The management of Ghana Revenue Authority (GRA) has intensified enforcement of tax compliance in Accra as it tests the Electronic Value Added Tax (E-VAT) system and tax reforms ahead of 2026.

According to GRA, the intensified compliance drive, which includes sector-specific audits and leveraging technology like the E-VAT system, is a direct test and foundational step for Ghana’s major 2026 tax reforms, particularly the revamped VAT system designed for real-time tracking and better revenue capture.

The GRA has declared 2026 the “Year of Compliance,” integrating these new digital tools and administrative changes to boost domestic revenue for Ghana’s economic goals. The government has hinted that the significant number of taxes abolished this year will be replaced with the widening of the tax net, hence, GRA’s tax compliance enforcement next year.

Mounting Education on Tax Compliance

Officials of GRA, since the reading of the 2026 Budget by the Finance Ministry, Dr Cassiel Ato Forson, have used various media and engagement platforms to educate the populace on their responsibility towards tax compliance and the new reforms.

This effort recognizes the essence of tax mobilization and collection to the government’s ability to provide development and inclusive initiatives to affect lives and national growth.

The Authority has rolled out a number of targeted compliance and administrative reforms. The rollout is accompanied by seal-offs for non-compliant businesses, which give no excuse for ignorance, hence the simultaneous tax education.

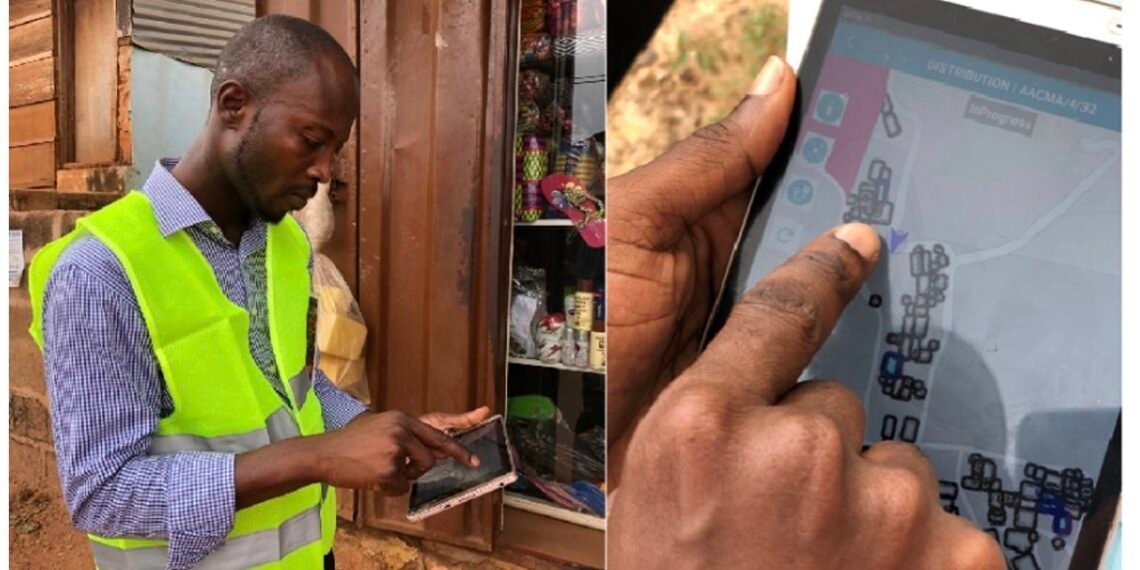

GRA in the past two years has operated phases of the E-VAT. From the pilot phase, where 50 taxpayers were covered, through subsequent phases of 58 percent and later 80 percent enrollment, GRA has expanded the e-system. Small and medium taxpayers were brought on board in December 2024, and currently, the Authority has targeted the integration of all other VAT-registered taxpayers into the E-VAT system.

According to GRA, the piloting of the E-VAT system increased revenue by 32 percent. By next year, when the system will be fully realized, revenue is projected to increase substantially, GRA management hinted.

As education of the system and general tax compliance continue, the Authority is confident in the positive impact of the E-VAT on VAT contributors and revenue collection, while combating tax evasion to promote transparency in the tax administration.

Test-Run Reform and Compliance Enforcement

The Assistant Commissioner in Charge of the Accra Area Enforcement Unit, Mr Joseph Annan Adjeikwei has visited many shops and businesses within the enclave to enforce compliance with tax obligations. Many businesses were completely sealed off after the visit due to non-compliance, while others were partially sealed off due to technical challenges with the E-VAT system.

The identified system errors and failures will provide an opportunity to brace the system for a similar eventuality in the coming year’s full tax compliance rollout.

On the field, the GRA team realized that many businesses deliberately refused to provide records, adding that aside from projections, legal sanctions also await offenders who fail to comply.

According to the wealth of information acquired by the GRA field officers on their journey to ensure tax compliance, stricter and smoother compliance is envisaged in 2026. The Authority assures continuous efforts to enforce tax compliance, enhance revenue mobilization, and curb under-declarations by many businesses in Ghana.

Untapped Night Revenues

The GRA team uncovered a significant number of night establishments, some of which are unregistered, while others fall short of tax obligations. As tax enforcement intensifies to anticipate achieving the revenue target in 2026, the ‘Night Market Economy Project’ is now in full implementation.

According to the GRA, this rapidly expanding market has been under compliance surveillance for the past two years. Compliance remains low, with just a few businesses complying with tax laws, while the majority make huge profits for themselves.

The GRA team emphasized that tax compliance enforcement will, going forward, operate under the 24-Hour economy agenda, ensuring that businesses operating in the evening, at night, and during the day comply equally with tax laws.

These operations cover food joints, entertainment spots, restaurants, and all businesses within the Ghanaian economy. Currently, premises and spaces of non-compliant businesses are being sealed off, as directed by GRA management and backed by law.

According to the Revenue Administration Act, 2016 (Act 915), penalties of up to 300 percent could be imposed on unpaid taxes once assessments were completed. The Authority, therefore, cautions all businesses to comply to avoid closure as notices have been served.

The nightlife in Ghana is vibrant, and night businesses are befitting, however, they should contribute their quota to national development through tax compliance, the GRA team declared.

GRA entreats all Ghanaians to willingly come on board and ensure tax compliance to increase revenue for development in the country.

READ ALSO: Mid-Curve Dominance Pushes Bond Turnover Past GH¢4bn in One Week