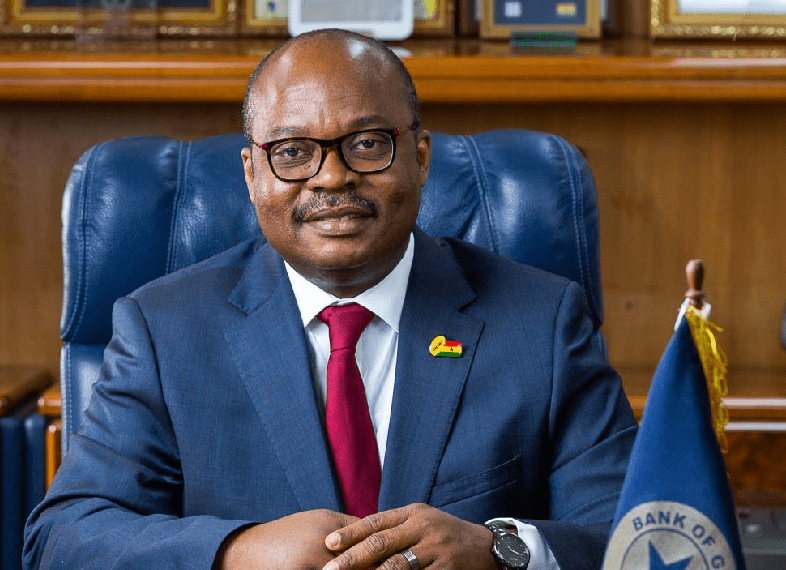

The Governor of the Bank of Ghana, Dr. Ernest Yedu Addison has intimated that the “global financial markets were also stressed” during the coronavirus pandemic that hit the global shores early this year, causing a lot of economic mishaps.

Dr. Ernest Yedu Addison made these comments while delivering his speech at the University of Ghana Alumni lecture series held recently at the Great Hall of the University on the theme ‘Pandemic, The Economy and Outlook’.

Speaking at the programme, the Bank of Ghana Governor opined that amidst the global crises there were “large swings in global stock markets, reversal of capital flows to Emerging Market and Developing Economies (EMDEs), and widening of EMDE sovereign bond spreads”.

This means that when the pandemic began to spread worldwide the financial markets were increasingly volatile, evidenced by rapid, directional change in value of certain securities with investors having to adjust to these price shifts referred to as market swing.

Additionally, the widening spreads gives an indication of a slowing economy. Since companies are more likely to default in a slowing economy, the credit risk associated with such securities also accelerates causing investors to demand additional interest on securities or decline in buying them to look for alternative safe havens.

Going further, Dr. Ernest Addison also asserted that the weak global demand and “the inability of Organization of the Petroleum Exporting Countries (OPEC) and its allies to agree on production cuts led to the collapse of oil prices, and further worsened financial market risk sentiments”.

Generally, “these developments led to tighter global financing conditions,” Dr. Addison whined adding that no one was left out, all including advanced, emerging market and developing economies were badly hit by the pandemic.

Touching on the swift and decisive policy reactions taken by Central Banks to help assuage the impact of the virus, Dr. Addison said a mix of conventional and unconventional measures were deployed depending on the “country-specific policy space to ease off the socioeconomic consequences of the pandemic”.

The Governor of the Bank of Ghana went on to say that “consistent with traditional responses to such negative economic shocks,” the toolkit deployed by central banks in advanced, emerging market and developing economies was to aggressively cut policy rates with some “bringing it down to historical lows”.

For instance, both the U.S. Federal Reserve and Ghana cut the policy rate by 150 basis points in March 2020.Similarly, in the emerging market economies, “policy rates in Turkey, Brazil, and Russia, were all cut by 300, 150, and 115 basis points, respectively”.

“Remarkably, monetary and macro-prudential policies were eased to support economic growth and provide adequate liquidity in the financial systems” he mentioned adding that temporary moratorium on loan payments, relaxing of prudential constraints were other policies undertaken by Central Banks in addition to the policy cut.

“To safeguard liquidity in the financial sector, central banks also provided short-term interbank lending facilities and resumed massive asset purchase programmes to ensure the smooth functioning of financial markets and credit flows,” he alerted.

However, he cautioned that his submissions on the COVID-19 responses by Central Banks were based on a survey of 29 countries including 6 Advanced, 9 Emerging Market economies, and 14 Sub-Saharan Countries.