Ghana’s Inflation rates has marginally dropped from 10.4% in December 2020 to 9.9% in January 2021, according to latest data released by the Ghana Statistical Service.

This implies that the average change in the general price level of goods and services was relatively low in January 2021 as compared to December 2020.

Inflation rates has over the years proven to have a strong correlation between interest rates and basically, the transmission mechanism through which inflation affect interest rate is through the nominal interest rate.

Nominal interest rate is the composition of real interest rate plus inflation. In other words, real interest rate is the interest adjusted for inflation. Banks however, use nominal interest rate which encompasses inflation. This is simply because, high inflation may erode the real interest rate charged on loans. Hence, all things being equal, high inflation will result in high interest charged on loans and vice versa.

Additionally, high inflation also reduces the purchasing power of money as the value of goods and services surges, thus, more money is needed to maintain the same level of goods and services demanded. The opposite is also true. Therefore, there will be more demand for credit as a result of high inflation will cause interest rate to increase and vice versa

Impact of inflation on interest rates

Speaking in an interview with the Vaultz News, the Chief Executive Officer of the Ghana Association of Bankers, Mr. John Awuah, confirmed that inflation does have an impact on interest rates.

He said just like any other price, interest is also a price on loans hence, changes in the general price level will also cause a change in the interest rate.

“Yes of course. Inflation does affect interest rates. Inflation is basically the persistent increase in the general price level. Lending rate is the price charge on loans, so when there is a change in the general prices, the lending rate is equally adjusted to accommodate the change in the value charge on loans,” he said.

Mr. John Awuah explained further that inflation and interest do move the same direction, however, the magnitude of change may vary from one bank to the other.

“So, you can see that lending rate which is also a price move, in the same direction as inflation; as to the magnitude, it varies across banks that’s why when you check the data, you will see average lending rate, not specific lending rate which basically tells you that the specific lending rate varies across banks due to several factors. However, the Ghana reference rate serves as the benchmark on which the lending rate is pecked.”

As expressed by Mr. Awuah, inflation and interest rate move in the same direction, therefore a drop in inflation is expected to a cause marginal decline in interest rate. However, the degree of this decline may vary from bank to bank.

Trends in Inflation in Ghana

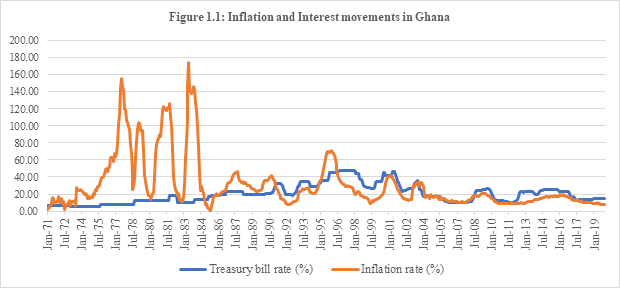

In Ghana, both inflation and interest rate movements have seen considerable volatilities during the regimes of monetary-targeting (MT), inflation-targeting (IT) and the periods prior as shown in Figure 1.1.

A perusal of the figure above reveals three main patterns on the historical relationship between inflation and interest rate in Ghana. First, there is a wide variation in inflation as compared to interest rate over the period from January 1971 to December, 2019. Evidently, the highest and lowest inflation rates (interest rates) are 174.14% (47.93%) and 1.14% (7.25%) for the respective periods of June 1983 (December 1997) and May 1985 (August 1975).

Second, the variation in inflation during the pre-IT regime is significantly higher as compared to that during the post-IT period. For instance, the maximum and minimum inflation rates recorded in post-IT (pre-IT) period are respectively 20.74% (174.14%) in June 2009 (June 1983) and 7.60% (1.14%) in September 2019 (May 1985). Clearly, inflation rate movements volatilities are lower for post-IT as compared to the pre-IT periods suggesting significant improvement in controlling inflation rate movements volatilities with IT relative to MT and the other monetary policy regimes.

Again, it can be observed that in inflation and interest rate partly move in the same direction since the inception of the inflation-targeting (IT) regime by the Bank of Ghana. Furthermore, the marginal drop in inflation is coming at a time when yield on Treasury bills (which is the short-term interest) has been falling albeit marginally, and which is consistent with the historical data.

Therefore, since inflation rate moves in the same direction with the short-term interest rate, and now that both variables have recorded a dip, is it valid for borrowers to expect lower interest rates from banks? This is one major que.

Read also: Several factors account for discrepancy between Policy Rate and Lending rate – John Awuah