Senegal has officially joined the ranks of African oil producers, with its first offshore oil field commencing production.

This milestone marks a significant step for the nation, which views its emerging oil and gas sector as a key driver of economic progress.

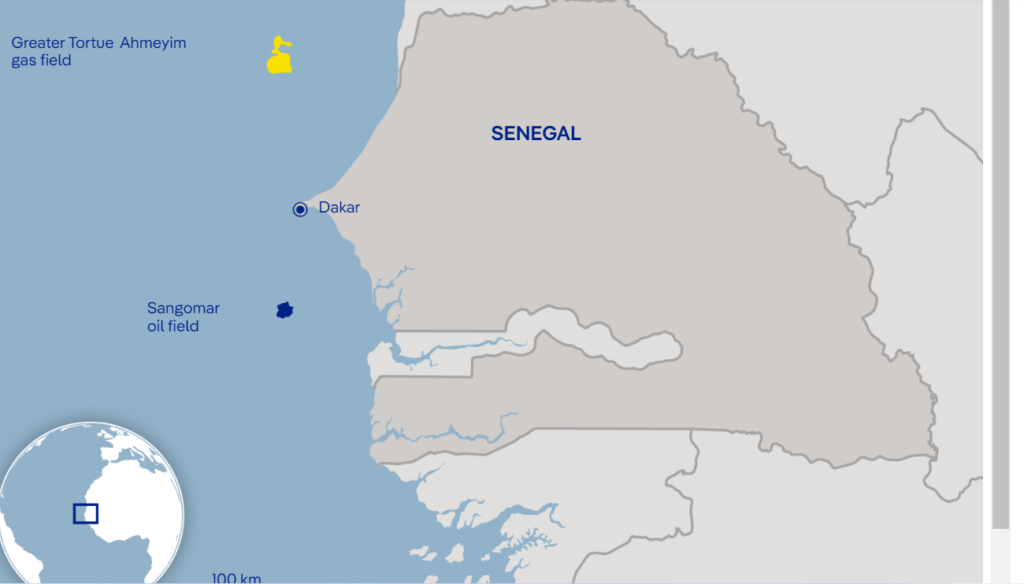

The initial phase of extraction from the Sangomar oil field, located approximately 90 kilometers (56 miles) off Senegal’s coast, will produce a modest 100,000 barrels per day for export.

While this output is significantly lower than Nigeria’s 1.2 million barrels per day, it represents a crucial development for Senegal.

In addition to the Sangomar field, Senegal’s substantial Greater Tortue Ahmeyim (GTA) gas field, which spans the border between Senegal and Mauritania, is anticipated to commence operations later this year.

Both projects, however, were initially slated to begin production three years ago.

“First oil from the Sangomar field marks a new era not only for our country’s industry and economy but most importantly for our people,” said Thierno Ly, the general manager of Petrosen, the state-owned energy company.

Petrosen holds an 18% stake in the Sangomar project, with Australian energy giant Woodside as the primary stakeholder.

The project has required an investment of approximately $5 billion (€4.6 billion). Furthermore, Petrosen maintains a 10% stake in the GTA field, which is being developed by BP and Kosmos Energy.

Economic Boost Amidst Caution

Experts caution that while these fossil fuel resources are expected to stimulate Senegal’s economic growth, they won’t transform the nation into a wealthy country overnight.

According to the International Monetary Fund’s (IMF) April 2024 regional economic outlook, Senegal is among the fastest-growing economies in sub-Saharan Africa, with a projected expansion of 8.35% in 2024.

This growth is largely attributed to the advent of oil and gas projects.

However, the overall contribution of oil and gas production to the economy is expected to remain “relatively limited,” comprising less than 5% of total GDP, according to Papa Daouda Diene.

Diene is a senior economic analyst at the Natural Resource Governance Institute, a US-based think tank.

“So as you see, these resources alone cannot transform Senegal into Dubai,” remarked Diene from Dakar.

“But if managed well — I really want to put the emphasis on that — if managed well, they can help initiate and strengthen Senegal’s structural transformation.”

Papa Daouda Diene

Challenges Amid Global Energy Transition

Despite the optimism, there is uncertainty regarding the long-term profitability of Senegal’s oil and gas investments due to the global shift towards cleaner energy sources, which is expected to reduce demand for fossil fuels.

Algerian climate policy analyst Yamina Saheb, a lead author on the Intergovernmental Panel on Climate Change report on climate mitigation, expressed concern over Senegal’s focus on fossil fuels.

“It’s very bad news indeed because they’re going to find themselves locked into an economic model that no longer works,” she stated.

The International Energy Agency’s (IEA) latest World Energy Outlook report indicates that global demand for coal, oil, and natural gas is flattening this decade and will decline in the next.

The October 2023 report projects that renewables will constitute nearly 50% of the global electricity mix by 2030, up from the current 30%.

“These expectations on fossil fuel revenues fueling development are a bit inflated,” said Mats Marquardt, a climate policy analyst at the German-based New Climate Institute, who has studied Senegal’s liquid natural gas (LNG) market.

“It’s clear that we were seeing that the Golden Age of gas is over. This is something that the IEA has been very vocal about, and under these circumstances, the business case for fossil fuel exports also has to be under scrutiny now.”

Mats Marquardt

If global oil and gas prices drop significantly, Senegal and other countries heavily investing in fossil fuel development might struggle to recoup their initial costs.

This scenario could lead to so-called stranded assets, where investments become obsolete before their economic value is realized.

READ ALSO: Lydia Forson Shares Fibroid Story To Raise Awareness