Institute of Economic Affairs (IEA), has called on the government to establish a State-Owned Ghana Lithium Company (GLC) to manage and develop the controversial Ewoyaa Lithium.

According to IEA, this proposed Stae-Owned Company would not merely hold equity but would be mandated to lead the effective exploitation and management of the country’s lithium resources.

Speaking on behalf of the Institute during the press briefing under the theme: “Ghana’s Ownership of Its Natural Resources- the Lithium Case”, Dr. Charles Mensa, IEA Board Chair, noted that the proposal seeks to shift the narrative from passive royalty collection to active sovereign ownership, ensuring that the state directs the development of the entire value chain from the extraction of raw spodumene to the manufacturing of batteries within Ghana’s borders.

“Secondly, the Institute calls on government to set up a State-Owned Ghana Lithium Company (GLC) to lead effective exploitation and Management of our lithium along the entire value chain. The GLC should be mandated to develop the entire lithium value chain from raw lithium to batteries in Ghana.”

Dr. Charles Mensa, IEA Board Chair.

This call for a paradigm shift is underpinned by staggering financial projections that highlight the opportunity cost of the current mineral concession regimes.

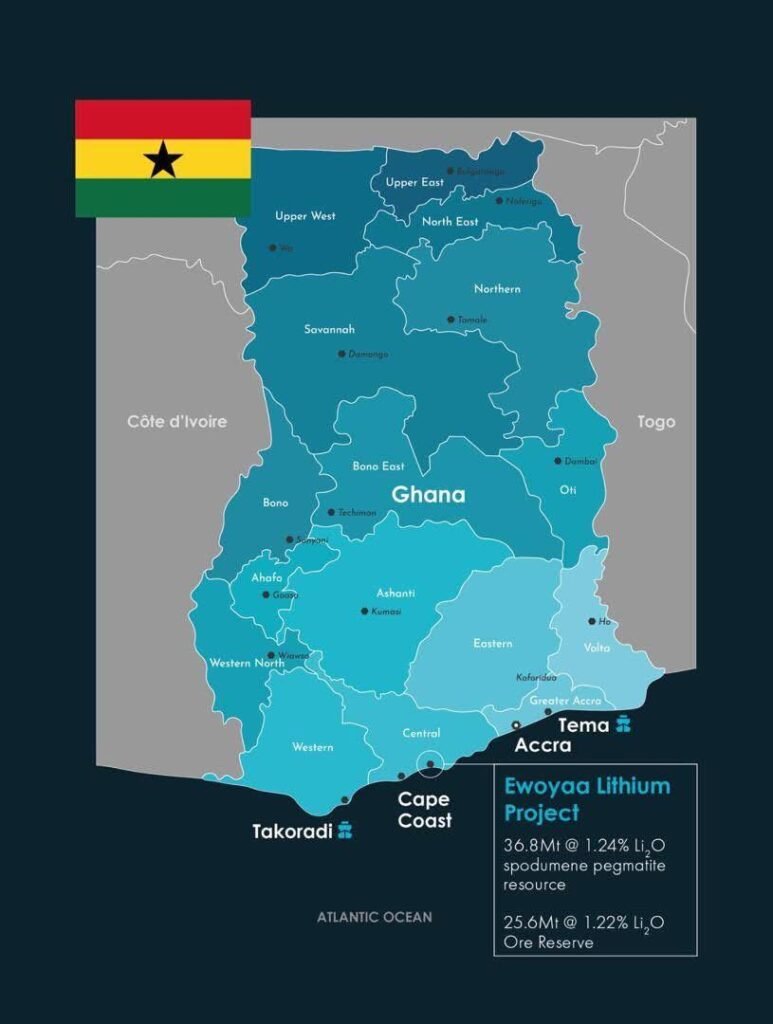

According to data referenced by the Institute, the Ewoyaa Mine, operated by Barari DV, is projected to produce 3.6 million tonnes of spodumene concentrate over its 12-year life of mine.

