The Governor of the Bank of Ghana, Dr. Ernest Addison has averred that the Domestic Debt Exchange Programme (DDEP), new revenue measures and structural fiscal reforms will provide significant debt service reductions and help create fiscal space.

These were Dr. Addison’s response to questions at a press briefing following the recent Monetary Policy Committee meeting held .

With the DDEP already being implemented, the next line of action for government in the domestic domain is for parliament to approve government’s newly proposed revenue bills, which according to the government, is imperative parliament prioritizes, as these bills, when passed, are expected to generate a yield worth GH¢3.96billion.

These outstanding bills are the Income Tax (Amendment) bill, Excise Duty & Excise Tax Stamp (Amendment) bills, as well as the Growth and Sustainability Levy bill. These bills are necessary for effective budget implementation and boosting the state’s efforts at increasing the tax-to-GDP from less than 13 percent to the Sub-Saharan average of 18 percent.

The passage of relevant revenue bills by parliament will therefore conclude the required prior actions to advance Ghana’s programme to the IMF Executive Board. This is critical in setting the economy on the path of recovery, including putting it firmly on a disinflation and sustained growth path.

Also as part of the Staff Level Agreement with the International Monetary Fund, the Governor of the central Bank noted that:

“Under the Staff Level Agreement with the IMF, the Bank of Ghana and Ministry of Finance have finalized a memorandum of understanding on zero financing to the budget, which will be signed shortly.”

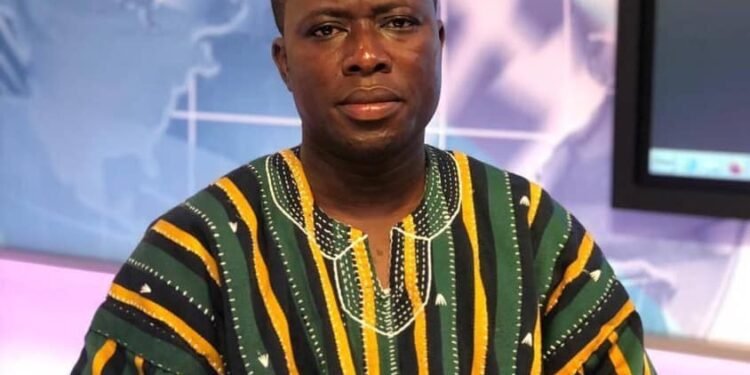

Dr. Ernest Addison

In the meantime, government has completed three prior actions – including tariff adjustment by the Public Utilities Regulatory Commission (PURC), publication of the Auditor-General’s report on COVID-19 spending, and onboarding of Ghana Education Trust Fund (GETFUND), District Assemblies Common Fund (DACF) and the Road Fund on the Ghana integrated financial management information system (GIFMIS) – as established in the Staff Level Agreement.

Dr. Addison indicates that the IMF Bailout Programme is progressing well

According to Dr. Addison, discussions regarding the proposed US$3billion International Monetary Fund (IMF) bailout programme are progressing well.

The Governor also noted that the budget statement for 2023 is on a consolidation path consistent with key elements agreed with the IMF at the Staff Level in December 2022.

However, he said, the fiscal outlook is contingent on financing the budget and will require a conclusion of the DDEP, and securing the requisite financing assurances from bilateral donors.

“We were anticipating that the IMF board will convene by the end of March, but this is subject to obtaining financing assurances from bilateral creditors. Fortunately, there has been progress on this front as the official creditors’ committee met last week and are now looking at a date in April – by which time they can provide the necessary financial assurances.

“Once we have signed the memorandum of understanding, and once parliament has passed the new revenue measures, we should have completed what is known as the prior actions. Therefore, there are two steps forward, and we hope that by the end of April we will see the executive board meeting take place.”

Dr. Ernest Addison

Against this backdrop, the Governor said:

“We are confident about the outlook, and the foreign exchange situation is not dire. We have been quite successful with our gold sales programme, and we have been able to increase our reserves through gold purchases. Thus, it is not as severe as initially projected.

“The good news is that indications are these discussions are proceeding well.”

Dr. Ernest Addison