Customers of telecommunication companies in the country are yet to feel the impact of the reduction in the Communications Services Tax (CST) announced by the government last year.

A survey conducted by the Research Department of The Vaultz Media (TVM) found 78 percent of respondents indicating that even though they are very much aware of the reduction in the CST, they do not see it reflecting in their data usages. Only 10.8 percent of the respondents sampled indicated that they have seen some improvements in the data packages provided by the telecom companies in the country.

Figure 1: Impact on data packages resulting from tax reduction

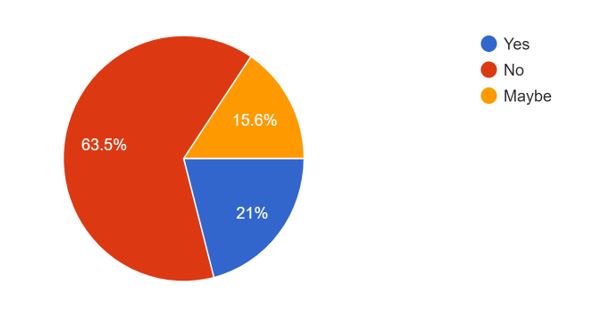

A similar trend was observed when the respondents were quizzed on whether they see an increment in the duration of their calls after the reduction was announced. 63.5 percent of the respondents said they do not see that their talk time has increased after the tax reduction was announced last year.

Only 21 percent of the respondents said they could see an increment in the number of minutes they talk when they purchased a particular amount of airtime after the tax was reduced. However, 15.6 percent of the respondents said they are not sure as to whether there is a change in the duration of their calls after the reduction in the communication tax.

Figure 2: Impact on talk time resulting from tax reduction

The majority of the respondents sampled (56.3%) for the survey were users of Mobile Telecommunication Network (MTN), followed by Vodafone (28.7%), Airteltigo (14.4 %), and the remaining 0.6 % were users of Glo and Surf line.

Figure 3: Share of telecom networks used by respondents

These statistics perfectly mirrors the dynamics in the telecommunication industry in the country. Data from the National Telecommunications Authority as of August 2020, showed that the market share of MTN was 58.4%, followed by Vodafone (20.4%), AirtelTigo (19.50%), and Glo Mobile with 1.87 percent.

With regards to the awareness of the reduction of the CST, the current survey shows that majority of Ghanaians are aware of the reduction. Sixty-five (65%) percent of the respondents said they were aware as against 35 percent that responded in the negative.

Whilst the sample may not be representative enough of the total subscribers of the various telecommunication networks in the country, the current survey provided some information on the impact of the reduction of the tax on customers. This should call for further research by the National Telecommunications Authority, using a larger sample size to test the recent findings to take the appropriate steps to ensure value for money for the customers.

The Telecommunication sector is one of the sectors that benefited significantly as a result of the outbreak of the coronavirus. With lockdowns and other restrictions in place, it became practically impossible for people to move about to transact. Digitization became the norm and almost all sectors of the economy had to move online. This reflected in the rise of data usage in the country as confirmed in March 2020 by the Chief Executive Officer of MTN Ghana, Selorm Adadevoh.

The Minister of Finance, Mr. Ken Ofori-Atta, announced the reduction in the Communication Service Tax (CST) from 9% to 5% when he presented the mid-year budget review in Parliament on July 23, 2020.

The reduction which took effect on 15th September 2020 was to enable people, businesses, and households to communicate effectively using information, communication, and technology tools to operate in the wake of the Coronavirus pandemic.

The Communications Service Tax (CST) is one levied on charges for the use of communications services that are provided by electronic communications service providers. CST is imposed under Section 1 of the Communications Service Tax Act 2008, (Act 754) and CST(Amendment) Act, 2013 (Act 864). It is paid by consumers to the communications service providers, who in turn pay all CST collected to the Domestic Tax Revenue Division of the Ghana Revenue Authority every month. The GRA is required under the law, to pay the CST collected into the Consolidated Fund.

At least 20% of the revenue generated from the CST is used by the government to finance the National Youth Employment Programme (NYEP) in particular and support the national development agenda of the country in general.

The introduction of the CST coincided with the removal of import duty, VAT, and National Health Insurance Levy (NHIL) on the importation and sale of telephone sets including mobile or cellular phones and satellite phones. This has the effect of reducing the cost of telephone sets and generally mitigating the tax burden that may result from the introduction of the CST.

READ ALSO: Telcoms Chamber commends government on reduction of communication service tax