The Minerals Income Investment Fund (MIIF) and Injaro Investment Advisors Ltd (IIAL) have jointly announced that the management and Board of Directors of the Fund, have decided to commit GHS25 million to the Injaro Ghana Venture Capital Fund (IGVCF) which is managed by IIAL.

MIIF noted that it is consistent with its mission to become a lever for Ghana’s development and Injaro’s objective of building sustainable African businesses, the investment strategy for IGVCF is to partner with best-in-class profitable Ghanaian SMEs with strong growth potential across various sectors including mining support services, food & agribusiness, education, healthcare, inclusive financial services, industrial services (including services for the mining and oil and gas sectors) as well as light manufacturing.

IGVCF will also promote environmental, social and governance best practices across its portfolio companies in its bid to contribute to job creation and sustained economic growth.

The Fund will make equity, quasi-equity or debt investments in SMEs mainly in Ghana and also in Côte d’Ivoire.

MIIF’s First Investment in the Alternative Asset Class

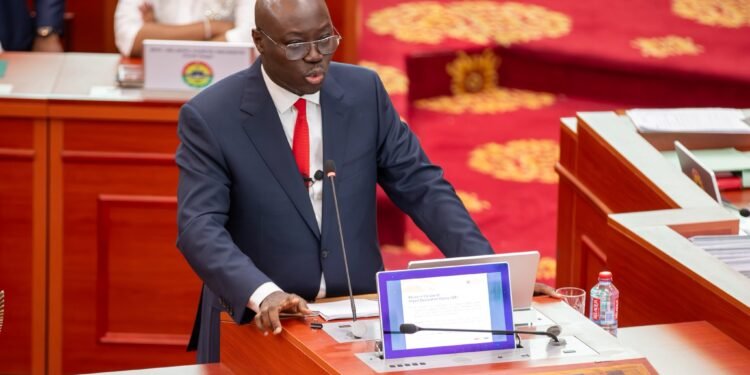

Mr Edward Nana Yaw Koranteng, the Chief Executive Officer of MIIF, said it is MIIF’s first investment in the alternative asset class and we are delighted at this.

“The objective of MIIF in line with President Nana Akufo Addo’s vision, is to invest in the development of the entire mining eco-system or value chain which covers the mining supplies and services sector even to the micro or SME level. As part of our alternative investment or diversification strategy, MIIF sees this Injaro opportunity, to invest in private equity, as a conduit to support this mining sub-sector and ultimately the growth of the real economy in Ghana.”

Mr Edward Nana Yaw Koranteng

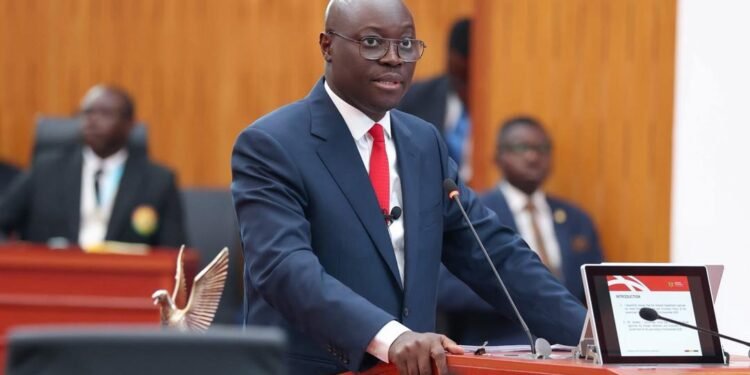

Mr Jerry Parkes, the Managing Director of IIAL, on his part, said the Injaro team is excited and grateful for the opportunity to work with MIIF to further entrench Private Equity as an attractive asset class which can be an effective tool for growing the real economy in Ghana while delivering long term social and financial returns for local investors.

“Having already secured GHS127 million for IGVCF primarily from local pension funds, and with a mandate from investors to grow the fund to GHS400M, the Injaro team welcomes commitments from institutional investors that want to diversify their portfolios and who are aligned with Injaro’s vision of growing the real economy in Ghana.”

Mr Jerry Parkes

Injaro Investment Advisors Limited (IIAL) is an investment advisory firm licensed by the Ghana Securities & Exchange Commission and is part of an international group which manages over USD100 million across multiple funds and has investments across Sub-Saharan Africa.

Injaro has expertise in the areas of private equity, corporate finance advisory, asset management, management consulting and project management.

Injaro manages the Injaro Ghana Venture Capital Fund (IGVCF), a private equity fund registered under the laws of Ghana and licensed by the Securities and Exchange Commission of Ghana to make investments in equity, quasi-equity or debt in small and medium-sized enterprises mainly in Ghana.

READ ALSO: Ukraine’s Atomic Energy Company Warns Of Potential “Catastrophic Lack Of Qualified Personnel”