The National Identification Authority (NIA) is set to roll out a groundbreaking e-wallet feature on the Ghana Card, marking a significant step in the country’s digital transformation journey.

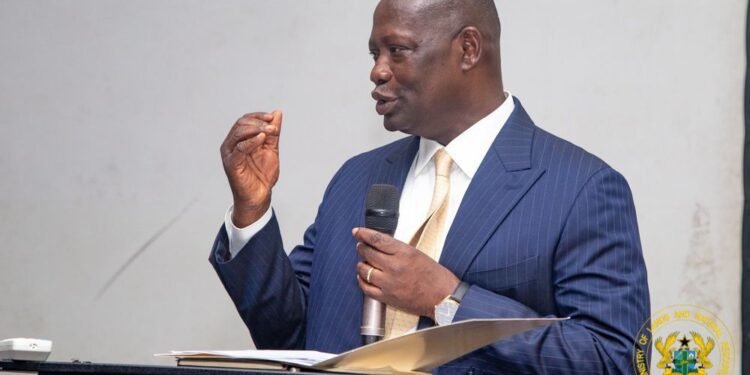

This initiative, announced by the Executive Secretary of the NIA, Yayra Korku Deku, will allow cardholders to store money on their Ghana Card and use it for everyday transactions. From payments at local shops to electronic transfers, the Ghana Card is being positioned as a multipurpose tool, capable of driving financial inclusion and optimizing digital transactions across the country.

Beyond providing convenience to citizens, the e-wallet is also designed to generate substantial revenue for the NIA. According to Mr. Deku, the authority has long been searching for ways to sustain its operations without overreliance on the central government’s budget. By monetizing the Ghana Card’s digital functions, the NIA expects to raise billions in revenue over time.

“What it means is that you can put money on your Ghana Card and use it to do transactions. That is to pay for anything that you do. And we are hoping that that one will generate a huge sum of money for us.”

Yayra Korku Deku

This financial independence, he believes, will enable the authority to optimize its operations and enhance service delivery.

Transforming Ghana’s Payments Landscape

The introduction of the Ghana Card e-wallet is set to disrupt Ghana’s payments ecosystem, which is currently dominated by mobile money services. With the e-wallet, cardholders will not only be able to make payments and transfer funds but also integrate seamlessly with existing digital financial platforms. The move places the NIA at the heart of Ghana’s fintech revolution, bridging identity verification with financial transactions in a way no other system has achieved before.

The NIA’s initiative has already caught the attention of key players in the financial sector. Several banks have expressed strong interest in partnering with the authority to support the e-wallet rollout. Mr. Deku revealed that some institutions even offered to “house” the initiative, but the NIA prefers to create a uniform platform that allows all financial players to participate equally.

This approach ensures inclusivity and prevents monopolization, while also opening the door for healthy competition and innovation. If executed effectively, the Ghana Card e-wallet could rival existing fintech solutions and push Ghana closer to achieving a fully cashless economy.

Integration with Gold Trading and Tokenization

In a bold move that stretches beyond payments, the NIA is also planning to partner with the Ghana Gold Board to enable gold trading transactions through the Ghana Card. By linking the card to tokenized gold trading systems, the authority aims to create a transparent, secure, and accessible framework for all Ghanaians to engage in the financial market.

“You’ve heard that Gold Board and others want to do tokenization. So we are also looking at that one where we can come in on to help them. So they adopt the Ghana Card as the means of the transaction where they are tokenizing.”

Yayra Korku Deku

This integration could mark a historic shift in how precious metals are traded in Ghana, blending digital identity with financial innovation.

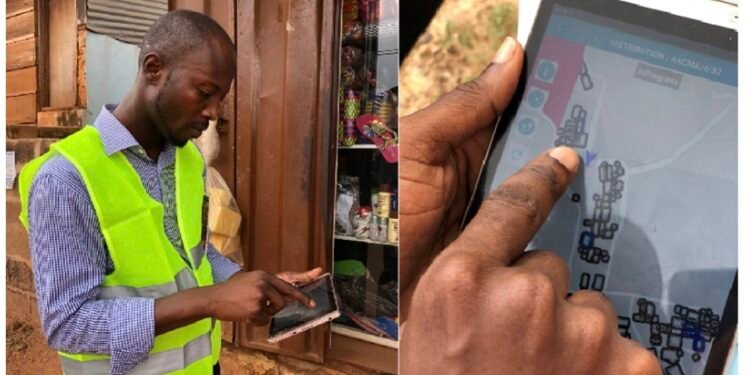

Since its inception, the Ghana Card was designed with three profiles: the e-ID, the e-passport, and the e-wallet. While the e-passport has already been activated, the e-wallet is the next major phase. Once operational, it will complete the card’s transformation into a comprehensive digital identity and financial tool.

The vision, according to the NIA, is to create a single card that not only identifies Ghanaians but also enables them to travel, transact, and participate in modern financial systems without barriers.

The rollout of the Ghana Card e-wallet promises wide-ranging benefits. For ordinary Ghanaians, it means more convenience and reduced dependency on multiple cards or mobile applications. For businesses, it opens new avenues for secure transactions and customer engagement. And for the NIA, it represents a chance to become self-sufficient while driving Ghana’s digital economy forward.

READ ALSO: Bank of Ghana’s 350 Basis Point Gamble: Will Inflation Hold as Lending Rates Fall?