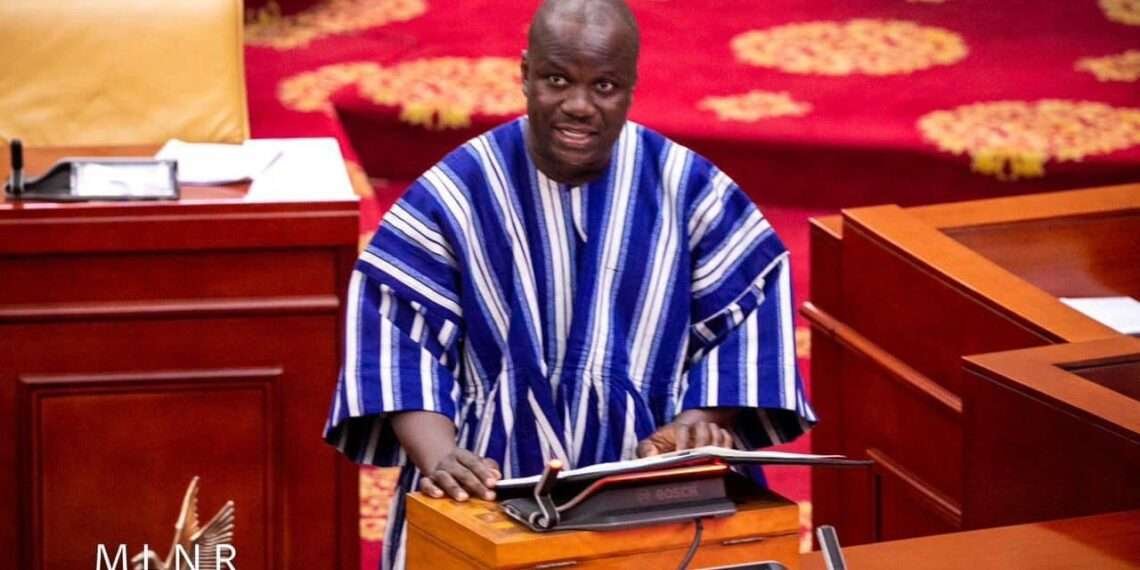

Samuel Abu Jinapor, Member of Parliament for the Damongo Constituency and former Minister for Lands and Natural Resources, has called on the government to clarify critical aspects of the proposed Board to maintain investor confidence in the country’s mining sector.

Hon. Jinapor raised concerns about potential duplication of roles, noting that Ghana already has well-established institutions overseeing various aspects of gold mining, exportation, and revenue management.

“The Ministry of Lands and Natural Resources, the Minerals Commission, the Minerals Income Investment Fund (MIIF), and the Bank of Ghana are the principal agencies of state responsible for regulating the exploitation, management, and utilization of our gold resources and proceeds therefrom.

“So now, what will be the mandate of this proposed Gold Board? How will it co-exist with the time-tested and cardinal institutions such as the Minerals Commission?”

Samuel Abu Jinapor, Member of Parliament for the Damongo Constituency

The Gold Board is one of the governing National Democratic Congress (NDC)’s flagship initiatives in the mining sector, aimed at improving governance, stabilizing the cedi, and maximizing revenue from gold exports.

The government has framed it as a key component of its economic revitalization strategy, with President John Dramani Mahama emphasizing its role in strengthening regulatory oversight in his maiden State of the Nation Address.

To accelerate the establishment of the Board, Finance Minister Dr. Cassiel Ato Baah Forson inaugurated a technical committee on January 27, 2025, tasked with developing a framework for its operationalization.

Speaking at the event, Dr. Forson stated that the Gold Board would regulate the gold industry in a manner that ensures greater transparency and efficiency while consolidating the government’s ability to manage the country’s gold resources effectively.

“Gold is Ghana’s leading precious mineral, and through dint of hard work by the Akufo-Addo administration, Ghana is today, by far, Africa’s leading producer of gold.

“Through numerous interventions including the innovative Gold4Oil Programme and the establishment of the Minerals Income Investment Fund (MIIF), Ghana has leveraged her gold resources for national economic growth.”

Samuel Abu Jinapor, Member of Parliament for the Damongo Constituency

Additionally, HonHon. Jinapor questioned whether the Bank of Ghana’s role in the gold trade would be handed over to the Gold Board.

“The Governor of the Bank of Ghana has suspended the Gold4Oil Programme, and there are speculations that it will be replaced with this new Gold Board. If so, what will be the contours of this arrangement?”

Samuel Abu Jinapor, Member of Parliament for the Damongo Constituency

Hon. Jinapor also warned about the potential consequences for private sector actors, particularly those who have heavily invested in the gold trade.

The possibility of the Gold Board having exclusive control over the purchase and export of gold, he noted, could have significant repercussions for private businesses operating in the sector.

“While it is welcoming to implement additional measures and/or interventions to have maximum benefit from our mineral resources, it is also important not to duplicate the mandate of institutions, which are already performing these functions.”

Samuel Abu Jinapor, Member of Parliament for the Damongo Constituency

Jinapor Calls for Greater Clarity

The establishment of the Gold Board represents a major policy shift that could have long-term implications for Ghana’s gold industry.

While the government argues that the Board will enhance efficiency and revenue generation, industry stakeholders remain skeptical about how it will function alongside existing regulatory bodies.

“Ghana has come far with her mining regulatory regime, which is highly respected across the globe.

“Nothing should be done in secrecy or surreptitiously to destroy Ghana’s hard-won reputation in this sector.”

Samuel Abu Jinapor, Member of Parliament for the Damongo Constituency

Samuel Abu Jinapor’s call for clarity reflects broader industry apprehensions about potential regulatory conflicts, private sector disruptions, and investor uncertainty.

If the government fails to provide clear answers, the rollout of the Gold Board could face resistance from both industry players and policymakers.

As the debate continues, the key question remains: Can the government implement the Gold Board in a way that strengthens the mining sector without undermining established institutions?

The answer will determine whether this initiative succeeds in revitalizing Ghana’s economy or becomes another policy misstep in the country’s resource management strategy.

READ ALSO: GSE Financial Stocks Surge 13.82% in Four Weeks as Investor Confidence Grows