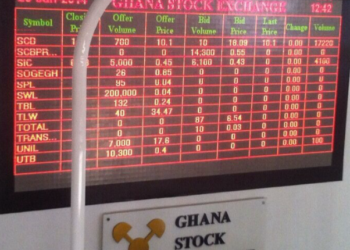

Investor sentiment on the Ghana Stock Exchange (GSE) has roared back to life as the bourse recorded one of its strongest trading sessions in recent weeks.

The renewed interest comes on the back of rising market indices, impressive year-to-date gains, and heightened activity among major listed equities. At the close of the latest trading session, a total of 1,416,021 shares valued at GHS 1,316,550.66 exchanged hands, marking a remarkable resurgence in market participation.

This surge represents a 236 percent jump in trading volume compared to the previous session on Monday, November 24. Despite this dramatic increase in activity, turnover dipped by 41 percent, highlighting a session dominated by high-volume, lower-priced trades. Still, the broader narrative remains overwhelmingly positive, with investors demonstrating renewed confidence in Ghana’s equity markets.

Gainers Take Charge as Market Closes Without a Single Loser

In a rare and bullish outcome, the day’s trading ended with three gainers and no losers, underscoring the market’s upward momentum. Societe Generale Ghana led the pack with a striking 7.14 percent share price appreciation, closing at GHS 4.50 per share. The bank’s consistent performance and investor-friendly outlook contributed to the strong demand seen during the session.

CalBank followed with a 2.7 percent gain, while MTN Ghana completed the list of gainers after inching up 0.24 percent. These gains reflect growing investor confidence in financial and telecommunications stocks, sectors that have proven resilient in Ghana’s economic recovery phase.

Notably, CalBank also dominated trading activity, recording an impressive 1.18 million traded shares, the highest among all equities. MTN Ghana trailed with 133,860 shares, followed by SIC Insurance Company with 44,401 shares, and Ecobank Transnational with 24,801 shares. The absence of price losers further amplified the session’s positive tone, signalling strengthened investor conviction in key stocks.

Indices Surge as GSE Continues an Upward Trajectory

The bullish mood extended to the performance of the GSE’s main indices. The GSE Composite Index (GSE-CI)—the benchmark indicator of the market—climbed by 28.71 points, representing a 0.34 percent rise to close at 8,587.31 points. This jump reinforces the index’s consistent upward trend, with gains of 1.98 percent over the past week, 2.83 percent in the last four weeks, and an impressive 75.66 percent year-to-date.

These figures place the GSE among Africa’s best-performing markets in 2024, driven by strong demand for financial, telecommunications, and consumer stocks.

The GSE Financial Stocks Index (GSE-FSI) also recorded significant growth, rising 0.57 percent to reach 4,442.44 points. The financial index has been on an even sharper ascent, posting a 5.42 percent gain in one week, 8.22 percent over four weeks, and a solid 86.6 percent year-to-date. Such sustained performance highlights the recovering health of the financial sector, which has benefitted from capital adequacy improvements, profitability rebounds, and growing investor appetite.

Further cementing the GSE’s positive outlook, the market capitalization of listed companies stood firm at GHS 167.5 billion. This reflects the collective confidence investors have placed in the economy and the strong fundamentals of Ghana’s listed firms.

The rise in trading volume, supported by stable market capitalization and upward-trending indices, suggests the GSE is entering a phase of renewed liquidity and vibrancy. This comes at a time when Ghana continues to implement economic reforms under its IMF-supported recovery program, creating a more stable macroeconomic environment for both businesses and investors.

Investor Sentiment Turns Optimistic as Year-End Approaches

As the year draws to a close, optimism is clearly building across the investment community. The combination of strong market gains, young investor interest, resilient corporate earnings, and improving economic indicators has set the stage for sustained momentum on the GSE.

The resurgence in trading volumes and absence of price declines in the latest session are signs that investors are regaining trust in Ghana’s capital market. If this trend continues, the GSE could finish the year as one of Africa’s standout performers, offering significant opportunities for both retail and institutional investors.

In the meantime, the market’s recent activity shows that confidence is back, and investors are moving swiftly to position themselves for the gains ahead.

READ ALSO:New Defence and Environment Ministers Will Be Appointed Next Year – Mahama