Major oil and gas operators are looking to automate their assets using digital technologies to reduce the impact of demand fluctuation on revenues, according to GlobalData.

This trend in digital technology use for industry operations has heightened, largely due to the impact of the COVID-19 pandemic on energy demand as well as labour availability.

As the Covid-19 pandemic continues to drag, digital oilfield technologies such as digital twins and other remote monitoring solutions will be game changers in upstream oil and gas operations, Global Data said.

Digital oilfields enable oil and gas companies and oilfield service providers to remotely monitor and control critical activities at production facilities. These technologies aim to boost productivity and efficiency in exploration and production (E&P) by minimizing equipment downtime and improving hydrocarbon recovery.

According to GlobalData, the use of these technologies is critical in today’s scenario where oil and gas producers are seeking to streamline their costs to recover from the Covid-led energy demand shock. Digital oilfields also help to reduce the need for the physical deployment of personnel on site, thereby improving worker safety.

Digital oilfield technologies have gained momentum with the advent of the Internet of Things (IoT). Such technologies use artificial intelligence (AI), predictive analytics, and visualization tools to generate data-driven insights in real time to speed up decision-making processes. The adoption is especially noticeable in newer projects that use the latest technologies and equipment to extract hydrocarbons.

Charlotte Newton, Analyst on the Thematic Research team at GlobalData said:

“Technologies such as digital twins have the potential to be the backbone of digitalisation in the sector. By creating 3D images and simulations of assets, systems, and processes, oil companies can imagine more sophisticated, and more reliable, machinery in oilfields both now and in the near future.”

Charlotte Newton , GlobalData

Oil Majors Dominate in Digital Technologies

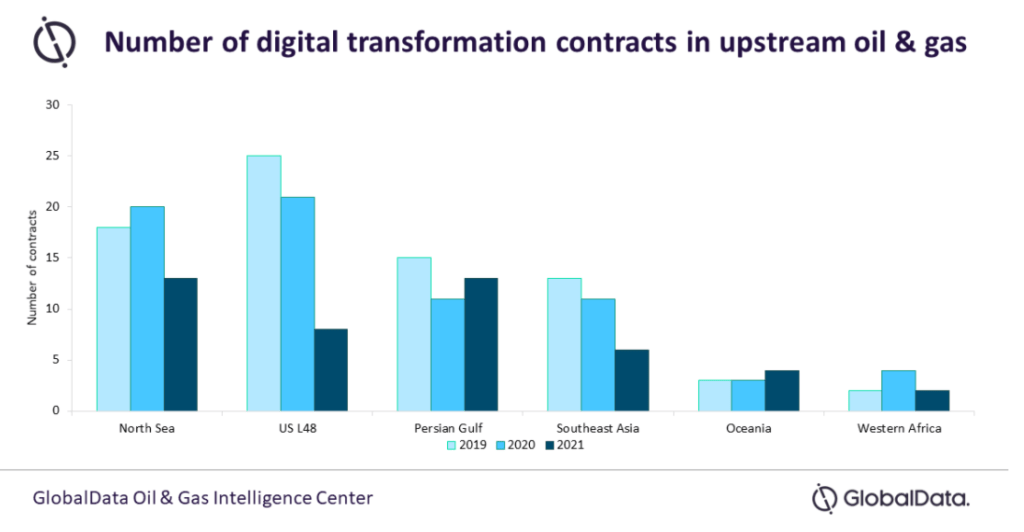

According to GlobalData, operators in Southeast Asian fields are also deploying digital oilfield technologies to optimize field development planning and boost production. More so, similar activity has begun in the Oceania and Western Africa regions, and this is likely to gain momentum with further rise in energy prices.

Ravindra Puranik, Oil & Gas Analyst at GlobalData indicated:

“The oil & gas (O&G) industry saw major disruption during the first waves of the COVID-19 pandemic, and companies are now looking to automate as many processes as possible to mitigate future operational risks.

“This is demonstrated by the fact that contracts activity relating to digitalization in the upstream remained resilient in the last two years, despite the pandemic-led industry downturn. Upstream hotspots in the North Sea, Norwegian Sea and Persian Gulf regions, as well as the US Lower 48 play attracted bulk of these contracts.”

Ravindra Puranik, Oil & Gas Analyst , GlobalData

The digital oil field space is largely dominated by oilfield service providers and industrial equipment makers that offer digital solutions and services to address complex business problems. Oil majors such as BP, Shell, and Equinor, also have garnered considerable experience in developing technologies to make digital oilfields a reality.

This move by oil companies appear unsurprising, since by mitigating operational risks as well as labour risks, companies also benefit from potential cost savings in the long term. This turns out to be a preferred option for oil companies given current industry setting.

READ ALSO: More SOE’s to Enlist on the GSE