The Ghana Revenue Authority (GRA) Commissioner General, Mr. Anthony Sarpong, has defended the government’s decision to increase the Growth and Sustainability Levy on mining companies from 1% to 3%, emphasizing that it is necessary to ensure the nation benefits from its mineral resources.

This decision, announced in the 2025 Budget, has generated concerns among industry players, with debates on its potential impact on the mining sector.

The discussion emerged during the 2025 Post-Budget Forum organized by KPMG and the United Nations Development Programme (UNDP), where various stakeholders analyzed the economic policies outlined in the budget.

Speaking on the sidelines of the forum, Mr. Anthony Sarpong highlighted the significance of the levy. He said;

“If you look at last year, gold prices have doubled [up]. What it means is that for every ounce of gold that we expected to sell at a certain price, that price has increased twice.’’

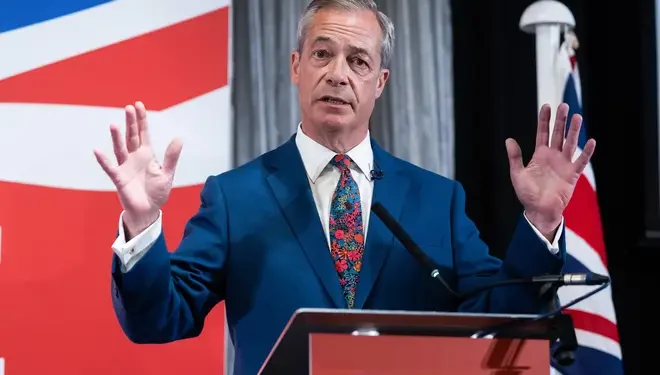

Mr. Anthony Sarpong Commissioner General Ghana Revenue Authority (GRA)

As a result, he emphasized that the government has opted to increase the Growth and Sustainability Levy to ensure a fair share of the mining sector’s increased revenue.

“In Ghana, we don’t have a tax law on what we typically call windfall tax. In other countries, if such a situation happens, the law allows the state to be able to take part of the revenue coming from the incremental prices as revenue.’’

Mr. Anthony Sarpong Commissioner General Ghana Revenue Authority (GRA)

He reaffirmed that the government saw this as an indirect way to benefit from the booming gold market, ensuring that the nation capitalizes on the current rising commodity prices.

The GRA Commissioner General emphasized that the decision to increase the levy was not made arbitrarily.

“The engagement we have had with some of the key miners was to have this conversation and to be able to increase the Growth and Sustainability Levy to 3%.’’

Mr. Anthony Sarpong Commissioner General Ghana Revenue Authority (GRA)

Need for a Windfall Tax in the Medium Term

While defending the decision to increase the levy, Mr. Sarpong also acknowledged the need for a broader legal framework to handle similar situations in the future. He proposed that Ghana must consider introducing a windfall tax law to properly regulate how the state benefits from unexpected revenue surges in the mining and other sectors.

A windfall tax would allow the government to automatically collect additional revenue whenever commodity prices, such as gold, experience substantial increases, ensuring a more structured approach to taxation in the mining sector.

The KPMG and UNDP 2025 Budget Forum, themed “Resetting the Economy for the Ghana We Want,” provided a platform for stakeholders to assess the government’s fiscal policies and their potential impact on businesses. Discussions at the forum emphasized the need for strong collaboration between the government and private sector players to achieve the budget’s milestones.

Meanwhile, Industry players have expressed mixed reactions to the levy increase, with some welcoming the move as a necessary step for revenue generation, others argued that it may deter investment in the mining sector. However, the government remains firm in its position that the increased levy is a necessary measure to ensure Ghana benefits equitably from its natural resources.

The decision to increase the Growth and Sustainability Levy from 1% to 3% is more than just a fiscal adjustment—it is a bold assertion of Ghana’s right to benefit fairly from its natural wealth. For too long, fluctuations in global commodity prices have dictated national revenue streams without a structured mechanism to ensure that Ghanaians reap the rewards of resource booms. By taking decisive action, the government is signaling that economic justice and national interest must take precedence over corporate convenience.

However, this move must not be an isolated policy shift. It should be the catalyst for a comprehensive overhaul of Ghana’s tax framework—one that includes a well-defined windfall tax regime to ensure that when global market conditions favor extractive industries, the people of Ghana do not remain mere spectators but active beneficiaries.

This is not just about taxation; it is about economic sovereignty. Ghana must not only extract resources from its soil but also extract real value for its people. The mining sector cannot thrive in isolation—it must be part of a broader national agenda that prioritizes fair revenue distribution, sustainable development, and long-term economic resilience.

The 2025 Budget may have set the stage, but the real test lies ahead; Will Ghana finally take full control of its resource wealth? The answer must be a resounding yes!

READ ALSO; Ghana’s $3bn IMF-Supported Programme Faces Serious Setbacks