The institute argued that stopping at the export of raw concentrate is a strategic economic failure. By refining this output into lithium carbonate, a critical component for the green energy transition, Ghana could unlock exponentially higher revenue.

With lithium carbonate prices hovering around USD 9,000 per metric tonne, the Institute estimates that investing in processing the 3.6 million tonnes (converted at a ratio of 5.323) could allow Ghana to generate a gross value of approximately USD 172.4 billion over the mine’s lifespan.

This figure dwarfs the potential returns from mere royalties and taxes, presenting a compelling case for the state to assume the role of the primary operator.

Strategic Partnerships and the Fallacy of Capital Constraints

To operationalize this vision of sovereign mining, the IEA outlined a pragmatic framework that leverages domestic expertise rather than relying solely on foreign operators.

The Institute proposes the identification of a consortium of capable Ghanaian contract miners through a rigorous competitive bidding process.

This “Ghana First” approach suggests that firms such as African Mining Services, BCM Ghana Limited, Engineers & Planners, Quantum LC Limited, Rocksure International, and the Underground Mining Alliance have the technical capacity to mine and manage the lithium under a service contract.

This model mirrors successful strategies in the oil and gas sectors of other nations, where the state retains ownership of the resource while paying private contractors a fee for extraction, thereby retaining the bulk of the windfall profits.

Furthermore, the IEA has moved to debunk the persistent narrative that the Ghanaian government lacks the financial muscle to undertake such capital-intensive projects.

The Institute describes the belief in our “inability to raise capital” as a mindset that must be disabused.

The reality of the global extractive industry is that foreign companies often leverage the very natural resources they intend to mine to raise the required capital from international markets.

“It is a truism that the mineral deposit is what is needed for developing proposals to raise the capital required for exploitation,” IEA noted.

As evidence of domestic financial capacity, the Institute pointed to the Minerals Income Investment Fund (MIIF), which successfully mobilized almost USD 33 million to invest in the Ewoyaa project for a shareholding stake.

This demonstrates that with the right structuring, Ghana can self-finance or attract investment on its own terms, rather than ceding control to foreign concessionaires.

Legislative Urgency in a Multi-Polar World

The timing of this intervention by the IEA is critical, occurring against a backdrop of shifting geopolitical dynamics and domestic political mandates.

The Institute emphasized the “fierce urgency of now,” invoking the wisdom of Martin Luther King Jr. to warn against the dangers of being “too late” in the unfolding conundrum of history.

With the global order shifting towards a multi-polar world, resource-rich nations like Ghana possess newfound leverage.

Countries and major financial institutions are increasingly willing to fund the exploitation of critical minerals on terms significantly more beneficial than the antiquated concession regimes that have historically characterized Ghana’s mining sector.

The IEA urges the government to speed up ongoing legislative and policy reviews to fast-track the operationalization of these recommendations, preventing the country from being locked into unfavorable terms just as the lithium boom accelerates.

This advocacy is consistent with the IEA’s longstanding role as a guardian of good governance and economic policy in Ghana.

Historically, the Institute has served as a check on government action, ensuring that policies align with the national interest rather than political expediency.

Their stance on the Ewoyaa Lithium Deal is rooted in a desire to see democratic dividends translate into tangible development.

The Institute highlighted that the Ghanaian electorate, having reposed confidence in the President with a margin of over 1.7 million votes in the 2024 general elections, expects democracy to deliver economic transformation.

With democratic reversals occurring elsewhere in West Africa, the pressure is on the administration to prove that democratic governance can effectively manage natural resources.

As existing mining leases expire and new discoveries are made, the IEA posits that the creation of the GLC is not just an economic necessity, but a political imperative to secure Ghana’s industrial future.

READ ALSO: Ghana’s Cybele Energy Clinches Guyana’s Block S7 in Historic Production Sharing Deal