Senior finance lecturer at the University of Cape Coast, Seyram Kawor, has revealed that the report on Ghana’s operational risk worsening between the end of 2022 and mid-2023, by the Economist Intelligence Unit (EIU) gives businesses the leverage of planning better to maximize returns on investments.

According to him, when it comes to the operational risk affecting the operations of companies in a particular country, generally the macroeconomic indicators; inflation, employment level, exchange rate of the country are considered. He stated that when those indicators are not very good, companies in the various countries find it very difficult to operate, and the interest rates might go up which results in the increase of prices of commodities in the country.

“For us in Ghana, and some countries in Africa, we’ve been hit by COVID-19, and COVID-19 coupled with the Russian-Ukraine war came in. So, that has heightened the operational performance of companies that live in Africa and the continent, thereby, affecting the prices of commodities that we have in the various markets. But this gives room for businesses to now plan very well and make sure that they strategize to ensure that they are able to maximize the returns they get on their investments.”

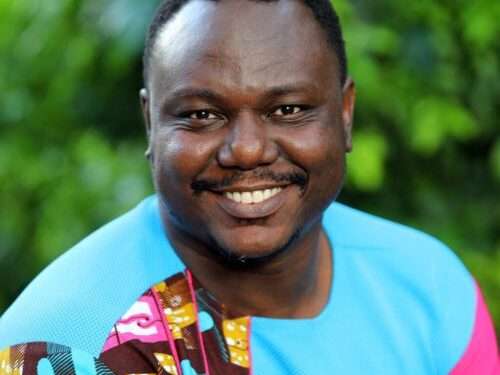

Seyram Kawor

Addressing operational risk challenges

Elaborating on the factors resulting in worsening operational risk of Ghanaian businesses, Mr Kawor indicated that such challenges can stem from both external and internal factors, that affect the operation of companies in Ghana. He explained that the external include the Russian-Ukraine war and the banking sector clean-up acting internally.

“We also have situations where our government was not able to manage the exchange rate very well, the domestic debt exchange that we also have over a period affected a lot of companies and individuals in the country, and that went a long way to affect the Bank of Ghana, where they have to increase the policy rate in the country.

“So, there are some factors that are external to us but then, largely, we can look at we not being able to manage the exchange rate system that we have in our country and the fiscal policies of government was not very good. We have increases in taxation within the period, and these increases have actually affected most of the businesses that are actually operating.”

Seyram Kawor

Mr Kawor stated that in recent times, Ghana has been able to secure the IMF deal which brings some level of stability. Also, he noted that it has however resulted in “inflation coming down and going up and we have seen the exchange rate stabilizing”, and government’s agreement with IMF in terms of zero financing of government programmes.

However, he highlighted that government must do more by prioritizing the needs of the country.

“Once we are able to prioritize the needs of the country, we will be able to do well. But my fear is that once we are entering an election year, and we have seen glimpses of the by-elections that have come and politicians tend to ignore all the policies and then the benchmarks that they have set for themselves, and that I think we need to go back and look at it and ensure that we follow what we have agreed with IMF and in the budget of the country.”

Seyram Kawor

The Economist Intelligence Unit latest Operational Risk Outlook revealed that Ghana is ranked among 16 out of 51 African countries whose operational risk worsened between the end of 2022 and mid-2023.

According to the UK-based firm, the worsening scores have been driven mainly by a deterioration in the macroeconomic risk subcategory. It stated that the operational risk scores for 16 of the 51 African countries in its Operational Risk Service worsened between end-2022 and mid-2023, including those for Ghana, Egypt and Sudan”.

This reflects the negative impact of rising domestic consumer prices on businesses’ profit margins and the wider implications for exchange rate and monetary policy.

READ ALSO: President Akufo-Addo Launches Phase II Of Planting For Food And Jobs Programme