The British multinational, EasyJet Plc. has rejected a takeover bid from Wizz Air, its Hungarian rival. The airliner revealed it rejected the acquisition bid on the grounds of the takeover approach employed by Wizz Air.

In the meantime, EasyJet has disclosed that an unknown bidder has approached the airline for “a low premium and highly conditional all-share transaction”.

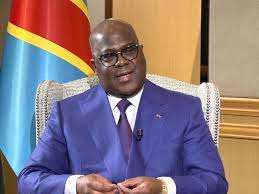

Mr. Johan Lundgren, EasyJet’s Chief Executive revealed that the airline’s governing board had “no hesitation in rejecting this approach” employed by the bidder.

The bidder to this end is no longer considering the offer, Mr. Lundgren disclosed.

However, the airline plans to raise £1.2 billion in the rights issue, as it seeks to recover from the aviation’s worst crisis in decades.

Also, Goldman Sachs, Societe General, Santander, Credit Suisse, and BNP Paribas will serve in the capacity of underwriters to the right issue.

The £1.2 billion rights issue “is priced at 410p per share, representing a deep discount of 36 percent on the airline’s theoretical ex-rights price of 638p per share”.

Also, the airline’s shares declined 8 percent during Thursday 9th September 2021 early trading to 723.78p, have been reported to have “lost half their value over the past year”.

This fall in share prices makes EasyJet the “biggest faller on the FTSE250”. Some other affected stocks within the aviation sector were “British Airway’s owner, International Airline Group (IAG), the biggest faller on the FTSE100, down with 3.5 percent while the travel group Tui dropped 3 percent”.

Wizz Air on the other hand “pledged to use the pandemic to expand into Western Europe”.

EasyJet recovery dilemma

The takeover interest comes eighteen (18) months into an industry-wide crisis spearheaded by the Covid-19 pandemic and various travel restrictions across Europe.

This aviation industry turmoil, cost EasyJet “more than £2 billion during the crisis, including suffering its first annual loss in its 25 years” of operation in 2020.

Mr. Lundgren believes the airline cannot in the interim “return to pre-pandemic levels of flying until 2023”, as EasyJet expects to “fly less than two-thirds of its normal flight schedule for the rest of the year”.

Furthermore, Mr. Lundgren disclosed that the funds to be raised from the rights issue will enhance EasyJet’s growth prospects.

“The capital raise announced today not only strengthens our balance sheet enabling us to accelerate our post-Covid-19 recovery plan but will also position us for growth.

“So that we can take advantage of the strategic investment opportunities expected to arise as the European aviation industry emerges from the pandemic.”

Mr. Johan Lundgren

In the meantime, this right issue would not be the first time EasyJet has relied on shareholders to shore up its cash reserve, as the airline raised £400 million last year June in a rights issue.

Overall, the airline “had access to £2.9 billion of liquidity at the end of June, having raised more than £5.5 billion since the start of the crisis”.

The Chief Executive disclosed that, EasyJet despite its current shortcomings, was in a better “position to grab market share from legacy airlines which face prolonged and more difficult path to recovery”.

EasyJet has already identified take-off and landing slots that has become available as other airlines retreat, Mr. Lundgren disclosed.

“We believe within 6 to 12 months that there will be more slots that become available as part of the retrenchment of legacy airlines”.

Mr. Johan Lundgren

ALSO READ: Bank of Ghana FX forward rates auction oversubscribed