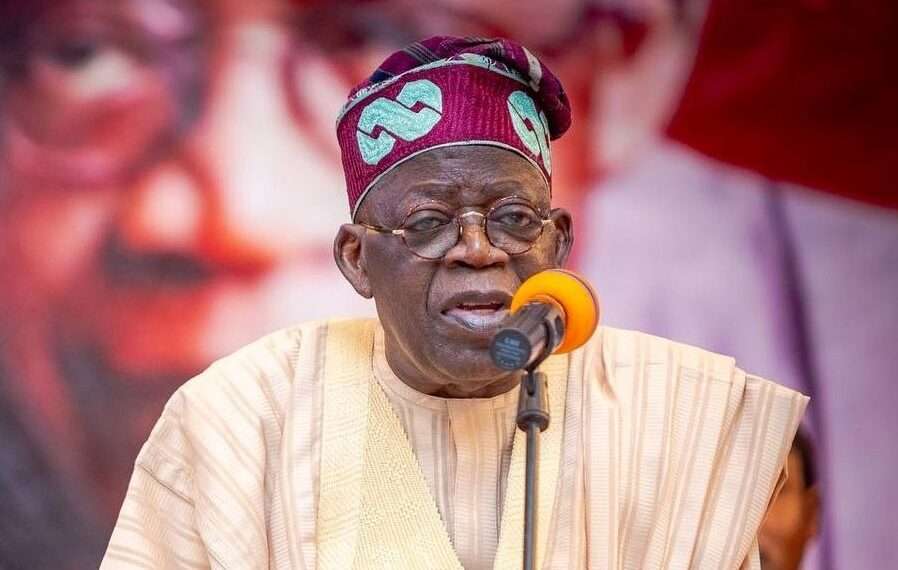

Nigerian President Bola Tinubu has unveiled an ambitious plan to achieve 7% annual economic growth by 2027, to lift millions out of poverty and expand the country’s economy to four times its current size by 2030.

Since assuming office in 2023, Tinubu has taken bold steps to revive Nigeria’s sluggish decade-long growth, including scrapping petrol and electricity subsidies and devaluing the naira currency twice to stimulate productivity. While these reforms were intended to boost output, they have instead triggered the worst cost-of-living crisis in a generation and have yet to translate into faster growth.

In the first quarter of the year, Nigeria’s economy grew by 3.13%, aided by a rebasing of its gross domestic product. This recalculation increased the economy’s estimated size to 372.822 trillion naira (about $243.55 billion), but the pace of growth fell short of expectations.

Speaking to the federal cabinet, Tinubu highlighted that the reforms had strengthened macroeconomic stability and investor confidence, but warned that low public savings remained a significant barrier. Public investment currently accounts for only 5% of the country’s gross domestic product.

“To sustain our momentum, we must optimize every available naira,” Tinubu said, directing his economic team to review revenue retention and deductions from the federal account, including fees collected by agencies such as the tax authority, Customs, and the Nigerian National Petroleum Corporation (NNPC) Ltd.

The Petroleum Industry Act (PIA) presently permits NNPC to retain 30% of specific revenues for managing oil and gas operations and deduct another 30% of its profits to fund exploration in underexplored frontier basins. These provisions have come under fire for being excessive and opaque, contributing to revenue losses and inefficiencies that have historically weakened Nigeria’s fiscal position.

Tinubu’s new target builds on his initial pledge of 6% growth when he first assumed office two years ago. The World Bank, however, projects that Nigeria’s economy will grow by 3.6% this year and 3.8% by 2027 — far below the president’s ambitions.

Debt Refinancing Plan For Power Sector Announced

In a related development, Nigeria has approved a phased plan to refinance 4 trillion naira ($2.61 billion) in electricity sector debt, aiming to stabilise the struggling power industry and improve supply across Africa’s most populous nation.

The debt, mostly owed to 27 power generation companies for unpaid invoices between 2015 and 2023, has deterred investment in the sector and worsened chronic power outages. Tinubu recently pledged to settle these debts after a verification exercise, giving the green light to the refinancing plan on Wednesday.

Finance Minister Olawale Edun said after a cabinet meeting in Abuja that the process would be completed within three to four weeks under the supervision of the Debt Management Office. “It is now fully approved, and we move to implementation,” Edun stated.

The refinancing strategy is expected to involve bond issuances and other instruments to spread repayment over time. It forms part of wider energy sector reforms, including a 35% reduction in electricity subsidies and tariff increases for urban consumers — measures projected to save the government about 1.1 trillion naira (roughly $718.58 million) annually.

READ ALSO: Asante Gold Secures $500M Financing to Expand Bibiani and Chirano Mines