The conflict in Ukraine and recent pandemic-related lockdowns in China appears to be dampening global goods trade in the first half of 2022, according to the latest WTO Goods Trade Barometer.

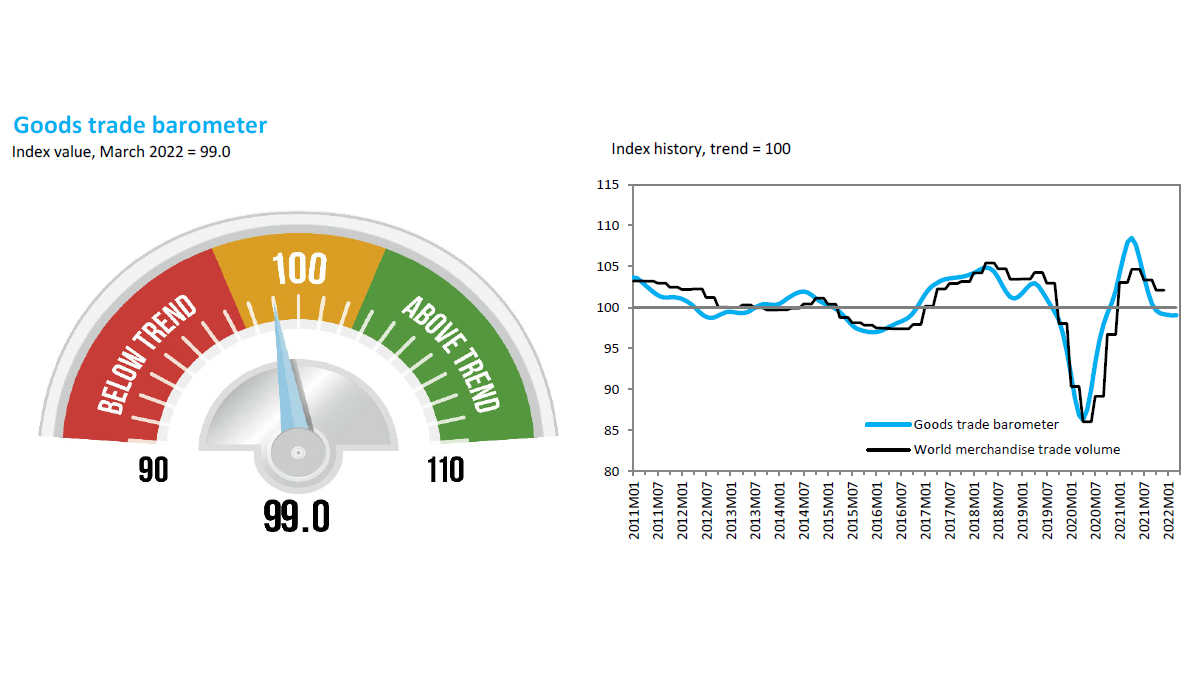

The current reading of 99.0 in March 2022 remains slightly below the baseline value of 100 for the index, which is a forward-looking composite of real-time indicators, suggesting continued slow growth in merchandise trade.

The latest outlook scales back the earlier optimism in the barometer from February, which suggested that trade might have been approaching a turning point, with stronger growth expected in the near future.

The anticipated upturn may have been short-circuited by the conflict in Ukraine, which started in late February and triggered sharp rises in food and energy prices, which tend to reduce real incomes and lower economic growth.

Disruption of trade by China’s imposition of major lockdowns

The WTO stated that China’s imposition of major lockdowns to combat a new outbreak of COVID-19 has further disrupted trade and production.

The barometer index might have risen above trend if some of the underlying data in the component indices had not turned down in March and April 2022. Component indices are smoothed to minimize the influence of extreme values, but this may obscure sudden changes in the latest months, the WTO noted.

Most of the barometer’s component indices are close to or above their baseline value of 100, for example export orders (101.2), automotive products (101.5), air freight (99.9), electronic components (103.8), and raw materials (99.5).

“Only container shipping remains firmly below trend (95.0). Non-smoothed data for export orders and air freight went from above-trend in one period to below-trend in the next, hinting at a sharper downturn. If the Ukraine crisis and Chinese lockdowns persist, their impact may be seen more clearly in the next release”.

WTO

In April, the WTO forecasted 3.0% growth in the volume of world merchandise trade in 2022, down from the 4.7% growth predicted in October, 2021. The current barometer reading is broadly consistent with the April projection, but forecasts are less certain at the moment and should be interpreted with care, the WTO warned.

