2020 dropped by 0.9 percent, a figure below the Fed’s inflation target of 2 percent in September 2020.

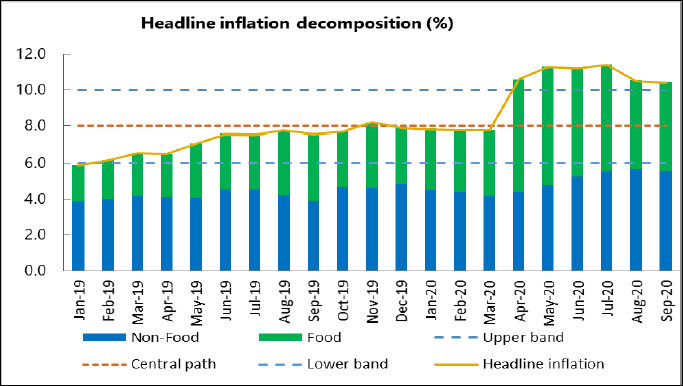

This was not so, compared with the behavior of inflation in Ghana. From the onset of the lockdown in March 2020 to September 2020, inflation trended upwards averaging 10.5 percent, a little above the higher band of 10 percent. Inflation rate increased to a record high of 11.4 percent in July 2020.

Obvious concerns during periods of recession just as last occurred during the 2007/2008 global financial crisis, warranted unusual responses from Central Bank’s and Governments, both in developed and developing economies. These actions were to stimulate the rather falling economic activity in those economies that were badly hit.

Similarly, in 2020, stimulus packages by governments were provided to support businesses and households, Central Banks trimmed down interest rates. The US Fed cut interest rates to zero while interest rate was eased to 14.5 percent by the Bank of Ghana among other monetary and fiscal responses. Therefore, almost similar actions were taken across the world to reduce the impact of the pandemic on economies. These responses coupled with the ease in lockdown triggered a gradual rebound in economic activity earlier than anticipated in Ghana and kept inflation still high, but not so for the US and other developed economies.

Chart of Inflation in the US

Chart of Inflation in Ghana

Again, we find divergent outcomes in trends of inflation and economic activity due to three major differences between the developed (US) and developing countries (Ghana) namely; expectations of inflation, structural factors and uncertainties due to resurgence of virus spread.

Inflation Expectations

The relation between inflation and economic activity declined due to inflation expectations. Although, monetary stimulus was high in the US, inflation expectations was relatively low due to the fact that inflation had stayed relatively low over the decade, hence, consumers anticipated that inflation would continue trending downwards. Also, this was due to the credibility of the Fed to keep short term interest rates below the inflation target. However, in Ghana, inflation was above the target largely due to the expected supply shocks when the lockdown was instituted. Albeit, after the lockdown was eased, these supply-side shocks persisted thus leading to moderately high expectations in inflation on the average.

Structural factors

The low inflation was also due to structural factors in the US. The dominance of market shares by large firms with high profit margins in developed economies meant that they could absorb higher costs without raising prices. Therefore, Covid-induced costs were largely not translated to consumers. However, in Ghana, where most businesses are mainly MSME’s, COVID induced costs were going to be transferred to consumers thus the averagely high inflation. Also, volatility in oil prices and supply shocks due to border closures contributed to the relatively high inflation rates. Also, the governments’ uncontrolled spending during the period after the lockdown also contributed to the moderately high inflation.

Resurgence of Virus spread

Uncertainties pertaining to the resurgence of the COVID-19 pandemic, and the unavailability of vaccines kept consumer spending low in developed economies thus leading to the persistent fall in prices. In developing economies such as Ghana, an ease in the lockdown was simply a time for hard-hit households to catch some breadth again by going about their activities without much expectation of a resurgence within the period after the lockdown was eased. While supply chains were disrupted, thus food materials were priced high during the period leading to the rise in inflation.

As the developed world gets vaccinated, uncertainties that surrounded the spread of the virus have begun to wane and thus economic activity has begun picking up. This trend is likely to increase prices, and even beyond target levels in the developed world. In developing countries, where COVID vaccines are yet to be made available, these difficulties highlighted are yet to be contained. Better handling of new strains of the COVID-19 virus and the arrival of the vaccine accompanied with prudent macroeconomic measures will lead to a much more stable inflation in 2021.

READ ALSO: Slight ease in inflation, not a sign for cheer yet; it’s early days.