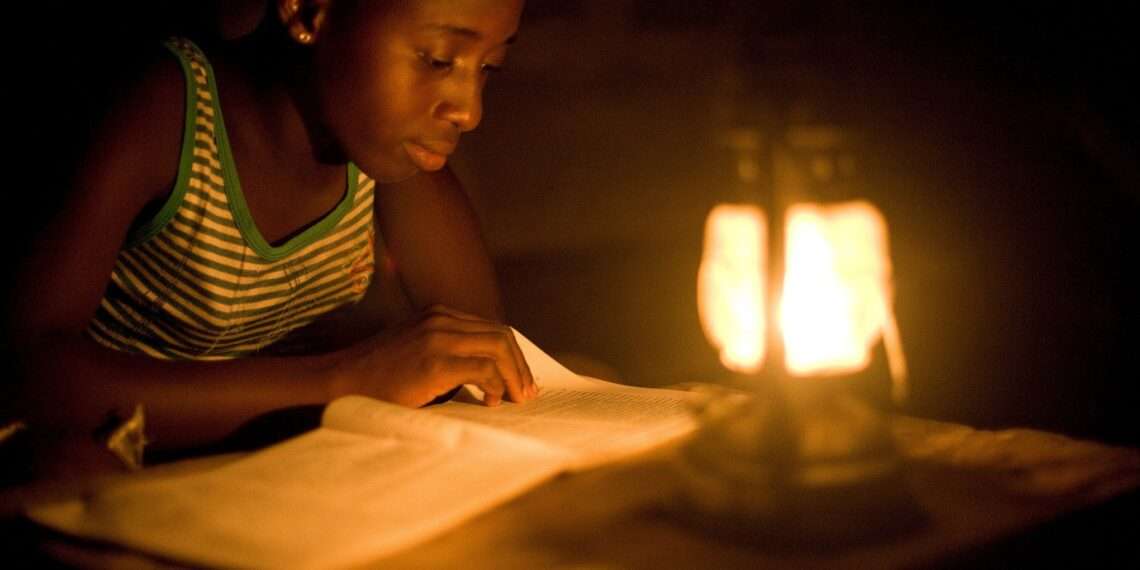

Businesses and households in Ghana are being cautioned to prepare for the possibility that the country could soon experience another period of prolonged, sporadic power outages, popularly known as ‘dumsor.’

The Institute for Energy Studies (IES) has warned of potentially severe power disruptions in the coming months, as one of Ghana’s largest independent power producers, Sunon Asogli, halts its operations. The IES caution comes amidst a standoff between Sunon Asogli and the government, highlighting deeper issues within Ghana’s energy sector that have long jeopardized power stability and economic growth.

“In case you are experiencing a ‘low-key dumsor’, be prepared to see an extended version of same due to government’s reluctance to act decisively on the root cause.”

Institute for Energy Studies (IES)

The suspended operation of Sunon Asogli, a power plant that produces about 12-15 percent of Ghana’s electricity, exposes the vulnerability within the nation’s power sector, which relies on consistent output from its key energy facilities to meet the growing demand for electricity.

The IES noted that, despite persistent requests from the Ghana Grid Company Limited (GRIDCo) to restore operations, Sunon Asogli remains resolute, citing insufficient operational funds.

IES described this standoff as emblematic of “longstanding issues in Ghana’s power sector – the inability of utility companies and government to meet payment obligations.”

For a country that has experienced power rationing in recent history, the impact of Sunon Asogli’s departure is significant. The IES pointed out that this is not a mere temporary setback but a serious strain on the already fragile power system, which lacks immediate backup or alternative generation sources.

According to IES, other power producers may struggle to fill this gap promptly due to limited capacity and the ongoing financial stress that has plagued the sector for years.

Economic Risks and the Return of ‘Dumsor’

The current standoff with Sunon Asogli brings to light potential economic consequences. If a prolonged ‘dumsor’ scenario returns, it could affect various sectors, disrupt productivity, and create an inhospitable climate for both foreign and local investment.

Even if alternative power sources could be brought online, their higher generation costs might lead to increased electricity tariffs for consumers and businesses alike.

This situation could worsen the financial strain on Ghanaian households and businesses. The institute noted that increased tariffs would “further strain the business community and citizens,” which have faced mounting costs in recent years due to factors like inflation and currency depreciation.

This possibility is a serious concern for small and medium enterprises (SMEs), which rely heavily on affordable and steady power supplies to maintain their operations and keep prices competitive.

The unpaid debts facing Sunon Asogli reflect a broader, persistent issue in Ghana’s energy sector. According to IES, “Power producers in Ghana often face delayed payments due to complex debt cycles, poor revenue collection, and cash flow issues within the sector.”

Political Implications and Recent World Bank Support

This power crisis emerges at a politically sensitive time, as Ghana prepares for general elections in December. Over the last two decades, energy crises have frequently been weaponized in political debates, with parties assigning blame and promising reform.

The unresolved nature of the energy sector’s financial problems often means that structural changes take a backseat to temporary measures and political promises. This has led to recurring cycles of power instability and outages, much to the frustration of Ghanaian citizens.

To mitigate the crisis, Ghana recently secured a $260 million package from the World Bank, which includes a $250 million credit and a $10 million grant to address some of the power sector’s most critical challenges.

While this funding provides a lifeline, it is seen as a temporary fix rather than a sustainable solution. The IES cautioned that unless structural reforms are made, including enhanced revenue collection, debt restructuring, and diversification of power sources, these financial injections may only delay future problems rather than resolve them.

Given the growing demand for electricity in Ghana, both businesses and households have a stake in the outcome. Without systemic reforms, the nation risks revisiting the dreaded ‘dumsor’ era, characterized by extended blackouts and economic setbacks.

For now, as IES has advised, the public should brace itself for potential power disruptions and prepare for what may be an extended period of power instability.

The call to action is clear: Ghana’s government must tackle the root issues in the energy sector to ensure reliable power access for all, support economic growth, and restore public confidence in the sector’s sustainability.

READ ALSO: Budget Squeeze Threatens UK Nature and Farming Schemes