Insurance Brokers in Ghana have called on the Government to introduce measures in the 2023 Budget Statement and Economic Policy to protect people’s investment in the insurance sector.

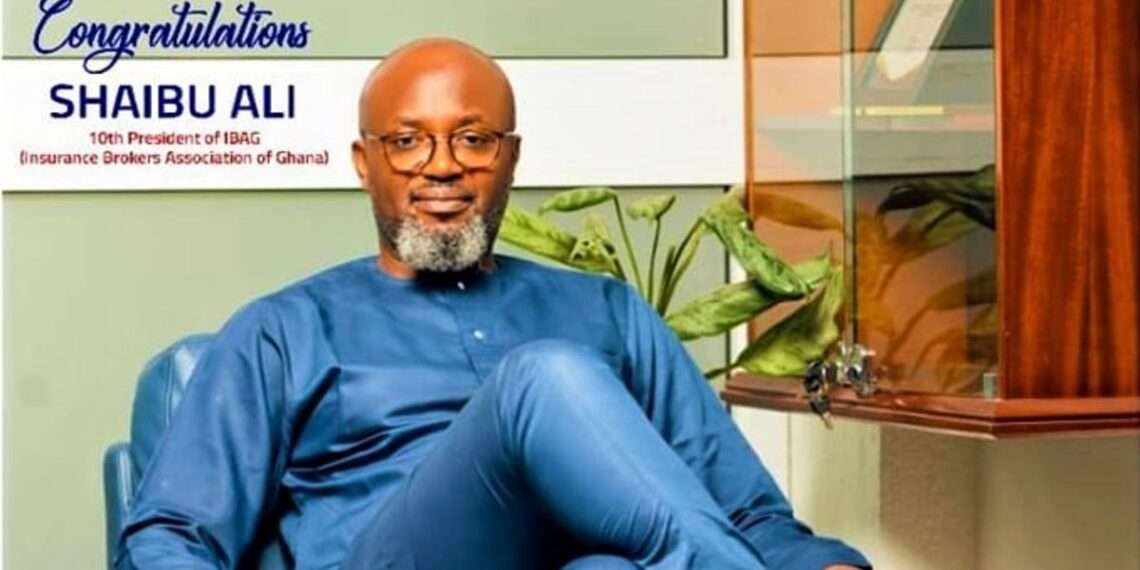

Mr Shaibu Ali, the President of the Insurance Brokers Association of Ghana (IBAG), asked the Government to make sure that any restructuring does not affect the insurance sector. He thus, underscored the contribution of the insurance sector to economic growth and the support it gave to people in times of disaster.

According to Mr Shaibu Ali, even though the economy is currently facing difficulties, the government must not solve with the insurance sector firm in mind.

“We appreciate that there’s a problem and that problem must be fixed heads on, but our investments must be protected by the Government.”

Mr Shaibu Ali

Mr Shaibu Ali made this known at a media soiree. He indicated that the program is aimed at deepening the relationship between IBAG and the media fraternity and formed part of activities for this year’s Broker Awareness Month.

The President of the Insurance Brokers Association of Ghana noted IBAG has started educating students in various Senior High Schools across the country to clarify the myth about insurance and said, “We need to demystify insurance, and we believe we can do this by getting closer to the younger ones still in school”.

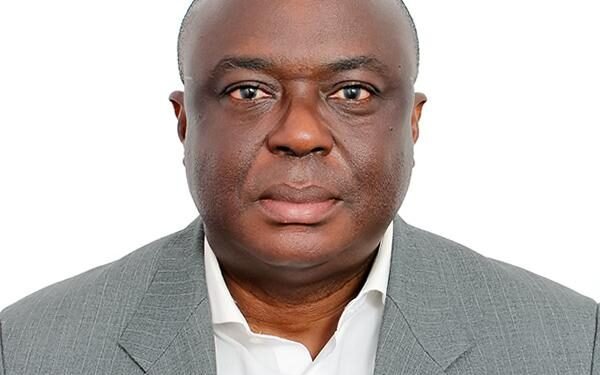

Mr Stephen Kwarteng Yeboah, the Vice President of IBAG, emphasised the need to protect the investment in the insurance sector and asked the Government to exclude the sector in any restructuring exercise.

“Because we cannot pay for the cost of borrowing, if there is any restructuring, the insurance sector should be isolated, otherwise it’s going to be a disaster for the nation.

“When It comes to the insurance, it is very delicate and the day that people lose hope in the insurance company we are dead, and because we’re already having problems with trust in the public, insurance is our last hope when everything is gone.”

Mr Stephen Kwarteng Yeboah

The calls came as Ghana prepares to implement a homegrown economic policy under an International Monetary Fund (IMF) loan support programme to restore macroeconomic confidence and lessen the current hardship facing Ghanaians.

Data provided by the National Insurance Commission (NIC) shows that the insurance sector, which at the end of 2020 had an asset of GHS8 billion and a premium of GHS4.2bn, contributed two per cent to Gross Domestic Product (GDP).

Meanwhile, President Nana Addo Dankwa Akufo-Addo assured that talks with the IMF would not lead to any investor losing money through a reduction in the face value of government bonds (haircut).

READ ALSO: The Accra Bourse Index Recaptures 2450 Psychologically Significant Point Mark