The Goods Trade Barometer is a composite leading indicator providing real-time information on the trajectory of merchandise trade relative to recent trends ahead of conventional trade volume statistics. Readings of 100 indicate growth in line with medium-term trends; values greater than 100 suggest above-trend growth while values below 100 indicate the reverse.

Exports of intermediate goods see continued growth in fourth quarter of 2021

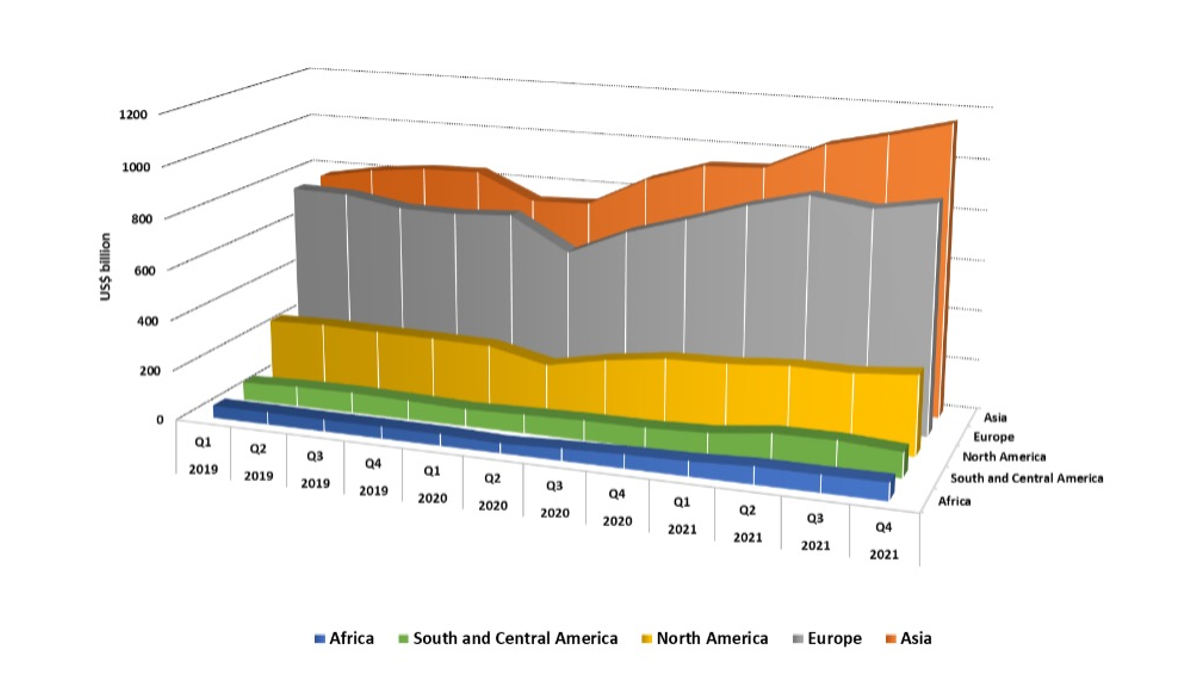

Meanwhile, the latest release by the WTO also showed that world exports of intermediate goods (IGs) continued to grow, recovering from the downturn.

World IG exports increased by 21 percent year-on-year in the fourth quarter of 2021, continuing the upward trend observed throughout the year. However, growth was slower than the 27 percent recorded in Q3 and the 47 percent in Q2.

The pace of trade in IGs, which range from crops used in food production to textiles and metals needed to produce goods, is an indicator of the level of activity in supply chains.

“Other industrial supplies”, comprising manufacturing inputs such as metal structures, electrical conductors and medical and pharma products, continued to be the key driver of growth, with a year-on-year increase of 31 percent in Q4.

World exports of food and beverage products grew slightly less, recording 23 percent growth in the fourth quarter compared with 28 percent in Q3, 2021. Ores and precious stones saw growth of 10 per cent in Q4, down from 13 percent in Q3 and 40 percent in Q2, mainly due to persistently decreasing iron ore prices.

Asian and African exports of industrial inputs to supply chains increased by more than 24 percent year –on-year in Q4, while European exports of inputs grew by 18 percent.

North America’s IG exports grew by 14.5 percent, largely driven by exports of soybeans to China. However, South and Central America saw IG exports decrease by 12 percent, mainly due to a reduction in Brazilian exports of iron ores and soybeans to China.

READ ALSO: MTN Group Ranks #1 African Brand, Among Top 10 Brands On The Continent