The International Monetary Fund (IMF) has disclosed that boom in crypto and crypto related activities will present new financial stability challenges to the global economy.

Crypto assets, according to the IMF, offers a new world of opportunities which helps to conduct financial transaction in a more advanced way.

“Quick and easy payments, innovative financial services, inclusive access to previously unbanked parts of the world, all are made possible by the crypto ecosystem.”

International Monetary Fund

However, with opportunities comes associated challenges and possible risks. Crypto despite its popularity and wide adoption for electronic transactions, comes with its own problems.

“The latest Global Financial Stability Report describes the risks posed by the crypto ecosystem and offers some policy options to help navigate this uncharted territory”.

International Monetary Fund

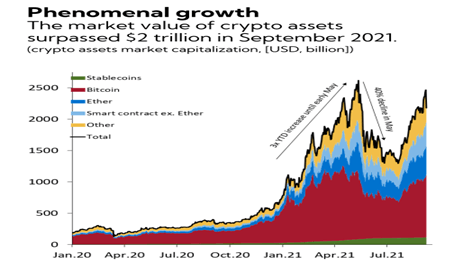

According to the IMF, the total market value of all crypto assets as of September 2021, summed up to over US$2 trillion.

The crypto ecosystem continues to flourish, as the number of exchanges, miners, digital wallets and stablecoin issuers keep increasing.

A lot of these digital entities that engage with crypto assets, the IMF stated, lacks agile “operational, governance, and risk practices”.

“Crypto exchanges, for instance, have faced significant disruptions during periods of market turbulence. There are also several high-profile cases of hacking-related thefts of customer funds.”

International Monetary Fund

So far, these incidents that have impacted the crypto ecosystem have not had a significant impact on financial stability, the IMF unveiled.

However, as crypto assets become more mainstream, their importance in terms of potential implications for the wider economy is set to increase.

Crypto adoption consequences

Adoption of crypto assets have been predominant in most developing countries as well as some advanced economies.

Recent crypto operations have been prohibited by the central bank of People’s Republic of China and the central bank of Nigeria (CBN), in view of the roll out of the central banks’ digital currencies.

“Although the extent of the adoption of crypto assets is difficult to measure, surveys and other measures suggest that emerging market and developing economies may be leading the way.”

International Monetary Fund

With regards to the potential financial stability challenges, the adoption of crypto assets can lead to “reinforcing dollarization forces”, as individuals will resort to the use of cryptos instead of local currencies.

Also, wide adoption of crypto assets, the IMF revealed, “can reduce the ability of central banks to effectively implement monetary policy”.

Funding and solvency risks arising from currency mismatches can affect financial integrity and stability, IMF hinted.

Additionally, crypto mining activities in developing and emerging economies can have dire consequences on energy use.

Economies that rely on “C02-intensive forms of energy, as well as those that subsidize energy costs, given the large amount of energy needed for mining activities”, will be affected.

An outlook on policy

As advised by the IMF, policymakers must initiate advances measures to monitor and supervise the development cryptos in their various economies.

“As a first step, regulators and supervisors need to be able to monitor rapid developments in the crypto ecosystem and the risks they create by swiftly tackling data gaps.

“The global nature of crypto assets means that policymakers should enhance cross-border coordination to minimize the risks of regulatory arbitrage and ensure effective supervision and enforcement.”

International Monetary Fund

Also, in some emerging economies, the wide adoption of crypto assets, the IMF revealed, can be attributed to weak financial systems.

The IMF, therefore, admonish policymakers to enact strong monetary policies to improve the financial and banking systems in their economies.

“Authorities should prioritize strengthening macroeconomic policies and consider the benefits of issuing central bank digital currencies\z and improving payment systems.

“Central bank digital currencies may help reduce cryptoization pressures if they help satisfy a need for better payment technologies.”

International Monetary Fund

Policymakers must prioritize making cross-border transactions cheaper, faster, transparent and more inclusive via the ‘G20 Cross Border Payments Roadmap’, the IMF disclosed.

READ ALSO: The Trilogy: Deontay Wilder Vs Tyson Fury