The Kantamanto Market in Accra, a vibrant hub for second-hand clothing, was recently engulfed in a devastating inferno, leaving over 100 shops and countless goods worth millions of cedis reduced to ashes.

The tragedy has not only disrupted livelihoods but also highlighted the need for robust disaster preparedness and response mechanisms thus the Ghana Union of Traders Association (GUTA) expressed concerns to engage with authorities to support the affected persons.

Consequently, Stakeholders including the Ghana Insurance Association (GIA) and GCB Bank PLC, have weighed in with support and actionable solutions to mitigate future occurrences.

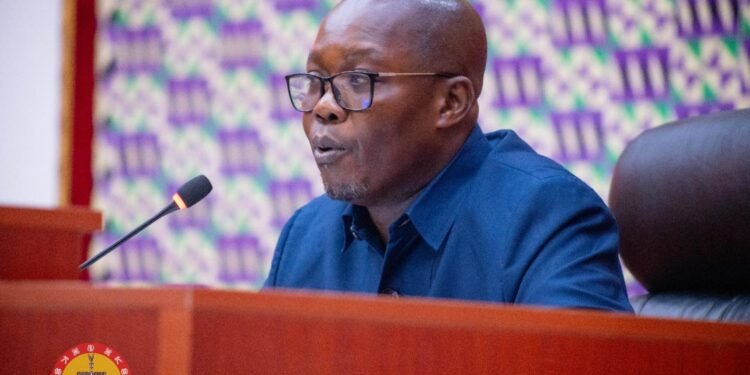

The President of the Ghana Insurance Association Mr. Seth Kobla Aklasi expressed the industry’s readiness to assist affected individuals while emphasizing the need for a disaster insurance pool. He explained;

“What we can alternatively do is that we create a pool, a certain pool from which there is a certain amount that is dedicated as premium, and then a certain amount that could be determined as to whether when there is a disaster like this, then we would definitely get to compensate anyone.”

Mr. Seth Kobla Aklasi President of the Ghana Insurance Association

However, he raised concerns about funding especially given the government’s challenges in meeting statutory obligations like the District Assemblies Common Fund. Mr. Aklasi added;

“Are we going to get government to contribute into that pool? We are all in this country. We are aware that government, for even their statutory or constitutionally mandated obligations, are behind schedule. How are we going to be able to take the fractions and invest them and be able to pay?”

Mr. Seth Kobla Aklasi President of the Ghana Insurance Association

He also mentioned past disaster management efforts, referencing the 2015 flood and fire incidents. According to Mr. Aklasi, insurance companies have conducted loss surveys and recommended risk improvements to reduce the frequency of such disasters. He added;

“If you’re able to do these things and reduce the frequency of occurrence of the losses, we’d be able to grant cover and cover you at the time of need.”

Mr. Seth Kobla Aklasi President of the Ghana Insurance Association

Moreover, President of the Ghana Union of Traders Association (GUTA), Dr. Joseph Obeng underscored the importance of collaboration with authorities to provide immediate relief and ensure long-term solutions for affected traders. He added;

“Sometimes, if we do not do it well, because they have this speculative thinking that maybe they want to take care of our kids, that’s why they’ve come to burn it. As soon as everything is settled, you see people rushing back to build their pavilions or kiosks without any proper planning.”

Dr. Joseph Obeng President of the Ghana Union of Traders Association (GUTA)

Dr. Obeng stressed the need for government involvement and metropolitan authorities’ assurance in creating a well-planned reconstruction framework to ensure properly settlement within the market by traders.

Meanwhile, the GCB Bank PLC has shown solidarity with the victims of the fire by activating support mechanisms under its Value-Added Package. Executive Head of Retail Banking at GCB Mr. Sina Kamagate elaborated on the initiative.

“As a bank that cares for its customers, we launched a product called the Value Added Package. The essence of that product was in anticipation of a day like this—a day where fire can bring their businesses down.”

Mr. Sina Kamagate Executive Head of Retail Banking at GCB

Mr. Kamagate assured customers who subscribed to the package of immediate insurance indemnification. He emphasized;

“We would make sure that we get them some bit of restitution or support to cushion them. For customers who haven’t signed up, this is the clearest opportunity for them to continue doing business with us.”

Mr. Sina Kamagate Executive Head of Retail Banking at GCB

He further encouraged traders to open accounts with GCB to qualify for insurance coverage for incidents such as burglary and fire.

“For customers who deposit an average of 50,000, we register them on an insurance plan, and the bank fully covers the premium.”

Mr. Sina Kamagate Executive Head of Retail Banking at GCB

Great Lessons from the Disaster, Insurance Coverage

The Kantamanto fire serves as a wake-up call for all stakeholders to prioritize disaster preparedness and risk mitigation. The incident has underscored the importance of Insurance Coverage that would enhance awareness among traders about the importance of insurance and creating accessible plans to protect businesses.

Additionally, it reiterates the need for a collaborative efforts thus government, traders, and financial institutions must work together to ensure proper market reconstruction and provide relief to affected individuals.

Therefore, there is the need for a risk mitigation programs for Implementing recommendations from loss surveys to reduce disaster frequency and improve resilience.

As stakeholders engage in discussions, it is essential to ensure that immediate relief is provided while laying the groundwork for sustainable disaster management systems.

READ ALSO; Apaak Slams Government’s Free SHS Indebtedness, Decries CHASS’s Late Intervention