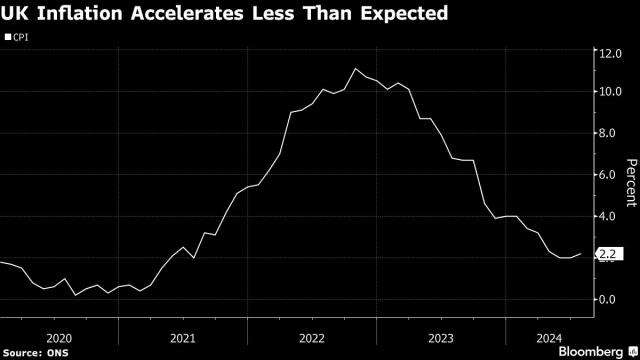

Britain’s annual inflation rate inched up to 2.2% in July, marking the first rise since December of the previous year.

The slight increase, driven primarily by a less significant drop in domestic energy bills compared to the sharp decline seen in July 2023, underscores the persistent challenges in the UK economy.

According to the latest figures from the Office for National Statistics (ONS), this uptick breaks a two-month streak where inflation had been steady at the Bank of England’s 2% target.

Although the rise was smaller than the 2.3% anticipated by economists, it still highlights the ongoing volatility in the cost of living.

Prices overall fell by 0.2% in July, a modest decline largely due to cheaper hotel stays.

However, this decrease was not as pronounced as the 0.4% drop observed in the same month the previous year, when energy bills plummeted, ultimately contributing to the current increase in the headline inflation rate.

Grant Fitzner, the ONS’s chief economist, explained the situation, noting that “inflation ticked up a little in July as although domestic energy costs fell, they fell by less than a year ago.” He added that this was “partially offset by hotel costs, which fell in July after strong growth in June.”

Core inflation, which strips out volatile items like food, energy, alcohol, and tobacco, registered a slight decline, falling to 3.3% in the year to July from 3.5% in June. Similarly, inflation within the services sector — a critical focus for the Bank of England’s interest rate decisions — dropped from 5.7% to 5.2%, driven largely by falling hotel prices.

Hotels saw a notable price drop of 6.4% in July, a stark contrast to the 8.2% surge during the same period last year.

Economists See Positive Signs in Inflation Data

Martin Sartorius, a principal economist at the Confederation of British Industry (CBI), welcomed the data, stating, “Inflation undershooting the Bank of England’s expectations will be seen as a positive sign that price pressures are continuing to normalize for households and businesses.”

He added that the data would offer “some measure of confidence” to the Bank’s monetary policy committee that domestic price pressures are easing, potentially supporting a sustainable return to the 2% target.

Earlier in the month, the Bank of England projected that the consumer prices index (CPI) measure of inflation would continue to rise, peaking at around 2.75% before gradually declining.

Commenting on the figures, Darren Jones, the chief secretary to the Treasury, acknowledged the challenges the government faces.

“The new government is under no illusion as to the scale of the challenge we have inherited, with many families still struggling with the cost of living,” he said. Jones emphasized the government’s commitment to making the tough decisions needed to rebuild the economy.

In response to the ONS data, City investors adjusted their expectations regarding interest rates. The probability of a rate cut in September rose to 45%, up from 36% before the data was released.

Markets now anticipate the Bank Rate could be lowered to 4.75% from its current 5%, with two cuts expected by year’s end — a shift from earlier predictions of just one.

Following the release of the inflation data, the pound experienced a slight dip, falling to $1.2825 from $1.2858.

The ONS figures were released alongside a report from the Institute for Fiscal Studies (IFS), which highlighted that poorer UK households endured significantly higher food price inflation compared to wealthier households during the cost of living crisis between 2021 and 2023.

The ONS reported that food and non-alcoholic beverage prices increased by 1.5% in the year to July, the same rate as in June, marking the joint lowest annual rate since October 2021. However, for the first time since March 2023, the annual rate did not decrease.