The Ministry of Energy has been cited for GH¢15.8 billion in financial irregularities in the 2024 Auditor-General’s Report, revealing systemic inefficiencies and breaches across key agencies, including ECG, BOST, GNPC, and GRIDCo.

The report paints a dire picture of the sector’s financial management, exposing deep-seated problems in revenue reporting, debt recovery, procurement practices, and contract execution.

At the center of the crisis is the Electricity Company of Ghana (ECG). The company was cited for under-declaring over GH¢2.95 billion in revenue.

While ECG actually collected GH¢11.59 billion in 2023, it reported only GH¢8.64 billion to the Ministry of Energy and relevant authorities.

The Auditor-General noted, “This under-reporting is not only misleading but unjustified,” describing the move as a breach of financial transparency and a distortion of public accounts.

In addition to revenue misreporting, ECG failed to disburse GH¢1.29 billion owed to Independent Power Producers (IPPs) and state-owned enterprises under the Cash Waterfall Mechanism, a key tool used to ensure equitable revenue sharing in the power sector.

ECG also defaulted on tax remittances, withholding GH¢70.9 million meant for the Ghana Revenue Authority (GRA). Its procurement practices were equally flawed.

The company spent an excess of GH¢251 million buying materials from intermediaries instead of sourcing directly from manufacturers.

Another red flag was the payment of GH¢75 million to Hubtel Limited for managing a digital revenue collection platform.

The contract was not only unsigned at the time of payment but also backdated and lacked clearance from the Public Procurement Authority.

“Hubtel collected GH¢10.3 billion on behalf of ECG, deducted its 1.5% commission before remitting the balance.

“This contravenes regulations which require gross revenue to be reported before any deductions.”

2024 Auditor-General’s Report

Beyond ECG

At Bui Power Authority, a growing debt of US$729 million owed by ECG remains unpaid. Meanwhile, the authority has defaulted on its own loans, incurring a penalty of US$846,785.

The report also flagged unfulfilled resettlement and social responsibility obligations to affected communities.

The Bulk Oil Storage and Transportation Company (BOST) was found to have bypassed the mandatory Ghana Electronic Procurement System (GHANEPS) for several procurement activities, undermining transparency.

Infrastructural neglect was also noted, with pipeline encroachments and millions of cedis worth of idle equipment lying unused at facilities in Buipe, Akosombo, and Kumasi.

The audit found delays in project execution, including contracts totaling over US$2 million and GH¢23.5 million.

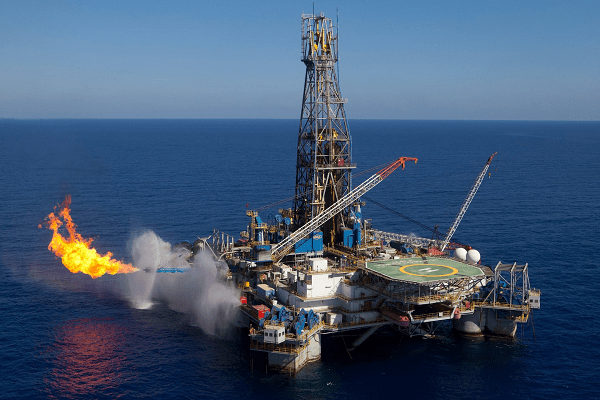

At Ghana National Petroleum Corporation (GNPC), accountability issues included an undocumented loan arrangement made on behalf of the Ministry of Finance, and the failure to acquire title deeds for a US$6.3 million property in Tema.

The corporation’s continued release of oil reserve reports without third-party validation also raises concerns about data integrity.

The Ghana Grid Company Limited (GRIDCo) was similarly criticized for lacking a formal Environmental, Social, and Governance (ESG) framework, despite operating in a high-risk sector.

The Auditor-General advised the company to adopt global ESG standards to improve transparency and sustainability.

The Energy Commission misallocated GH¢120,378 from the Energy Fund, an issue that remained unresolved for over two years.

Other regulatory bodies, such as the National Petroleum Authority and the Unified Petroleum Price Fund, were cited for smaller infractions, primarily involving the misapplication of funds and weak compliance protocols.

Overall, the report recorded GH¢18.4 billion in financial irregularities across all public institutions in 2024, a 109.3% increase from GH¢8.8 billion in 2023.

The jump was driven largely by the energy sector, with GH¢15.6 billion categorized as recoverable through improved collection and financial restructuring, and GH¢2.8 billion classified as administrative and procedural breaches.

These revelations come at a critical time for Ghana, which is under a fiscal consolidation programme with the International Monetary Fund (IMF). The Auditor-General has urged immediate reforms.

“Without decisive action, the energy sector risks becoming a fiscal time bomb, bleeding the national purse while holding back the country’s development agenda.”

2024 Auditor-General’s Report

Recommendations include stricter enforcement of public procurement laws, sanctions against responsible officials, improved contract management systems, and urgent reforms in energy sector governance.

With public finances under strain, the 2024 Auditor-General’s findings are likely to fuel calls for a major overhaul of how energy-related institutions are managed, monitored, and held accountable.

Read Also: Banking Sector Shakeup: Five Ghanaian Banks Under Intense BoG Scrutiny Over Capital Failures