The Ministry of Finance has implored the general public to ignore media publications that suggest that the GH¢241 million earmarked as E-Levy Transaction Services in Appendix 4B of page 242 of the 2022 Budget Statement has been dropped.

According to the Ministry of Finance, its attention has been drawn to social media publications claiming that government has dropped the allocation of GH¢241,933,000 for the E-Transaction Levy Services in the 2022 Budget and it will, therefore, not appear in the Appropriations Bill.

The Finance Ministry stated that it is also aware of allegations making the rounds that a private company has been awarded a contract to collect the E-Levy. Another allegation about the E-Levy transaction services, according to the Finance Ministry, is that the services of the said private company have now been abrogated.

In a press statement, the Ministry of Finance said it wishes “to state that these allegations are all untrue”.

GRA to manage collection of E-Levy

The statement clarified that the Ghana Revenue Authority (GRA) is the state agency mandated to provide for the collection services, the cost of which shall not exceed the standard cost of revenue mobilization as has always been the practice.

“This standard indicative cost is what is outlined in the budget. GRA will manage all discussions to ensure full deployment of their current platforms and resources for the collection of the E-Levy”.

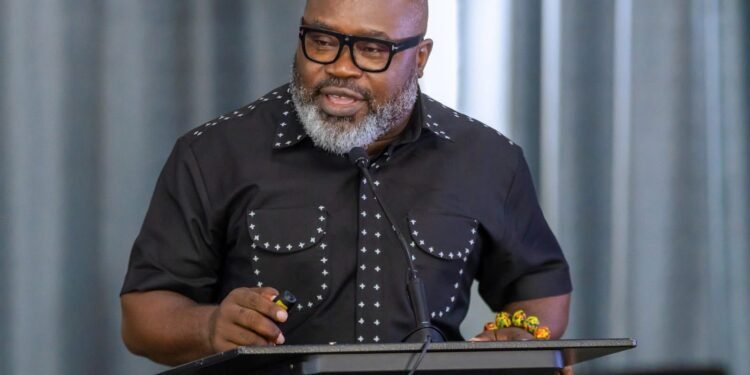

Ministry of Finance

The statement recalled that on December 6, 2021, Minister for Finance, Ken Ofori-Atta, provided full clarification on the earmarking of GHC241m as the E-levy services fee. The Finance Ministry indicated in its press statement that “for avoidance of doubt, and to prevent further misinformation, we reproduce the relevant sections of the Minister’s statement”.

“We do have an understanding with the Ghana Revenue Authority which uses up to 3% of the money it raises for ensuring that they can make such collections. The GH241 million is therefore a reserve that is intended to be put aside to facilitate GRA’s collection of these resources.

“Additionally, typically when we have new tax measures, there is the issue of refunds and we usually make some compensation for that, sometimes 6% or so of the value to ensure that if those refunds come, we are able to pay for them.

“So, in essence, this really will be to back up GRA in a way to ensure that all the problems that people envisage and the difficulties other countries have had will be mitigated in Ghana, so we should be in readiness to support that”.

Ken Ofori-Atta

E-Levy as an efficient means of raising revenues

The Finance Ministry is very optimistic that the 1.75% levy on electronic transactions will help raise the needed revenues to undertake government’s programs next year.

“We wish to reiterate that; the E-Transaction Levy remains one of the efficient means by which Government would be able to raise the needed revenue to support the economic development programmes for 2022. We count on your support”.

Ministry of Finance

Finance Minister, Ken Ofori-Atta stated on Wednesday, November 17, 2021 whilst presenting the 2022 budget statement to parliament that “It is becoming clear there exists enormous potential to increase tax revenues by bringing into the tax bracket, transactions that could be best defined as being undertaken in the informal economy”.

According to him, after considerable deliberations, government has decided to place a levy on all electronic transactions to widen the tax net and rope in the informal sector which shall be known as the ‘Electronic Transaction Levy or E-Levy’.

Mr. Ofori-Atta explained that the new E-levy will be a 1.75% charge on all electronic transactions covering mobile money payments, bank transfers, merchant payments and inward remittances to be borne by the sender except inward remittances, which will be borne by the recipient.

Per the government’s projections, the E-levy is expected to generate GH¢6,963,386,254 in 2022 and GH¢7,888,562,147 in 2023. However, public outcry for a review of the rate or a total overhaul of the E-levy continues to make the waves across the length and breadth of the country.

READ ALSO: Ghana Ranks Among Top Ten Wealthiest Nations In Africa