Kenya’s new pharmaceutical manufacturing plant expected to be built starting from early 2022 by Square Pharmaceuticals is likely to boost local production and scale up export growth, according to Fitch Solutions.

The factory which is expected to cost US$74.4 million will produce essential medicines including malaria and diabetes drugs. The site will reportedly manufacture over 2 billion tablets and capsules a year and Square pharmaceuticals which is the largest pharmaceutical company in Bangladesh will offer the relevant technology and training needed for Kenya to make these drugs.

“The new production facility will therefore significantly boost local production, while the local industry will also benefit from the transfer of technology and knowledge which could lead to production of more medicine in the country over the long term.”

Fitch Solutions

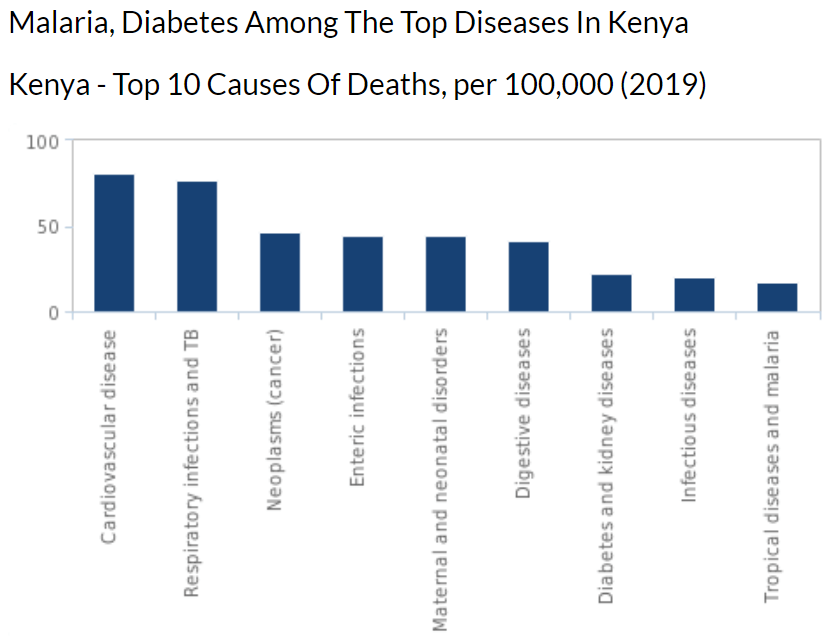

The company’s therapeutic focus is expected to be on malaria and diabetes given the high burden on society from these diseases, Fitch Solutions said.

Malaria remains one of the leading causes of morbidity and mortality in Kenya. About 25million people, out of a population of 34 million people, are at risk of malaria, according to the Kenya Medical Research Institute. The prevalence of diabetes in Kenya has more than doubled in the last three decades, according to WHO’s first Global Report on diabetes in 2016.

Square Pharmaceutical’s product portfolio includes a number of essential medicines such as paracetamol and antibiotics which are not so sophisticated to manufacture. Thus, the pharmaceutical manufacturing plant will also likely manufacture these, Fitch added. These medicines already have a market in Kenya as the country’s top ten causes of deaths indicate.

Square Pharmaceuticals to increase exports but below imports

The Square Pharmaceuticals manufacturing plant is also expected to boost exports. The plant in Kenya will be the largest pharmaceutical manufacturing plant in East and Central Africa, according to Square Pharmaceuticals.

“We therefore believe that the new plant will provide a boost to exports once it is established. We have revised slightly upwards our forecasts and now project that Kenya’s pharmaceutical exports will grow at a five-year local currency CAGR of 8.4% (6.6% in US dollars), to reach KES20.8 billion (USD180.0 million) by 2025.” The figures show an upward revision from its previous five-year local currency CAGR of 7.0% and 5.2% in US dollar terms, Fitch added.

The country’s medicine imports will not slow but continue to grow at a medium pace. According to Fitch Solutions, current estimates show that around 80% of local medicine demand in Kenya is met through imports and it is expected this will remain largely stable.

“We note that top multinational companies such as Pfizer, Sanofi, Novartis and Merck & Co are all active in the Kenyan market, but since these companies have no local manufacturing facilities, they only export to the country.”

Fitch Solutions

Fitch therefore forecasts that Kenya’s pharmaceutical imports will grow at a five-year local currency CAGR of 8.6% (6.8% in US dollars) to reach KES98.0 billion (USD848.0 million) by 2025, but the increase in local production will limit growth potential.

Expectations are that Kenya will maintain its trade deficit for pharmaceuticals over the coming years. This means that despite the fact that exports will gain momentum, foreign-made medicines will continue to dominate the market while foreign manufacturers continue to have commercial opportunities in Kenya.

“This is because Kenya still has no capabilities to manufacture most innovative drugs due to a number of challenges in its pharmaceutical industry.”

Fitch Solutions

According to Fitch, Kenya’s pharmaceutical regulatory environment is considered complicated due to the overlapping work of government organisations and this serves as a disincentive for foreign companies to propose to have a direct manufacturing presence in the country.

READ ALSO: Ghana: New Discovery of Iron ore to Boost Metals and Automotive Industries