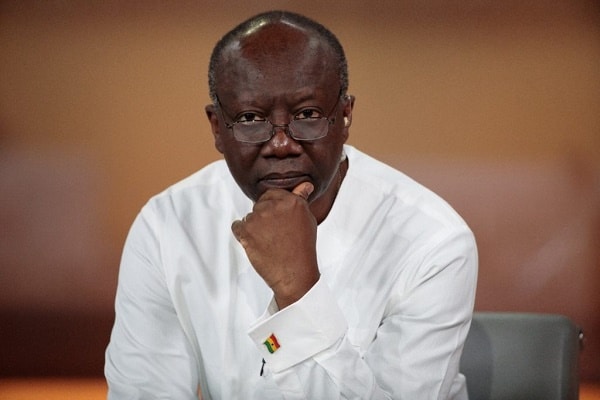

Hon. Kenneth Nana Yaw Ofori-Atta, Finance Minister, has announced that there will be no further extension of the Domestic Debt Exchange Programme (DDEP) beyond the stipulated date, January 31, 2023.

According to the Finance Minister, he believes the government will successfully secure the 80% support needed to implement the policy and receive approval from the International Monetary Fund.

Ofori-Atta pointed out that the government is operating on a tight schedule to bring in foreign exchange via the IMF agreement, which is crucial for the economy.

“I’m confident that we’ll get there you know; we have done the staff level agreement as you know. We met with the Paris Club membership and we have given them till end of February to go through what we call the common framework or some version of it but that will be facilitated and then, we expect them to go to board in Washington in March.”

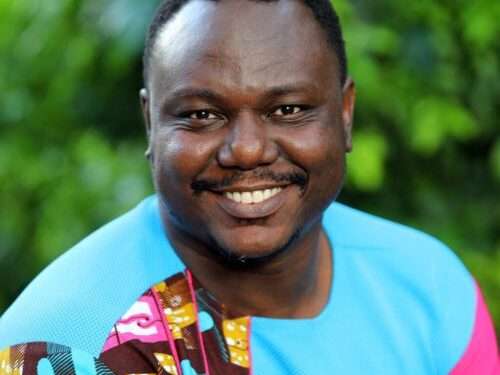

Ofori-Atta

Ofori Atta also mentioned that the country had no luxury of time to waste. Any further delays Ofori-Atta said, could harm the economy and financial situation in Ghana.

“So really, we don’t have that type of time, because as you know.., usually the first quarter is when we would have gone to the international capital market for our usual Eurobond issuance.

“Now that market is not there for us this year, maybe even next year, an agreement in the fund programme is what one is using to give the necessary comfort that is required.”

Ofori-Atta

In the interim, in response to resistance from individual bondholders and collective investment schemes, the government has begun engagement with them to address their concerns regarding their inclusion in the DDEP.

That notwithstanding, some investors are still pleading on the government to be totally exempted from the programme.

DDEP: Association of Rural Banks Plead To Be Exempted

The Debt Exchange negotiations are still on as the Ghanaian Association of Rural Banks have asked that government exempts them from the Exchange Programme.

The Association stated having over 40% of their investments in government bonds, amounting to ¢753 million, thus, believe that adding them to the debt exchange program will be detrimental to their operations.

Adding on, the Association disclosed it still has some funds locked up in a letter addressed to the Finance Minister. This, they attributed to the financial sector clean-up done in six( 6) years ago (2017).

“The RCBs (Rural and Community Banks) still have a significant proportion of their funds amounting to ¢460 million locked up with various fund management companies after the completion of the financial sector reforms.”

The Association of Rural Banks, Ghana

All attempts made at getting the Securities and Exchange Commission (SEC) and other regulators to intervene to get the funds released to RCBs have been futile, the Association said.

“Any haircut or unilateral rescheduling of coupon payments would, therefore, significantly affect the operations of the rural banks. It will mostly affect their liquidity and solvency position especially when these banks are already reeling under the current precarious economic situation facing the country.”

The Association of Rural Banks, Ghana

As part of its efforts to revive the economy and secure an agreement with the International Monetary Fund (IMF), the government has proposed that bondholders will not receive any interest payments on their bonds for the 2023 fiscal year.

The government stated that dividends will likely start to be paid out next year, 2024, but at a reduced rate of 5%.

As a result, bondholders who wish to transfer their bonds will not be able to recover the full original principal invested in the bonds.

Since the proposal was announced, it has been met with rejection by numerous bondholders, who are expressing disappointment over the situation.

The bondholders believe that if the proposal is carried out, they will incur significant losses, with some stating that their investments may no longer be profitable. Others especially, old pensioners grieve the DDEP with its associated terms and conditions will mean for them death.

It is based on all these and even more that Martin Kpebu, a private legal practitioner and vocal critic of the policy, described the program as “a weapon of mass destruction.”

READ ALSO: We Cannot Put Aside Debt Exchange– Economist