The most recent data from the Africa Private Equity and Venture Capital Association indicated that in the three months leading up to September 2023, fund managers specializing in African investments produced $1.2 billion in deal value, reflecting a 16 percent decrease compared to the corresponding period in the previous year.

According Africa Private Equity and Venture Capital Association, both deals sized below $100 million and above $100mn recorded a significant drop in the total deal value in the first nine months of 2023, compared to the year 2022.

Since the beginning of the year, fund managers have been riddled with caution, evidenced by the decline in the total deal value across all ticket sizes. The absence of large private debt deals particularly weighed on the total deal value recorded this quarter.

Venture Capital influenced activity levels of deals below $100 million due to the retreat in seed and early stage investments. The private Industry has faced its share of challenges in the current macroeconomic landscape, impacting deal making in Africa.

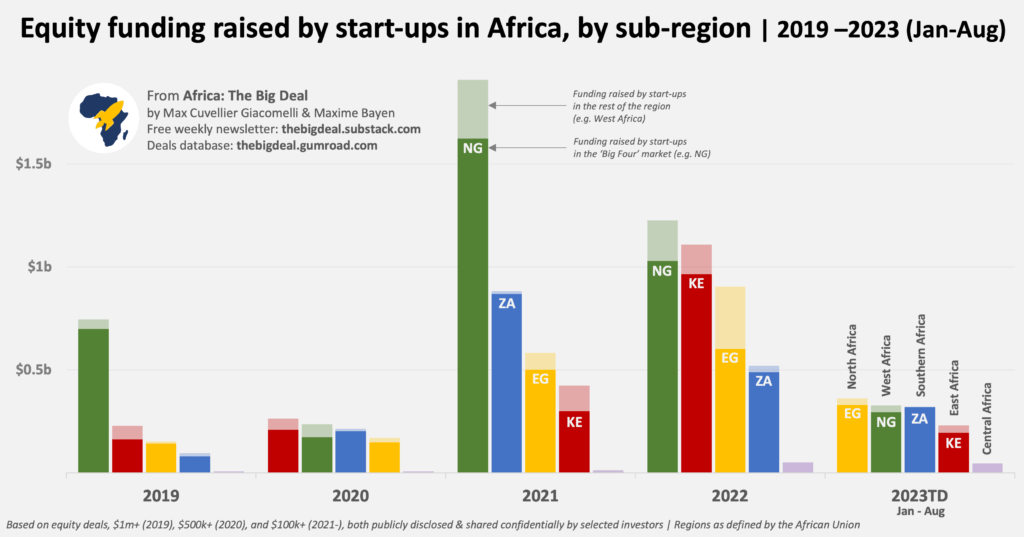

Notably, West Africa bore the brunt of this decline, experiencing a 59 percent drop in the third quarter of 2023 compared to Q3 2022, and a 59 percent drop in 2023 so far compared to the same period last year.

The decline was attributed to the decrease in venture capital investments, which has historically been a driving force for deal activity in the region.

However, West Africa is not to be underestimated despite the ongoing slowdown, the region still dominated, capturing 36 percent of all venture capital deals in Africa in Q3 2023.

Interim Fundraising Defies Headwinds

Fundraising continued to be challenging in 2023 as factors such as the declining rate of exits and concerns about valuations and potential returns.

But despite a difficult year, the interim fundraising defied the headwinds faced by many fund managers. In the first nine months of 2023, African-focused fund managers raised more in interim closes than they did in the entire year of 2022.

Exit Activity Battered by Market Pressures

If the trend in investment has been gloomy over the past 15 months, the trend in exits has been worse as fund managers are feeling more pressure on the sell side and may have delayed exits given volatile markets pressured by uncertainty.

Over the first nine months of 2023, African private capital exit volume fell to 25 (from 82 in 2022), a sharp decline of 73% compared to 2022.

Although all exit routes have suffered, this impressive drop was mainly driven by a dizzying decline in sales to trade buyers and sales to PE firms and other financial buyers, which barely reached 14 and 8 in 2023, compared to 39 and 19, respectively in 2022.

Notwithstanding the retreat of sales to trade buyers and other PE firms, these two exit routes continued to attract the largest shares of exit volume.

Trade Buyers now concentrate more than half of the total number of exits (56% in 2023 YTD, from 41% on average between 2017-2022), while sales to PE firms and other financial buyers cumulate one-third (32% in 2023 YTD, from 31% on average between 2017-2022).

Examples of exits successfully completed in Q3 2023 include AfricInvest’s exit from InstaDeep, a leading global technology company, to BioNTech and Verod Capital Management’s exit from CSCS plc, a financial market infrastructure platform, to trade buyers FMDQ Group.

READ ALSO: NPP Presidential Primaries: Dr. Bawumia Blows His Trumpet Hours After Polls Commenced