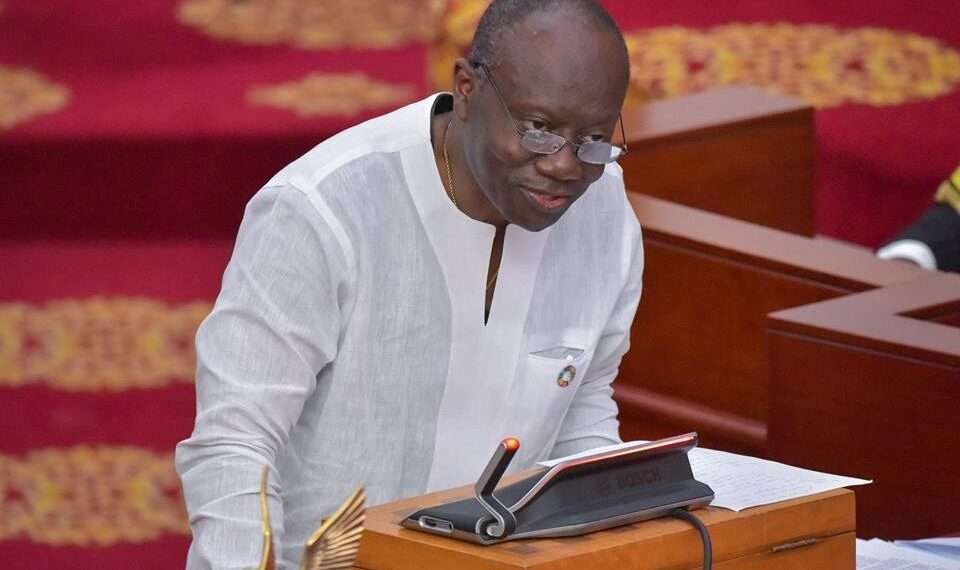

The Finance Minister, Ken Ofori Atta, has re-emphasized that the current state of Ghana’s debt and economy is due to the unfortunate impacts of the Covid-19 pandemic and the Russia–Ukraine war.

The lingering effect of the pandemic and war, according to the finance minister, exacerbated the high macroeconomic instability experienced in 2022, along with downgrades by rating agencies as well as the consequential pressures on government finances due to the actions of non-resident investors and the delayed passage of our revenue bills.

Addressing Parliament on the status of the Domestic Debt Exchange, the finance minister averred that the situation is further compounded by the comparatively low levels of domestic revenue collected by government.

“In 2022, tax to GDP was just about 12.6%; woefully below the SSA average of 18% and insufficient enough to meet pressures on the public purse.”

Ken Ofori Atta

Following the inception of negotiations with the International Monetary Fund, Mr. Ofori-Atta divulged it was agreed that Ghana would have to address its economic challenges on three fronts, “that is embark on fiscal consolidation, undertake debt operations and secure financing assurances from development partners,” he said

“As I have indicated earlier, the domestic debt exchange programme was to alleviate the debt burden while minimizing its impact on investors and the financial sector. Participation in the programme has always been ‘Voluntary’.

“The details of the domestic debt exchange are outlined in the Exchange Memorandum, and the subsequent amendments have been publicly available.”

Ken Ofori Atta

The coverage of the Exchange includes all locally issued bonds and notes of government as well as ESLA Plc and Daakye Plc bonds. Based on the results of the audit of the public debt, government excluded Treasury-bills and Pension Funds from the exchange.

Out of the total ¢97,749,624,691 eligible bonds that were issued, ¢82,994,510,128 was successfully tendered.

This accounted for about 85% of outstanding eligible amounts and met the target of 80% as expressed in the Memorandum of Exchange.

“Government is however mindful that the Gh¢82,994,510,128 bonds that were successfully tendered represents 64% of the outstanding debt stock of Gh¢130billion at the end of December, 2022.”

Ken Ofori-Atta

Treasury Bill, Concessional loans Becomes The Major Source Of Finance To Ghana

However, the finance minister in his public address further noted that despite the economic challenges, the main source of financing for the 2023 budget to hold up the country while in its crisis state are treasury bills and concessional loans.

According to him, this has become the case because of the closure of the international domestic bond market.

“Mr. Speaker, as the domestic international domestic bond markets are shut for the financing of government programmes, we are relying on Treasury bills and concessional primary sources of financing for the 2023 budget.

“We therefore call on this House to support government financing requests to ensure a full recovery from these economic challenges.”

Ken Ofori Atta

Meanwhile, Treasury bills saw an oversubscription in their latest auction on February 10, 2023.

According to the auction results from the Central Bank, the government secured GHC3.35 billion from the 91, 182, and 364-day Treasury bills.

This is GHC590.49 million away from its GHC2.759 billion target.

The majority of the subscriptions were from the 91-day bill which secured GHC2.07 billion and GHC398 million from the 182-day bill and GHC875.68 million from the 364-day bill.

The interest rates, however, hovered around 35.8%.

Read also: All Pensioners Who Did Not Participate In The Bond Offerings Are Exempt – Finance Minister