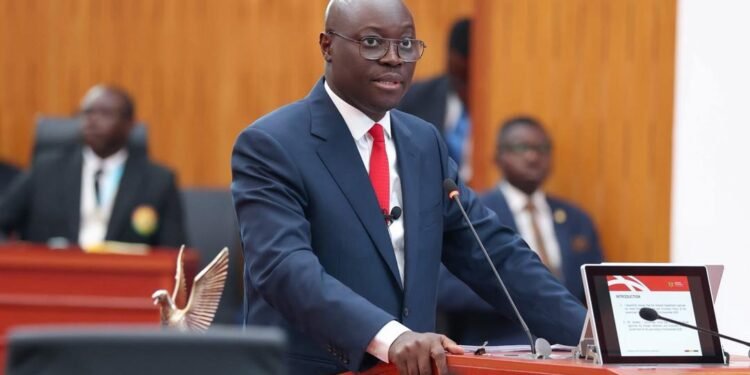

Governor of Bank of Ghana has weighed in on the Bank’s diligence in continuous sterilization and credibility building to anchor achievements as the macroeconomic stress eases.

Speaking at the IMF’s Governor Talks Series on the sideline of the IMF/World Bank Annual Meetings in Washington, DC, he mentioned that strong sterilization and liquidity management as well as government’s fiscal discipline restored the macroeconomic indicators and more of these cost intensive efforts are needed to hold the anchor while stability eases.

The Bank’s entire monetary framework needed to be upgraded to strengthen the credibility of the Bank and sterilize liquidity build-ups, the Governor alluded.

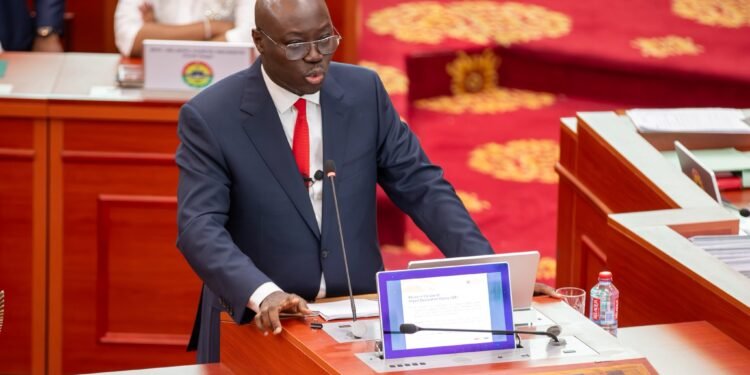

In responding to the moderator, Abebe Aemro Selassie, Director of African Department, IMF, the Governor admitted that the gains made in the Ghanaian economy is a complementary effort from the Bank, Ministry of Finance, government in general, the IMF, and other stakeholders.

“I am happy to say that 8 months down the line we have turned the corner, Ghana is back. The first 8 months have been revealing and we think that we have done a good job. We are getting all the upgrades from our rating agencies which shows clearly that we are on the right path.

“I want to thank the IMF for their tremendous policy support in this journey and we intend to go along with them.”

Dr. Johnson P. Asiama, Governor of the Bank of Ghana

Current Outlook

Despite inheriting significant fiscal arrears, the government is prioritizing expenditure-led consolidation over aggressive tax hikes, in line with conditions under the IMF’s Extended Credit Facility (ECF) program.

Ghana’s fiscal policy, financial and monetary architecture, and macroeconomic stability has improved over the past months. Restoration and transformation is being seen in policy formulation, monetary frameworks, and institutional discipline.

Ghana’s current domestic debt-to-GDP ratio stands below 44% by end of June. The government is embarking on expansionary fiscal policy to stimulate economic growth through increased spending to boost demand and employment.

By focusing on fiscal discipline, efforts are being made to limit external financing to consolidate economic gains, though the country has re-entered the international financial market.

According to the Finance Minister, Dr. Cassiel Ato Forson in July 2025, the government through the Bank of Ghana added to earlier payments, “US$349,523,674.56 in respect of Eurobond debt service obligations.” The focus is to maintain fiscal discipline and successfully complete and exit the IMF program.

Government has prioritized expenditure-led consolidation over aggressive tax hikes. The recovery efforts of the Ghanaian economy are rewarded with upgrade of its foreign-currency sovereign credit rating.

Introducing and implementing the Bank’s Liquidity Framework, has helped streamline and reduce liquidity. In April this year, through a liquidity mop-up operation, the Bank embarked on an aggressive liquidity absorption to absorb Gh¢ 79.8 billion, a 76.6% increase from the previous year.

Inflation is at 9.4%, growth rate as projected by the International bodies is around 4 and 4.3%, while the exchange rate has appreciated and is fairly stable to the major currencies.

“We met inflation at nearly 44%, currently it is down to 9.4 %. We have seen a strong rebound in growth, we are running ahead of program targets for the year on almost everything: inflation, reserves buildup, economic growth, etc. We are happy to announce that we will be able to exit the Fund program come next year.”

Dr. Johnson P. Asiama, Governor of the Bank of Ghana

The shared achievements through government’s will to maintain fiscal discipline and restore the economy, and the Bank of Ghana’s goal to stabilize the monetary system is yielding fruit.

The impact of the macroeconomic indicators is reflected in the reduced import cost and the corresponding relatively lower prices of commodities.

These put the economy in good standing and in favour with credit organisations and developed countries whose willingness to invest in the Ghanaian economy has appreciated; as President Mahama popularly reference it, “Ghana is open for business.”

Risks ahead

There are lots of uncertainty within the global market and economy which can have undulating effects on Ghana’s economy. Trade tariffs with major trading partners still have some dark clouds looming around it. Actions of countries, especially the developed economies can easily be transferred to a middle-income country like Ghana.

Maintaining fiscal consolidation while improving infrastructure, increasing employment, and continuous debt restructuring are constant battles to be fought. Sustained efforts to shrink corruption and lessen government waste also lurks in the corner. Furthermore, climate shocks might reduce agricultural productivity amid the investments within the sector.

Ghana needs to prepare to absorb any of these external and internal shocks while maintaining the progress and stability enjoyed. A long road lies ahead as a lot more economic sacrifices and disciplines warrant victory.

The Bank of Ghana is not complacent due to these gains, the Governor assures. He indicated the need to continue building reserves, as the Bank works closely with the Ghana Gold Board.

Dr. Johnson Asiama revealed that his focus as the Governor of the Bank of Ghana is to rebuild the Bank’s balance sheet, de-dolarize the currency, and restore credibility. He concluded that these are his vision and he hopes they become his legacy at the end of his tenure.

READ ALSO: Buaben Asamoa Blasts NPP, Praises Mahama’s Matured Leadership