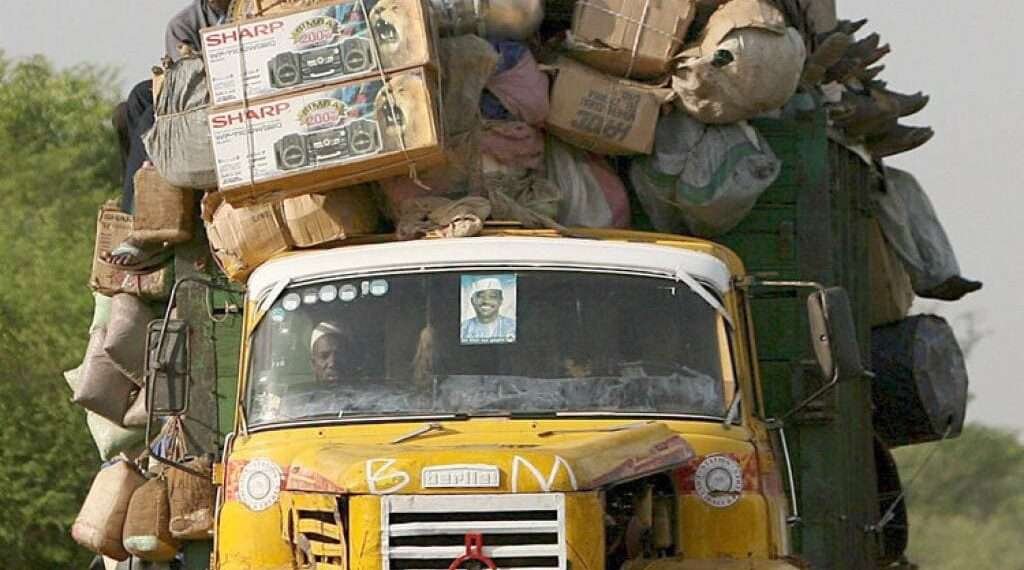

New research suggests the days where African logistics struggled to cater to the country’s growing population and dynamic private sector for a long time is about to change and the benefits for the continent’s wider economy could be transformative.

That shift, according to the research, is thanks to the African Continental Free Trade Area (AfCFTA) agreement, which introduced frictionless trade between its African signatories. Signed in February 2021 and now coming into force, AfCFTA is a catalyst for rapid investment and expansion of the continent’s nascent logistics sector, according to a report by the World Economic Forum titled: AfCFTA: A New Era for Global Business and Investment in Africa.

The report indicated that the AfCFTA is addressing the challenges of inconsistent or inadequate freight and logistics that have long hindered intra-African trade. Countries face high custom delay periods, shortages of paved roads upon which freight can be transported and a higher loss of goods due to limited cold chains compared to other regions globally.

African states currently import $36.8 billion worth of freight or logistics goods, from passenger freight and transport to parcel and courier services, every year from within and outside the continent. Under AfCFTA, that amount is set to swell — the report noted that African companies can fulfil that demand.

Meanwhile, the AfCFTA Forum expects an increase in intra-African freight demand of 28% translating to additional demand for almost 2 million trucks — used primarily for the expected growth in trade of automotive parts and pharmaceuticals — 100,000 rail wagons, 250 aircraft and more than 100 vessels by 2030.

Maritime trade is projected to increase from 58 million to 132 million tonnes by 2030 with the implementation of AfCFTA, and the growth in this sector will help, in particular, with a projected boom in agro-processing trade caused by AfCFTA.

African Companies And People Set To Benefit From AfCFTA

The report noted that as the largest continent in the world, and with a hitherto struggling intra-continental logistics network, the AfCFTA presents a major opportunity to invest in logistics and freight at a growth inflection point.

The overwhelming demand and need for logistics and transport services will only increase as the AfCFTA is implemented, intra-African trade increases and more small and medium-sized enterprises require logistics providers to connect to larger markets. If commodity prices decrease, as they are projected to due to the removal of trade barriers and import costs, consumption and demand will increase, benefitting African manufacturers and the mobility sector.

Large logistics companies have historically been too expensive for African companies to use, but we are now seeing the rise of new digital logistics companies that reduce costs and can improve the quality of services while also promoting sustainability.

The report indicated that closing the urban-rural divide will also yield significant opportunities. It noted that rural areas are naturally more reliant on regional supply chains than urban dwellers, but inadequate road infrastructure too often leaves them isolated and economically excluded. Start-ups have already begun to address these issues, proposing innovative solutions to integrate rural and city markets.

Infrastructure gaps, especially those that take a long time to fix, such as road issues, have spurred companies to turn to novel solutions, including cargo drones, inland waterways and ports and other means of transport to reach rural communities and bring them into the growing economic system.

Business-to-business (B2B) logistics, already a major component of Africa’s logistics economy, is expected to dominate the sector in the short- to medium-term. African companies spent $2.6 trillion on B2B services in 2015 and are expected to spend another $1 trillion by 2025 — and the AfCFTA will only accelerate opportunities for companies providing B2B services.

The report intimated that business-to-consumer logistics will also continue to increase as consumer spending rises, e-commerce becomes more prevalent with AfCFTA and urbanisation continues.

READ ALSO: Don’t Approve 20% Tax On Fruit Drinks And Water- GFL Appeals To Parliament