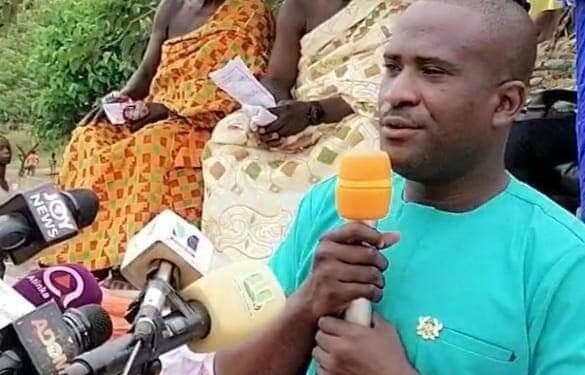

Prof. John Gatsi, an Economist and the Dean of the School of Business at the University of Cape Coast has hinted that a very difficult fiscal situation awaits the country in 2021.

Speaking in an interview, he intimated that this is very much anticipated due to the kind of expenditure incurred especially, in the past six months which have not aligned with budget provisions, for the most part.

This he said, in reaction to a statement made by the governor of the Bank of Ghana, Dr. Ernest Addison during the just recent MPC press briefing that, the country’s debt stock is somewhat justifiable due to the government’s provision of social interventions to households. Although, he raised concerns about their sustenance into 2021.

According to him, the country’s current debt level is not in any way justifiable. He explained that, by and large, these kind of expenditures throughout this period have been masked with electioneering undertones (i.e. for the purpose of informing the choice that voters make). And that, they would not be available to citizens after the elections.

“If you go throughout the country, many parliamentary candidates and their key members are going around distributing money. Is it not the case that, part of the money that we are complaining about is what is in their hands that they are distributing?”

“So, what the governor is saying is that those things are only available because of the elections, so when the election is over you would not get them again.”

Furthermore, he explained that there is no grounds for justifying long-term borrowing for consumption. Long-term borrowing is only justifiable when such is used for strategic infrastructure for the country, and that is how economies develop, he emphasized.

“If you are justifying that people have COVID-19 related issues and because of that they are suffering and we are given these monies, to a large extent the money is not available to the general population, the money is available to people that identify with the government, or if they believe that giving you the money will make you vote for them. So, the money is not largely about trying to sustain businesses.”

More so, the country has not invested in more productive activities that would help generate revenue for the servicing of loans. Thus, the space for the payment of loans is tight, he reiterated.

Essentially, a chunk of the composition of government’s expenditure in 2021 consists debt servicing and payment of emoluments leaving only little space for revenue-generating expenditures.

Ghana’s debt management strategy unsustainable

Considering recent debates on whether Ghana should opt for a downgrade from a lower middle-income status into a developing country status. Prof. Gatsi argued that it is not permissible, neither is it a good sign of proper management of a country that has achieved lower middle-income success to choose a downgrade.

However, he argued that much of this decision depends on the “orientation and psyche of the managers of the economy.” Aside this, he mentioned that the results of Monday’s election would largely determine what path to head towards.

According to him, “we would see the full picture of the economic management of the country after the exit, if the governing party loses. And again, if the governing party wins, then we will know the direction they would like to go.”

The government’s mandate is to utilize its debt efficiently, so that it can be repaid with time. However, if more than half of the debt is spent on recurrent expenditure which is quite questionable, then obviously the country’s debt has not been managed well, he argued.

“So, if your aim is to use your debt for consumption, even if you downgrade yourself to a developing country status, so that you could qualify for concessionary borrowing, you would still not sustain your debt because your orientation to debt management is bad.”

He further argued that, the debt accumulation of the country is not changing anytime soon, and this cycle that has been created may continue if the governing party wins. However, when the opposition party wins, then we would expect a different strategy.

“The history of engagement in economic management for this country has been that, always when a governing party is exiting during the transition arrangement, you would get to know the true picture. So, what we are claiming to be bad, you would see a worsening picture during the transition, that would define what the new government should be doing.”

Strategies to raise revenue in the short-term to fund 2021 expenditures

Prof. Gasti also mentioned that the best solution in the short-term, going into 2021 is to become moderate. “But again, finding an alternative solution in the short-term is not possible, since whatever effect we are talking about today is a policy outcome and some of these policies have been implemented since 2017.”

So, if a government has used four years to implement a debt management strategy that has not been sustainable, then it is not appropriate to suggest that there would be any short-term solution to be implemented, he maintained.

For him, the governing party, if maintained would resort to more borrowing.

READ ALSO: Government’s freebies are deferred payments- Economist