Databank Research has projected that the cost-push pressures currently being experienced in the country will persist until the end of September (end of third quarter) this year.

In its Weekly Fixed Income Update, Databank Research noted that the implementation of the Electronic Transaction Levy (E-Levy) from May 1, 2022, and the impending hike in utility tariffs are further upside risks to inflation.

Databank Research stated that the first and second-round effects of petroleum and transport price hikes, elevated food prices and the lagged impact of exchange rate pass through were the main drivers of the April 2022 inflation rate.

Ghana’s inflation continued the relentless run in April 2022, rising to 23.60% year-on-year as against 19.40% in March 2022. Therefore, inflation has increased by 11% over 4 months in 2022, continuing the upward run since second half of 2021, Databank Research stated in its report.

Meanwhile, Databank Research warned that a further tightening of the Monetary Policy Rate (MPR) by the Bank of Ghana (BoG) could stifle economic growth since liquidity levels are already tight on the interbank market

Based on this, Databank Research highlighted that it expects the Monetary Policy Committee (MPC) to exercise restraint in May 2022, deferring a potential 100 basis points hike in MPR to July 2022, despite real negative returns to investors due to rising inflation.

“Real returns on fixed-income securities are also depressed with the high inflation profile, continually undermining the Treasury’s financing operations. We note that short-term interest rates are misaligned, resulting in negative real yields, which could prompt the MPC to act in the week ahead”.

Databank Research

Ghana’s galloping inflation baffling

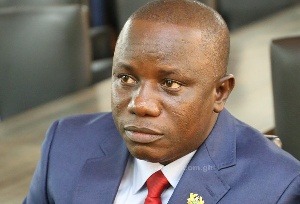

Meanwhile, Dr Ernest Addison, Governor of the Bank of Ghana, described Ghana’s current inflation rate as baffling.

Speaking in a virtual interview before the ‘Bloomberg Invest: Focus on Africa conference’, Dr Addison said, “It’s an issue which in a sense, is baffling to all of us. A year ago, inflation in Ghana was near single digit, particularly we were at 7.5% and then we find ourselves a year later in high double digits.”

“It’s a very complicated environment”, he said, adding that “we have come out of COVID-19. But Ghana, fortunately, was able to weather the impact of COVD well without recording high interest rates”.

“And it seems as if the economy has picked up significantly with a positive growth rate of 5.4%. At the Central Bank, we have anticipated this. In November last year, we raised the policy rate by 100 basis points, and then, we were rather surprised by the inflation rate which came out later on after that, in February [2022] in particular, which triggered the 250 basis points adjustment in the policy rate”.

Dr Ernest Addison

Dr. Addison further noted that “A lot of the shocks that we are seeing now, tend to be supply-side in nature”. He indicated that the Central Bank is trying to manage liquidity very tightly to “ensure that we don’t have excess liquidity fueling further inflation and an exchange-rate depreciation”.

Even though the Governor is optimistic that inflation will be tapering off for the rest of the year, he added that “If markets get tighter and we see capital beginning to exit, the interest-rate instrument will have to do part of the work”.

He however, did not preempt the possible decisions of the MPC as it continues its 106th regular meetings to review developments in both the global and domestic economies which will determine the Committee’s decisions on the policy rate.