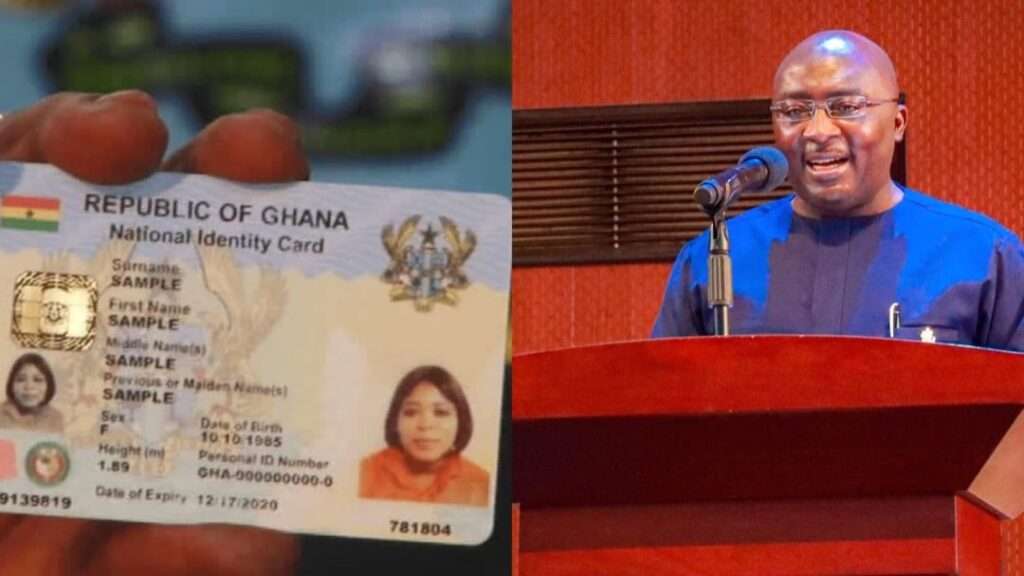

A fresh debate has emerged over the role of Vice President Dr. Mahamudu Bawumia in linking the Ghana Card to bank accounts, following claims by the opposition.

Wisdom Yayra Koku Deku, CEO of the National Identification Authority (NIA), has pushed back against assertions made by the New Patriotic Party (NPP), urging them to “educate ourselves small.”

The controversy began when the NPP’s Director of Communications, Richard Ahiagbah, insisted that Dr. Bawumia had spearheaded the linkage of the Ghana Card to bank accounts, a move he claimed was a significant innovation under the previous administration.

Ahiagbah criticized Yayra Koku for failing to acknowledge Dr. Bawumia’s role and advised him to “give credit” where it was due while focusing on his duties.

Adding to the criticism, NPP member Dr. Palgrave Boakye-Danquah accused Yayra Koku of lacking awareness of developments in the digital identification space.

He alleged that “Yayra Koku doesn’t even read to know this has been implemented already by Dr. Bawumia” and suggested that the NIA CEO had no superior innovation to contribute to what had already been achieved.

Clarifying the Difference In Ghana Card Linkage

In response to these claims, Yayra Koku refuted the assertions, explaining that there is a fundamental distinction between linking the Ghana Card to bank accounts and mobile money (MoMo) for identification and verification purposes and using the Ghana Card for actual payments.

He cited LI 2111 Regulation 7(1) (2012) to back his argument.

According to Yayra Koku, the legal framework for using the Ghana Card in financial transactions has been in place since 2012, long before the erstwhile NPP administration came into power.

He explained that the existing regulation mandates the Ghana Card to be used for any transaction requiring identification, which includes linking it to bank accounts and SIM card registration.

“Please know the difference. LI 2111 Regulation 7(1) (2012) makes it clear that the Ghana Card must be used for any transaction requiring identification (that is the linkage). This legislation was passed in 2012”.

Wisdom Yayra Koku Deku

Yayra Koku further clarified that the requirement for individuals to present their Ghana Card when opening a bank account or registering a SIM card is a direct result of the 2012 regulation.

He stressed that the previous administration cannot claim credit for implementing a system that was legally established more than a decade ago.

“That is why you will need your Ghana Card before opening a bank account or registering a SIM card. So linking your Ghana Card to your accounts was established in 2012 by LI 2111”.

Wisdom Yayra Koku Deku

Public Urged to Ignore Misinformation on Ghana Card Linkage

Furthermore, Yayra Koku urged the public to be discerning about claims made regarding the Ghana Card’s linkage to financial transactions.

He cautioned against political misrepresentation of existing policies and advised citizens not to be misled by attempts to rewrite history for political gain. “Please let us not confuse ourselves”.

Experts in the digital finance space have also weighed in on the discussion, emphasizing that the use of national identification systems for financial transactions is not unique to Ghana.

Several countries have implemented similar frameworks to enhance financial security, prevent fraud, and promote financial inclusion.

However, the success of such initiatives depends on proper public education and government accountability in their implementation.

Meanwhile, some analysts have pointed out that rather than engaging in political debates over credit-taking, efforts should be channeled into ensuring the Ghana Card system is fully optimized.

Many Ghanaians still face challenges in acquiring their Ghana Cards, and addressing these bottlenecks should be prioritized to ensure seamless integration across all sectors.

The debate over digital identification and financial transactions continues to be a key topic in Ghana’s political landscape.

As the country moves toward a more digitized economy, the role of past and present administrations in shaping these policies remains a point of contention.

Whether the erstwhile NPP government deserves credit for advancing the Ghana Card’s financial integration or merely built upon an existing framework remains a subject of public discourse.

READ ALSO: AI Revolution, 70% Of Computer-Based Jobs At Risk