The Bank of Ghana (BoG) together with individual financial institutions have been advised to channel adequate resources into the training of staff to lessen employee involvement in fraud cases in the banking sector.

This comes on the back of the latest banking industry fraud report from the Bank of Ghana (BoG), revealing an alarming rate of involvement of employees of banks in perpetrating fraud in the sector.

Per the report by the BoG, fraud cases in the banking sector increased from 2,175 to 2,295 representing 5.4 per cent in 2019.

Out of the total number of 2,295 fraud cases reported to the Central Bank in 2019, suppression of cash and deposits accounted for the largest portion, that is 77 per cent, with the staff of the financial institutions being the lead perpetrators of this type of fraud.

In the same fraud report by the BoG, Rural and Community Banks reported 55 per cent of the total cases, and commercial banks and savings and loans institutions reported 23 per cent and 22 per cent of the cases respectively. In total, eighty-three (83) institutions reported cases in 2019, as compared to seventy-two institutions (72) in 2018.

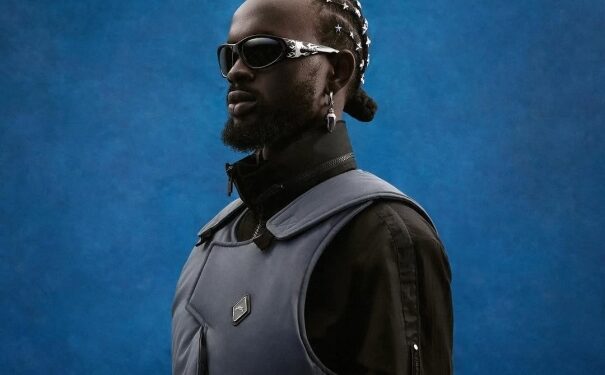

In responding to the growing involvement of both contract and permanent staff in bank fraud, the Business Operations Manager at e-Crime Bureau, (a cyber-security, digital forensics, intelligence and investigation) Philip Danquah Debrah explained that effective staff training and orientation will go a long way to curb this act.

“We need to enforce training. Usually, we take training as an option, but in the case of fraud and the cases that are being reported, it should be something that the Bank of Ghana and the financial institutions must enforce and regulate to ensure that the awareness level of staff, the technical competencies to detect some of these issues are there. And these should be filed as regularly as possible for the Bank of Ghana to know the efforts the banks and financial institutions are pushing through,” he pointed out.

Speaking further, Danquah Debrah also touched on the need for relevant information to be regularly shared amongst financial institutions to further reduce cybercrime within financial institutions.

“Now what we have seen is that usually, an incident occurs in one bank and the next moment another bank experiences the same. The gap here is about sharing of information. Sharing information doesn’t mean you are disclosing who may be behind it or which bank may be involved. But the magnitude of the incident and the modus operandi of the criminals can really help to address any issues going forward. Because if you do an analysis of the electronic types of crime, the modus operandi cuts across, and if we are able to share valuable information on some of these incidents we will be able to address the issues that come up.”

Leading fraud trends

The total amount of fraud reported by the Banking Industry to the Bank of Ghana was estimated at GH¢115.52 million. Out of the total values reported, approximately GH¢33.44 million (28.96%) was reported as losses incurred, while close to GH¢82.06 million (71.04%) was recovered.

Areas of fraudulent activities

The driving fraud trends responsible for the total values reported were Cyber – email fraud, forgery and manipulation of documentation fraud, ATM/POS fraud as well as credit fraud, burglary, impersonation, E-money fraud, remittance fraud, among others.