Ghana’s finance ministry has stated that negotiations on the terms of a domestic debt exchange agreement with local pension funds will continue, despite protests from some pension groups in the country.

The finance ministry, meanwhile, bemoaned the low participation of the public in the debt exchange program, noting that it is delaying the process. The ministry, thus, assured that the document would be made public once an agreement on the details is reached.

“Where participation in the domestic debt exchange is too low, the perennity of the Government’s efforts to resolve the current crisis and the expected international financial support would be jeopardized. This would put further strains on the Government’s capacity to honour its commitments and repay its debt.”

Finance Ministry

The finance ministry of Ghana is in the midst of economic turmoil and debt restructuring. The government, in a bid to mitigate the ongoing economic crisis, has negotiated a staff-level agreement for a $3 billion loan package from the International Monetary Fund (IMF). The deal will only be approved by the IMF board if Ghana undergoes comprehensive debt restructuring, the fund has said.

Groups Resist Inclusion of Pension Funds in Debt Restructuring

So far, six labour unions have kicked against imposing cuts on pension funds as part of the debt exchange programme aimed at supporting the country’s economic recovery. They include: Ghana National Association of Teachers (GNAT), Ghana Registered Nurses and Midwives Association (GRNMA), the National Association of Graduate Teachers (NAGRAT), Ghana Medical Association (GMA), Ghana Chamber of Commerce and the Trades Union Congress (TUC).

The unions vowed to resist any attempt by the government to reduce the value of pension funds of their members which are in institutional bonds. They explained that the Tier-3 Pension Scheme and the Ghana Education Service Occupational Pension Scheme (GESOPS), run for its members, were initiatives taken by the association to better the lives of its members in active service, and retirement and intended to make its members live meaningfully. They are of the view that including it would be suicidal for members both in active service and retirement.

In addition, at a press conference in Accra, President of NAGRAT, Angel Carbonu, warned that if the government proceeds with its plan, union and other labour unions in the country would embark on an industrial strike.

“We enter into a contractual agreement that I am buying bonds at ‘X’ percent. So, I have informed the beneficiaries that I have bought bonds on their behalf at this rate. All of a sudden, government who is the party on the other side of the agreement comes to say, for me, this is what I can pay, take or leave it.

“This will not be accepted, NAGRAT and other teacher unions do not accept this. We are members of the forum made up of the public sector unions and we want to assure our members that we will resist this move by the government.”

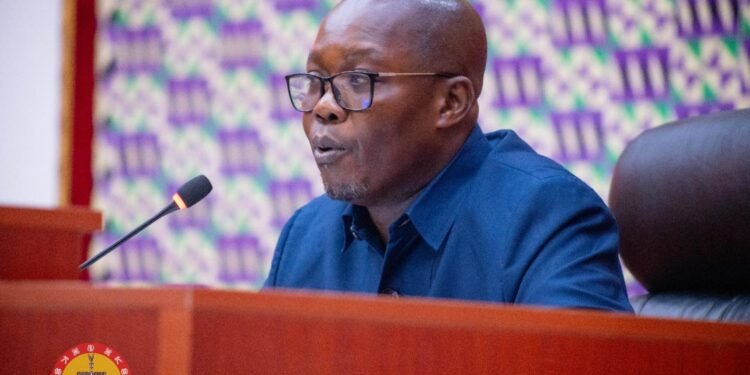

Angel Carbonu

Echoing similar views, the GMA, said the debt restructuring programme would have a negative impact on its members’ pension funds and healthcare delivery in the country.

The GMA was also concerned about the negative effect of the debt exchange programme on private health facilities, private health insurance and mutual schemes that have invested heavily with Government of Ghana bonds.

Meanwhile, pension funds are a collection of contributions from individuals. By design, they are meant to protect the vulnerable during retirement.

In early December, the finance ministry launched a plan to exchange local bonds for longer-dated maturities, which included pension funds. But after the deal met stiff opposition, the government said it would exempt pension funds from the restructuring program.

Later on December 24, it extended the deadline for the exchange to Jan. 16 from Dec. 30, having previously extended it from Dec. 19. It also announced a change to the debt exchange, with eight additional instruments to be created.

Ghana’s public debt was 467.4 billion cedis ($46.7 billion) in September 2022, of which 42% was domestic debt, according to the most recent central bank figures. Ghana also requested a restructuring of its bilateral debt through the Common Framework platform set up by the Group of 20 major economies.

READ ALSO: Ghana’s Inflation Rate Surges to a Staggering 54.1%