The debate over Ghana’s tax policies has intensified following the government’s commitment to scrapping multiple levies, including the controversial E-Levy and betting tax.

While the administration of President Mahama remains steadfast in its promise to eliminate these taxes, economic analysts and tax experts caution that the reality of governance may force a reconsideration.

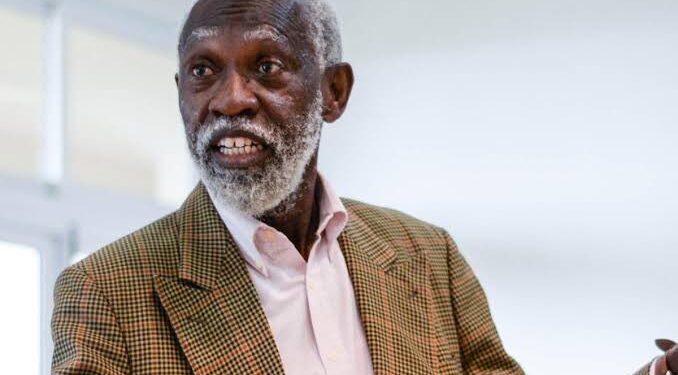

Speaking on the matter, economist and former chairman of the National Development Planning Commission (NDPC), Prof. Stephen Adei, has strongly opposed the removal of the E-Levy, arguing that it is one of the more efficient means of broadening Ghana’s tax base.

“I have always felt that it is wrong to remove E-Levy,” he stated firmly.

“Some taxes are very difficult to collect, and therefore, those are the ones we must look at. Rationalizing some of them will be necessary, some will be eliminated, some will be kept, some consolidated, but the effective tax rate is what you aim at”

Prof. Stephen Adei, Former National Development Planning Commission Chairman

Prof. Adei highlighted the dangers of abolishing taxes without a clear alternative, recalling the experience of the previous administration.

“That’s what Akufo-Addo said but he actually multiplied the taxes. At the end of the day, if the government doesn’t have the revenue to match the expenditure, you are going to resort to taxes. It is one thing making a political statement and another thing ruling the country.”

Prof. Stephen Adei, Former National Development Planning Commission Chairman

For him, the challenge is not necessarily about individual taxes but rather the need to rationalize the tax system to prevent some citizens from bearing a disproportionate burden.

“Some are paying cumulatively about 45%, while others are paying nothing because we cannot find them,” he noted the disparity.

Rethinking the Betting Tax Structure

Beyond the E-Levy, another debated issue is the betting tax, with experts weighing in on how best to implement it without driving gamblers underground or harming state revenue collection.

Isaac Quaye, a tax practitioner and lawyer, suggested a shift in approach rather than outright elimination.

“For the betting tax, the tax on the stake could be increased, whilst when you win, you go with the wins,” he proposed.

He explained that the taxes on betting wins were pushing the youth to explore other betting avenues outside the fiscal space, giving money to “other entities outside the jurisdiction”.

Quaye’s argument underscored the concern that overburdening betting winnings with excessive taxation might only encourage illegal betting or offshore transactions, making enforcement difficult.

He recommended that rather than taxing winnings, the government should focus on increasing the tax on betting stakes.

“The structure should change. There’s tax on the stake and the tax on the winnings. They are complaining about the tax on the winnings. So increase the tax on the stake.”

Isaac Quaye, Tax Practitioner and Lawyer

This suggestion presents a pragmatic approach, ensuring that the government collects its due revenue upfront without creating avenues for evasion. However, the timing of such adjustments remains a critical factor.

He argued that flexibility in governance is necessary, emphasizing that good rationalizing could successfully replace elimination, changing the tax structures to appeal to the optics of Ghanaians.

Betting Tax as a Deterrent

While some argue for a restructuring of the betting tax, others advocate for an even more aggressive approach, suggesting that betting should be taxed not just as a revenue source but as a tool to discourage youth participation.

Theophilus Tawiah, a policy analyst, maintained that the government should prioritize societal values over political expediency.

“It is not all of us that are into betting. The betting tax is towards a certain segment, a certain tax unit who are into betting. That also offers revenue to the state, but what kind of society are we trying to encourage?”

Theophilus Tawiah, Policy Analyst

Tawiah expressed concerns about the growing culture of betting in Ghana and its potential negative impact on youth employment.

“At the moment, people have to second guess whether to work or not to work (because of betting). So we should not just play politics with our societal values, the cohesion of the country as a whole because betting, in all fairness, is not necessarily a good thing”

Theophilus Tawiah, Policy Analyst

“There’s a deterrent effect,” he emphasized. For him, taxation should not only be about generating revenue but also about shaping national priorities.

“I will probably suggest that it should either go higher, from 10% to probably 20%, so that we don’t have our youth moving into betting rather than going to active employment”

Theophilus Tawiah, Policy Analyst

His argument presented a moral and economic dilemma for the government: should betting taxes be lowered to ease the burden on gamblers, or should they be increased to discourage excessive gambling?

Political Promises vs. Economic Reality

The Mahama administration’s commitment to scrapping E-Levy and betting taxes was a central campaign message, but economic realities may force a reassessment of this promise.

Prof. Adei’s warning echoes past experiences where political decisions on taxation had to be reversed due to fiscal constraints.

“What would happen is that they may leave one and then have to find other sources. That’s how the multiplication came under the former regime”

Prof. Stephen Adei, Former National Development Planning Commission Chairman

The challenge for the new government is to strike a balance between fulfilling political commitments and maintaining fiscal stability.

Whether through restructuring existing taxes or introducing new ones, the fundamental question remains: can the government afford to scrap these levies without plunging the economy into deeper financial distress?