Kosmos Energy has successfully refinanced its revolving credit facility (RCF) and also completed the semi-annual redetermination of its reserve based lending facility (RBL), after an amendment and extension of same last year.

Jointly, these financing activities and strong free cash flow in the first quarter of 2022, further strengthened the liquidity position of the firm and places it in good standing. Total liquidity at the end of the first quarter of 2022 increased to approximately $0.9 billion, including the impact of the reduced RCF size.

Regards refinancing the revolving credit facility, the new debt has a total capacity of $250 million while extending the maturity to the end of 2024. The reduced RCF size will offset an increase in the margin, resulting in slightly lower interest expenses going forward, a report released today, April 1, 2022 stated.

“In anticipation of the cessation of the London Interbank Offered Rate (LIBOR), this is one of the energy industry’s first credit facilities linked to the Secured Overnight Financing Rate (SOFR). The facility remains undrawn.”

Kosmos Energy

Redetermination of RBL

With regards to the spring redetermination of the Reserve Based Lending, the report stated that the Company’s lending syndicate approved a borrowing base capacity of $1.25 billion with current outstanding borrowings of $0.9 billion. According to the report, total commitments as of April 1, 2022 were $1.25 billion.

“The RBL facility is secured against the Company’s production assets in Ghana (excluding the incremental interests acquired from Occidental Petroleum in October 2021) and Equatorial Guinea with the first amortization payment scheduled for March 2024.”

Kosmos Energy

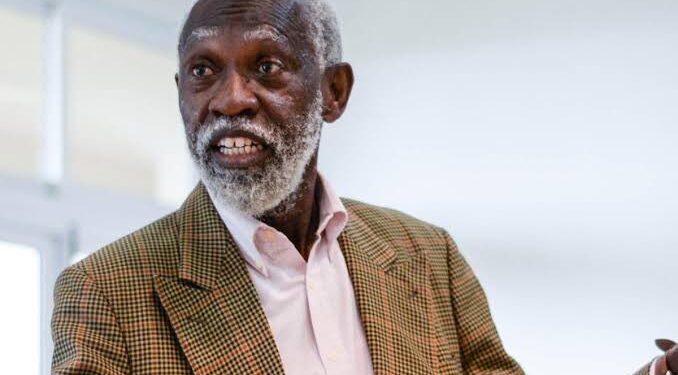

Neal Shah, Chief Financial Officer of Kosmos Energy, said:

“We are pleased to have successfully completed the RCF refinancing and our RBL redetermination, which secures the liquidity necessary to support the growth of our differentiated portfolio. We appreciate the continued support of our key relationship banks.

“With strong free cash flow generation, coupled with the recent receipt of pre-emption proceeds, we are making excellent progress in reducing both leverage and absolute debt while growing liquidity. At current oil prices we expect leverage to be below our 1.5x target by year-end 2022 and are well on the way to achieving that outcome.”

Neal Shah

Before the existing RCF refinancing and RBL redetermination was effected, the company had already downsized its debt portfolio as of October 2021, through an amendment and extension of its reserve based lending from $1.5 billion to $1.25 billion. Like the existing gamut of measures to reduce RBL, the company’s lending syndicate approved a borrowing base capacity of $1.24 billion with current outstanding borrowings of $1.0 billion.

Exactly a year ago, at an effective date of April 1, 2021, Kosmos acquired an additional 18.0% interest in the Jubilee field and an additional 11.0% interest in the TEN fields in Ghana from Occidental Petroleum for a purchase price of $550 million.

The Company said that in funding the transaction, Barclays and Standard Chartered Bank provided Kosmos with a $400 million bridge loan, which the Company expects to refinance with the proceeds from a future senior notes offering. The remaining consideration was funded from available liquidity, which the Company expects to re-finance with the proceeds from the equity offering of approximately $100 million.

READ ALSO: Modified Version Of E-Levy May Generate More Revenues Than Expected – Economist