The Governor of the Bank of Ghana (BoG), Dr. Ernest Addison, has assured that the central Bank will swiftly respond with a reduction in interest rate if it’s able to successfully tame inflationary pressures.

Dr. Addison said, it is expected that the interest rates of government securities will go up in the short-term once the policy rate has been hiked by the 250 basis points which poses further stress to fiscal debt sustainability, particularly through high interest payments. The Governor underscored that every economic decision comes with a trade-off, and so is the recent MPC decision to raise the policy rate to 17%, up from 14.5%.

“Yes, that is another trade-off. In economics, when you raise interest rates, in the short-term, it would affect the interest rates of government instruments. Every medicine has a side effect, but we are hoping that the medicine would cure the problem and if we contain inflation pressures, we would definitely respond with a reduction in the interest rate, which would help deal with the debt sustainability problem. It is similar to the supply side aspect on growth. These are short-term tradeoffs. If we successfully bring inflation down, the supply side would pick up”.

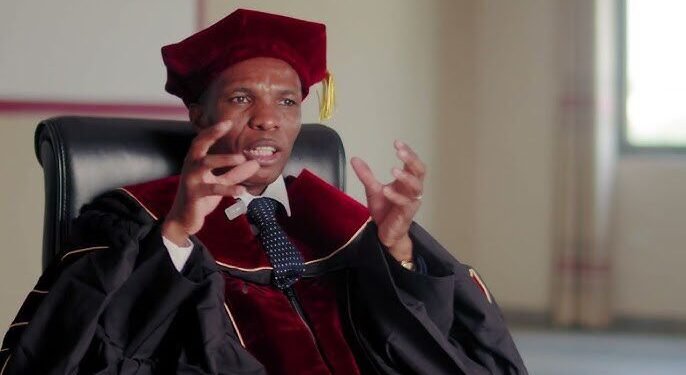

Dr. Ernest Addison

Still commenting on the consequences of the policy rate hike by 2.5%, the Governor said another trade-off would be on the country’s growth targets, especially this year. On the impact of growth, Dr. Addison said “obviously, the short-term impact would affect growth but once inflation is brought under control, we expect that interest rates would come down and then, we will see growth rebound”.

Responsiveness of policy rate to lending rates

A major challenge in monetary policy effectiveness in the country is a situation where the policy rate is being reduced but the banks failing to reduce their cost of credit. This has awakened concerns that once the Central Bank increased its policy rate by 250 basis points, Banks are also likely to respond by increasing their lending rates which is already high.

Addressing such concerns, the Governor said his outfit expects banks to respond in such a manner but said that lending rates have been gradually trending downwards in the past few years.

“It is true that the banks were quite slow in reducing their lending rates but eventually the lending rates came down from well over 30% to as low as 20% and so even though the pace of adjustment was slow it eventually moved, and we expect that the policy rate upward adjustment should be transmitted. It is part of the mechanism to ease aggregate demand pressures, so that transmission is quite important. Unfortunately, these are some of the short-term trade-offs between inflation and growth and we have to sacrifice a little bit of the growth part and focus on inflation because we cannot afford to have inflation drift further away from our medium-term target band”.

Dr. Ernest Addison

Fiscal and monetary policies to withdraw stimulus in the economy

Speaking on how the measures from the fiscal side can help with the monetary measures outlined to stabilize the economy, the Governor said the expectations are that both monetary and fiscal measures will help withdraw stimulus from the economy which will ultimately impact on aggregate demand.

“The policy rate adjustment that we have announced as well as implementation of the fiscal measures would withdraw stimulus from the economy. This type of stimulus withdrawal should affect aggregate demand and therefore deal with the inflation pressures that we are seeing. If the question is whether we think that these measures would be effective, I believe we have assessed that a policy rate adjustment of 250 basis points should be effective.

“We are complementing that together with the liquidity withdrawal from the banks because this would require the banks to hold more Ghana cedis with the central bank and those Ghana cedis would therefore not be available out there chasing goods and services or foreign exchange. That would really help deal with the aggregate demand pressures that we are dealing with”.

Dr. Ernest Addison

In terms of the announced measures, Dr. Addison said the increase in reserve requirement to 12% is one measure that “we would evaluate its impact on the liquidity of banks at the next MPC meetings”. He said based on the findings, “we will then decide on the next step, so that obviously is in a sense time-bound”.

READ ALSO: Deaths From Non-Communicable Diseases On The Rise In Africa – WHO Warns