The year 2020 was eventful for the payment service industry on account of the COVID-19 and increased technology, innovation and changes in consumer preferences. GhIPSS

As such, the Ghana Interbank Payment and Settlement System (GhIPSS) recorded an increase in the value of transactions processed in 2020 by 16% over the value recorded in 2019, according to the 2020 Payment Systems Oversight Annual Report released by the Bank of Ghana.

The value of transactions processed in 2020 was GH¢254 billion compared to the GH¢219 billion processed in 2019. The rise in the value of processed transactions corresponded to the total number of transactions processed by the GhIPSS which recorded an increase of 103 percent across all of its platforms as at the end of 2020. According to the report, a total of 77 million transactions were processed across all the platforms, compared to 38 million transactions processed in 2019.

Innovation by Financial institutions

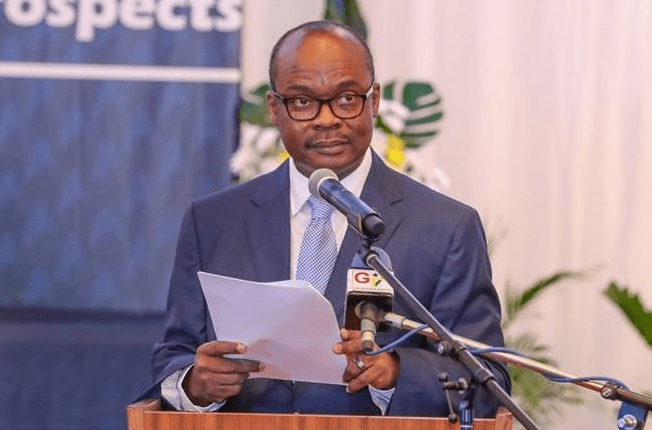

Dr. Ernest Addison, Governor of the Bank of Ghana, highlighted in the foreword of the report that Financial institutions adjusted to the new norm, innovated and partnered with Financial Technology Firms (FinTechs) to deliver various digital financial services. He indicated that the Bank of Ghana instituted various policy measures that promoted digital payment as means to help curb the spread of the COVID-19 virus.

“The Bank of Ghana continued to stay focused on promoting financial inclusion, protecting the payment systems landscape and collaborating with relevant stakeholders to help preserve the gains made in digital payment.

“Once again, as a central bank, we have successfully sailed through another turbulent year, and delivered on our mandate of monetary and financial stability, despite the adverse effects of the COVID-19 pandemic. Together, I am hopeful that we will continue to safeguard the payment systems landscape while promoting innovation in the financial ecosystem”.

Dr. Ernest Addison

Performance of various payment platforms

All the major payment streams (excluding cash) showed significant increases in both volume and value with the exception of Cheque Codeline Clearing (CCC) which recorded a decline in volume of transactions by 13.59 percent with a slight increase in value of transaction by 2.30 percent.

The number of mobile money accounts increased by 18.49 percent to 38,473,724 at end of December 2020 from the 2019 position of 32,470,793. Mobile money continued to show increases in both volume and value of transactions as well as total float balances (equivalent cash of the electronic money held by the banks) during the year, the report highlighted.

The number of cards issued by banks increased in 2020. Issued credit cards increased by 13.73 percent to 33,039 while prepaid and debit cards also increased by 53.98 percent to 573,703 and 8.7 percent to 4,813,063 respectively.

Ghana Inter-Bank Settlement

The total volume of Ghana Inter-Bank Settlement (GIS) transactions as at the end of December 2020 increased by 4.80 percent to 1,442,182. Total value of transactions also went up by 15.55 percent to GH¢2,433,537.47 million. In 2020, average value per transaction was GH¢1,687,399.70 compared with GH¢1,530,504.36 in 2019.

GhIPSS Instant Pay (GIP), a service which permits payments to be sent across financial institutions electronically from a customer’s bank account to a beneficiary bank account increased in both volume and value by 257 percent and 165 percent respectively. The volume of Ezwich card and Gh-link transactions however, decreased over the 2019 position with slight increases in their respective value of transactions during the year.

Internet and Mobile Banking also experienced significant patronage in the year under review. The value of Internet Banking transactions increased significantly by 101.50 percent to GH¢24.21 billion in 2020 compared with the 2019 position of GH¢12.01 billion. Mobile Banking transaction value was GH¢12.94 billion in 2020 compared with GH¢6.69 billion in 2019 and showed a growth of 93.51 percent.

Despite the increase in transactional value, the number of registered internet banking customers declined by 7.88 percent from 1,106,270 in 2019 to 1,019,073 in 2020. Registered mobile banking customers on the other hand, increased by 12.30 percent from 4,245,479 in 2019 to 4,767,719 in 2020. As the patronage of digital services continue in 2021, it is expected that all the payment platforms will experience an improvement over the performance in 2020.

READ ALSO: Ghana Police Service Schedules Meeting With FixTheCountry ahead of its protest