In a world driven by oil, the price of this essential commodity holds the key to shaping the entire economic landscape.

Oil prices are set to rise this year, as projected by the April 2024 World Bank Commodity Markets Outlook.

The price of Brent crude is expected to average around $84 per barrel in 2024, slightly higher than the $83 per barrel seen last year.

This increase is attributed to growing geopolitical tensions and a delicate balance between oil supply and demand.

The World Bank’s forecast assumes that there won’t be any further escalation in conflicts, which means that oil prices are expected to ease from their early April levels.

It’s anticipated that the average price for the rest of 2024 will be lower due to a reduction in recent risk-related price premiums.

Looking ahead to next year, the World Bank predicts that oil prices will trend downwards, averaging around $79 per barrel, as supply conditions improve.

In terms of production, oil output is expected to grow by 0.8 million barrels per day this year, driven primarily by increased supply from the United States.

Meanwhile, production from the Organization of the Petroleum Exporting Countries and its allies (OPEC+) is projected to decrease, contributing to these market dynamics.

“Consumption is foreseen to increase about 1.2 mb/d this year—a notable deceleration from 2023—with all the net demand growth in emerging market and developing economies (EMDEs). Next year, oil demand growth is anticipated to slow further, with a contemporaneous reversal of OPEC+ supply reductions pushing production higher, resulting in building inventories.”

World Bank April 2024 Commodity Markets Outlook

Presently, Brent crude is going for $89.23 per barrel.

However, the report said, “A moderate conflict-related supply disruption could raise the average Brent price this year to $92 a barrel.” And more severe disruption could see oil prices reaching or even surpassing $100 a barrel, which will raise global inflation in 2024 by nearly one percentage point.

From mid-2022 to mid-2023, global commodity prices experienced a significant decline of nearly 40%, which contributed to a substantial drop of almost two percentage points in global inflation during that timeframe. Since mid-2023, the World Bank reports that its index of commodity prices has largely remained stable without significant fluctuations.

Financial markets have reacted to these developments by adjusting their expectations regarding the potential size and speed of interest rate cuts this year, as inflation has proven to be more persistent than initially anticipated.

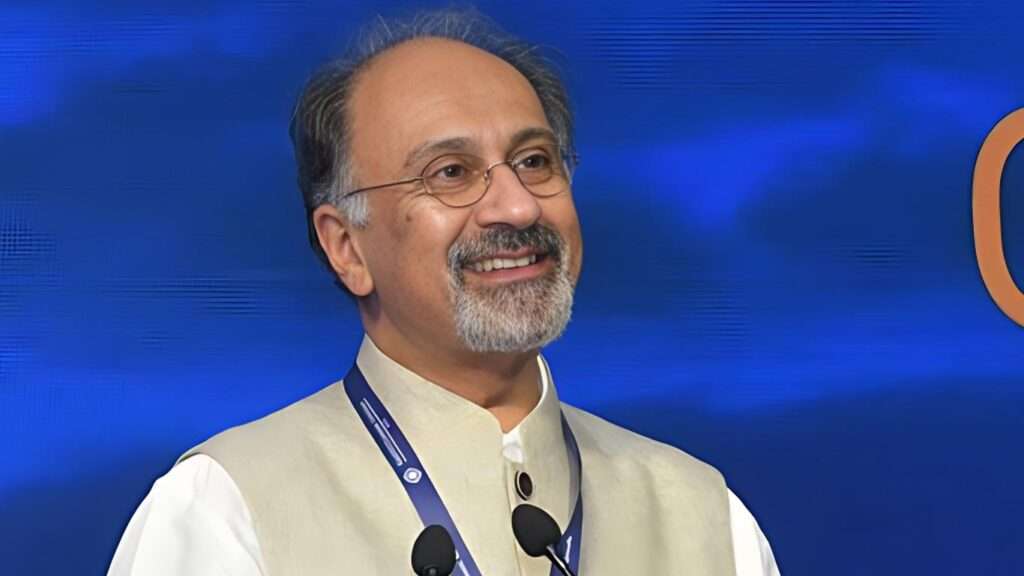

Indermit Gill, the World Bank chief economist, said, “Global inflation remains undefeated. A key force for disinflation – falling commodity prices – has essentially hit a wall.”

“That means interest rates could remain higher than currently expected this year and next. The world is at a vulnerable moment: a major energy shock could undermine much of the progress in reducing inflation over the past two years.”

Indermit Gill

Middle East Conflict Risks

Furthermore, the World Bank warned that an escalation of conflict in the Middle East could lead to higher prices for natural gas, fertilizers, and food.

Approximately one-fifth of global liquefied natural gas (LNG) exports pass through the Strait of Hormuz. If this supply route were disrupted, prices for fertilizers that rely on LNG in their production would see significant increases, likely causing a ripple effect on food prices.

However, assuming the crisis remains contained, the World Bank’s baseline forecast predicts a decline in overall food prices by 6% in 2024 and a further 4% decrease in 2025.

Similarly, fertilizer prices are expected to drop by 22% in 2024 and an additional 6% in 2025.

Ghana can take strategic steps to better prepare for fluctuating oil prices and potential geopolitical tensions.

First, diversify the economy by investing in other sectors like agriculture, manufacturing, and renewable energy to reduce reliance on oil revenue.

Enhance fiscal discipline and build fiscal buffers to mitigate the impact of oil price volatility on government finances.

The government should encourage domestic refining capabilities to reduce dependence on imported petroleum products. Also, it should strengthen energy security by promoting energy efficiency and expanding renewable energy sources.

Finally, Ghana should invest more in education and skills development to create a more resilient and diversified economy capable of withstanding external shocks.

READ ALSO: EC Responds to Mahama’s Accusations