In a recent report by SB Morgen, titled “What Could Happen To Your Chocolate? Rising cocoa prices may impact sweet tooths,” the dynamics of the global cocoa market have been scrutinized, revealing a complex web of challenges affecting cocoa farmers, processors, and consumers alike.

According to the report, geopolitical events and domestic issues in key cocoa-producing regions have driven cocoa prices to historic highs.

The report highlighted how disruptions such as terrorist attacks in the Red Sea, export interruptions in Ecuador due to gang violence, and debt restructuring in Ghana have collectively fueled this surge in cocoa prices.

“Factors such as increased freight rates resulting from Houthi terrorist attacks in the Red Sea and export disruptions in Ecuador, the third-largest cocoa exporter, due to drug-related gang violence, have raised cocoa prices.”

SB Morgen

One striking concern raised in the report is the potential impact on consumer demand for chocolate products. Despite historically resilient demand, continuous price hikes risk eroding this demand over time.

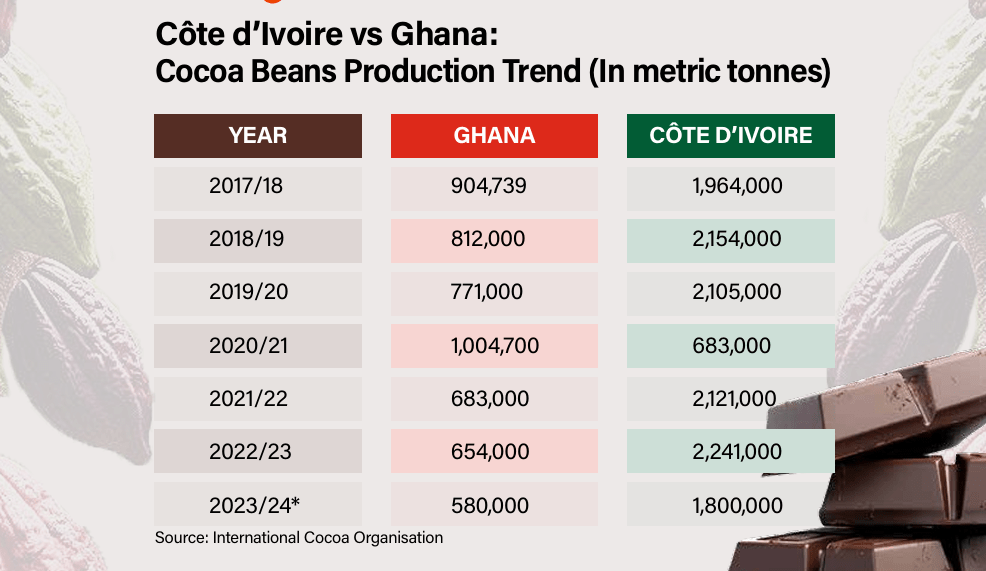

In Ghana, where cocoa is a vital foreign exchange earner, challenges persist in maximizing the industry’s potential. The report outlines how financial constraints, including debt restructuring, have hindered Ghana’s ability to support its cocoa farmers effectively.

Farmers in cocoa-growing regions are grappling with multiple challenges, from limited access to essential resources like fertilizers to the allure of selling land to illegal miners for gold prospecting.

“The decision to sell my farm to galamsey operators was relatively easy compared to say a decade ago when cocoa farmers were treated well,” a farmer in the Ashanti region said.

“Despite farming 45 acres of cocoa land, I have been unable to build even a single room all these years due to financial constraints. The value of land with a higher potential for gold can reach GHS 80,000 ($6,000), while those with lower prospects are priced at GHS 20,000 ($1,700).

“As a farmer, I struggle to obtain enough fertilizers for my cocoa farms. It has been two years since I last received seven bags of cocoa fertilizer, while others, with no cocoa farms, seem to effortlessly acquire up to 200 bags.”

Ghanaian Cocoa Farmer

Also, the dire state of infrastructure, particularly roads, has compounded these difficulties, making it costly and cumbersome for farmers to transport harvested cocoa pods.

Supply Chain Struggles and Regulatory Threats

Moreover, the cocoa market’s supply chain is under strain. Cocoa processing plants in Ghana and Côte d’Ivoire have either halted operations or reduced production due to exorbitant bean prices.

This disruption has led chocolate manufacturers to raise prices globally, affecting consumers directly.

The report cited specific instances of plant closures and reduced operations due to unsustainable bean prices, highlighting the interconnectedness of challenges across the cocoa value chain.

Local processors are struggling to secure cocoa beans at pre-agreed prices, leading to financial strains and market instability.

Furthermore, geopolitical tensions are simmering, especially in Côte d’Ivoire, where anti-French sentiments are on the rise.

“While France receives a significant volume of exports from Côte d’Ivoire, other countries like the Netherlands, Belgium, and the UK import larger quantities from Côte d’Ivoire, ranking higher in total export value.”

SB Morgen

Looking ahead, the report highlights impending regulatory challenges. The European Union’s forthcoming ban on commodities linked to deforestation poses a significant threat to cocoa production in West Africa. This looming regulatory burden adds another layer of complexity to an already fraught industry.

As cocoa prices continue to soar, the resilience of the chocolate industry will be tested. SB Morgen’s report serves as a timely reminder of the broader implications of cocoa market dynamics on global trade, supply chains, and consumer behavior.

READ ALSO: UNRWA Closes East Jerusalem Headquarters