Financial Analyst Joe Jackson has raised questions about the inclusion of new taxes in the 2024 Budget statement by the Finance Minister, Ken Ofori Atta.

Jackson expressed concern that the Finance Minister did not provide the rates for these new taxes, making it difficult for taxpayers to properly evaluate the implications.

In an interview, a day after the budget presentation, Jackson, the Director of Operations at Dalex Finance, emphasized the need for detailed information on the new tax measures.

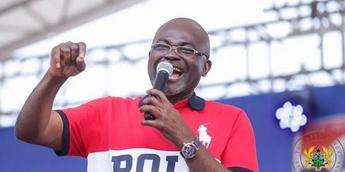

“From where I sit, there is not enough information to be able to discuss the taxes. How do we discuss the tax when we don’t know what the rate is? How do we discuss the tax when we don’t know what the impact is? We need to interrogate this. These are the highlights, and the details are going to come out.”

Joe Jackson

Despite the Finance Minister providing highlights of the budget, Jackson highlighted the importance of knowing the specific rates to have a meaningful discussion about the tax measures. He pointed out that the lack of information on rates hampers the ability of taxpayers to understand the full impact of the proposed taxes.

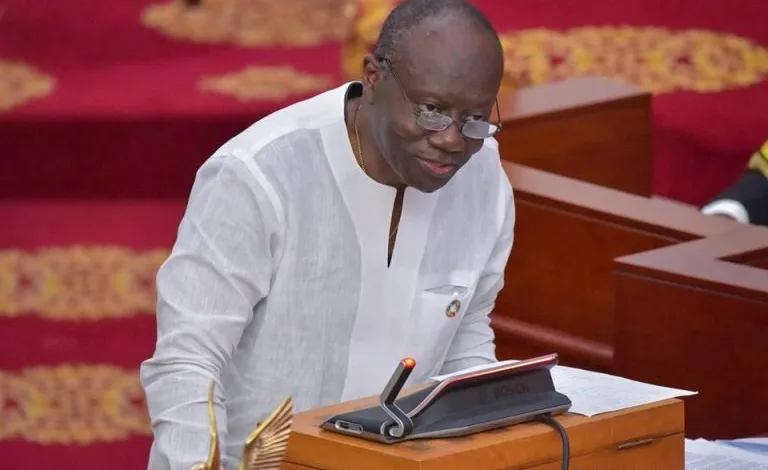

In the budget statement, Minister Ken Ofori Atta announced various tax reliefs aimed at boosting the economy in 2024. However, the absence of specific rates for the new taxes left many stakeholders, including Joe Jackson, calling for more details to properly assess the implications.

Before the budget presentation, there were widespread calls from different quarters for the removal of certain taxes to alleviate the high cost of living. Campaigns were carried out against taxes on items such as sanitary pads and the COVID levy. The Finance Minister addressed some of these concerns during the budget presentation by announcing eight tax reliefs for the upcoming year.

The budget, themed “Nkunim”, meaning victory in Twi, aimed to chart a course toward fiscal consolidation, macro stability, and growth that began a year ago, according to Ken Ofori Atta.

The tax reliefs announced in the budget included the extension of the zero rate of VAT on locally manufactured African prints, waivers on import duties for electric vehicles for public transportation, and exemptions on the importation of agricultural machinery equipment, among others.

Former Deputy Finance Minister Coitizes Budget

Despite these announcements, George Kweku Ricketts-Hagan, the Cape Coast South MP, criticized the 2024 budget, describing it as lacking appeal and unfit for purpose given the hardships faced by Ghanaians. He expressed skepticism about the government’s ability to fulfill the promises made in the budget, referring to it as “empty rhetoric.”

Ricketts-Hagan, a former Deputy Finance Minister, also disclosed the Minority Caucus’s intention to reveal alleged hidden taxes totaling GH¢11 billion in the budget in the coming days.

“In terms of the contents, I don’t think there is anything to write home about. Nothing is exciting in the budget. It is business as usual, rhetoric, things they will do. If they haven’t been able to do it in the last seven years, I am wondering how they are going to do it in the one year, now that things are much harder.”

George Kweku Ricketts-Hagan

Despite Finance Minister Ken Ofori-Atta’s positive outlook on Ghana’s economic future during the budget presentation, the criticism from Joe Jackson and George Kweku Ricketts-Hagan underscores the need for clarity and detailed information on the new tax measures to facilitate informed discussions and assessments.

The position of George Kweku Ricketts-Hagan resonates with the most recognized voices from the Minority caucus and many Ghanaians following the budget presentation.

However, most analysts have opined that the questions and judgments may be premature as the details will be in the budget statement. They thus urged citizens to pay attention when the budget document is made available.

READ ALSO: Battling Attrition Ahead Of 2024 Elections; Insecurity Consumes Members Of Parliament