Ghana has taken another significant step toward restoring debt sustainability by securing its third bilateral debt restructuring agreement, this time with the United Kingdom.

The deal, valued at over US$256 million, represents a major breakthrough in the government’s ongoing negotiations with the External Creditor Committee. It follows earlier agreements signed with France and the Export-Import Bank of China, cementing Ghana’s determination to rebuild credibility on the international stage.

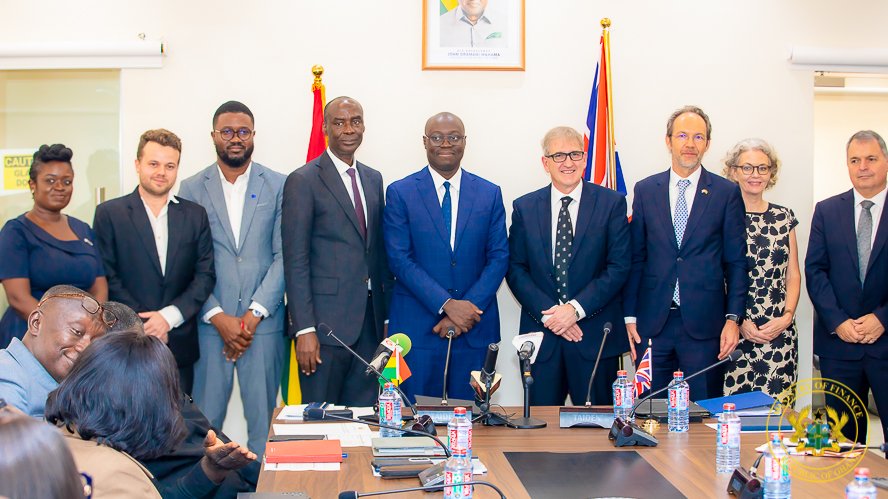

The agreement was signed in Accra by Minister of Finance, Dr. Cassiel Ato Forson, and representatives of UK Export Finance, with His Majesty’s Trade Commissioner to Africa, John Humphrey, present as part of an official visit to Ghana.

According to Dr. Forson, the UK’s involvement sends a powerful signal to other creditors that Ghana is serious about meeting its commitments and determined to return to a path of fiscal stability.

“Today we’re signing with the UK, and as you all know, our relationship with the UK goes many years back. Signing with the UK concludes more or less our journey of recovery, knowing that the UK is with us.”

Dr. Cassiel Ato Forson

Unlocking Infrastructure and Development Projects

Beyond the debt restructuring, the agreement promises tangible benefits for Ghanaians, as it unlocks about 2.8 billion cedis in infrastructure investment. Five priority projects have been identified for immediate execution:

- The Bolgatanga Road Project

- Obetsebi Lamptey Interchange Phase II

- Kejetia Market Phase II in Kumasi

- Tema–Aflao Road Project

- Komfo Anokye Teaching Hospital Maternity Project in Kumasi

These projects, which had stalled due to financing challenges, are now expected to resume, injecting new life into Ghana’s infrastructure drive. For many Ghanaians, particularly those in Kumasi, Tema, and the northern regions, this deal represents hope for improved roads, modern markets, and better healthcare facilities.

Dr. Forson emphasized that these projects fall in line with the government’s broader 2025 National Budget objectives, which aim to prioritize infrastructure development, social services, and economic expansion under reduced financing pressures.

Strengthening Economic Confidence

The debt restructuring deal is also seen as a confidence-building measure for both domestic and international investors. By demonstrating progress in restructuring its external debt, Ghana signals that it is taking credible steps to manage its liabilities while laying the groundwork for economic recovery.

“This agreement is not just about restructuring numbers—it’s about restoring confidence and ensuring that our people see tangible development outcomes. The projects unlocked today will stimulate local economies, create jobs, and improve living standards.”

Dr. Cassiel Ato Forson

The deal aligns with Ghana’s ongoing debt sustainability program under the International Monetary Fund (IMF), which has called on the government to negotiate in good faith with bilateral creditors to secure relief and ensure fiscal discipline.

UK’s Enduring Partnership with Ghana

Speaking at the signing ceremony, John Humphrey, His Majesty’s Trade Commissioner to Africa, reaffirmed the UK’s commitment to Ghana’s long-term development agenda. He highlighted the recently launched 24-hour Economy Policy and stressed that the UK would continue to provide support in both financial and technical cooperation. “The UK is proud to stand with Ghana at this critical time. Our partnership goes beyond this debt restructuring; it is about building a resilient future together,” Mr. Humphrey said.

UK Export Finance, which has played a pivotal role in structuring the deal, is expected to continue providing guarantees and credit facilities to support Ghana’s priority projects. This, according to analysts, could also attract private sector investment into Ghana’s economy.

This third bilateral agreement marks an important milestone in Ghana’s debt restructuring journey. With France, China, and now the UK on board, the government is confident that other creditors will follow suit. The cumulative effect of these agreements is expected to ease the country’s debt servicing burden, free up fiscal space, and allow greater investment in productive sectors of the economy.

Economists have pointed out that once Ghana successfully navigates its debt challenges, the country could witness stronger investor interest, a rebound in foreign direct investment, and a gradual appreciation of the cedi. The success of these agreements also carries political significance, as they provide the new government with the credibility needed to push forward with economic reforms.

A Path Toward Debt Sustainability

For Ghana, debt restructuring is not merely about postponing repayment obligations. It is about resetting the economy on a path that balances growth and fiscal responsibility. The US$256 million agreement with the UK, while modest compared to Ghana’s total external debt, is a critical piece in the larger puzzle of achieving debt sustainability.

“We are taking steps to restructure debt in excess of 256 million dollars, and this will unlock projects our people have been waiting for. We believe that after the signing, the projects will begin, and the benefits will be felt by ordinary Ghanaians.”

Dr. Cassiel Ato Forson

As Ghana inches closer to concluding agreements with all its bilateral creditors, the hope is that these deals will translate into a more stable economy, a revitalized infrastructure sector, and renewed investor confidence.

READ ALSO: Pearl Nkrumah Takes the Helm at Access Bank Ghana—First Woman Ever to Lead the Bank