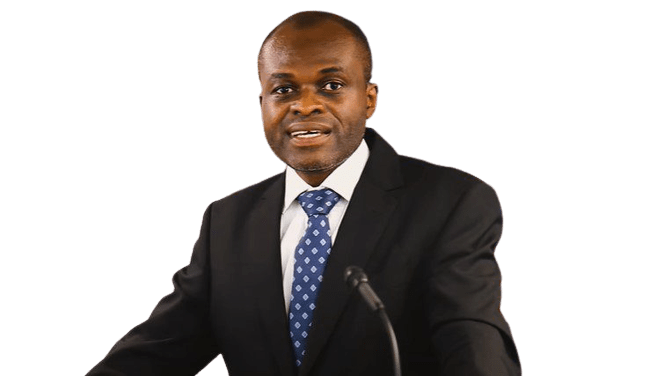

The Executive Secretary to the Importers and Exporters Association of Ghana, Sampson Asaki Awingobet, has expressed his disappointment in the government as a leaked document has exposed government’s decision to reverse its 50% benchmark value reduction on some commodities.

Benchmark values are reference values that Customs use in determining values that could be imposed on imports meant for clearance at the country’s ports.

The Vice-President, Dr Mahamudu Bawumia, last year, announced a drastic reduction in the benchmark values by 50% at a town hall meeting in Accra.

However, a leaked letter by the Ghana Revenue Authority, GRA, to the Ministry of Finance has disclosed, that the government of Ghana through the Ministry of Finance has directed the Ghana Revenue Authority to reverse the 50% benchmark value reduction on some commodities against which duties paid by importers at Ghana’s ports are calculated.

“As per discussion held previously, I have directed that the attached list be excluded from enjoying the 50% and 30% discount on goods and vehicles respectively under the “Benchmark Policy,” the letter states.

Upon noticing the letter, Samson Awingobet reacted to the leaked letter in an interview, saying that government is not being completely honest with Ghanaians in the sustenance of Ghana’s economy and it has informed the Importers and Exporters Association and will, therefore, influence their decision on who to vote for at the December polls.

“If you come to tell us that you have reduced benchmark values and the business community has applauded you, you just did us ‘419’. It is the same thing they did to importers where they said they have abolished the duty on spare parts and we applauded the Government. When it came to implementation, they just said Abossey-Okai should come together and identify which one is spare parts and which one is not. You can imagine,” he said.

“Why do they do this seven months to elections? Anyway, it is good that they have done it now than for it to run after elections in December when they want power. It is good they have come this time so that the business community, importers and consumers can make up their mind come December 7th,” he added.

What problem can the 50% benchmark reduction value reversal cause?

The Welfare Officer of the Ghana Union of Traders Association, GUTA, Benjamin Yeboah also on sighting the leaked document has cautioned authorities of a major disadvantage they will face after reversing the 50% reduction in the benchmark values.

According to him, the purpose of implementing the 50% reduction will be defeated by the reversal, hence, affecting the country’s economic growth.

He argued that the 50% reduction has gone a long way to ensure compliance by importers at the various points of entry and with its reversal, some importers might resort to smuggling.

Speaking in an interview, he said: “compliance is not by putting more security personnel at the borders but by putting in place tax exemptions like the 50% reduction in the benchmark values. If these are removed, then smuggling and other illegalities will resume.”

If smuggling and compliance issues become prevalent at the various points of entry, government will lose revenue generated from the ports and borders.