China’s top state oil companies are aggressively pursuing plans to boost domestic fossil fuel output despite the nation’s energy transition journey gaining speed.

Oil and gas output results released by PetroChina and China National Offshore Oil Corp. Ltd showed increases in the first nine months of 2021.

According to analysts, most major state-owned companies are aiming to invest billions of dollars in subsequent years to ensure that the country’s upstream sector continues to see output growth, in line with expectations for energy security.

Kang Wu, head of Asia Analytics and Global Demand at S&P Global Platts, commented:

“China’s state oil companies will keep a unique focus on upstream sector investments given the country’s growing dependence on imported oil.

“With energy transition underway and the energy sector set to witness big changes in coming decades, it appears that Beijing wants to ensure that sufficient investments keep flowing in to boost domestic oil production for its own energy security. Whether or not this strategy works to prevent China’s oil production from eventually going down in the long run, remains to be seen.”

Kang Wu, S&P Global Platts

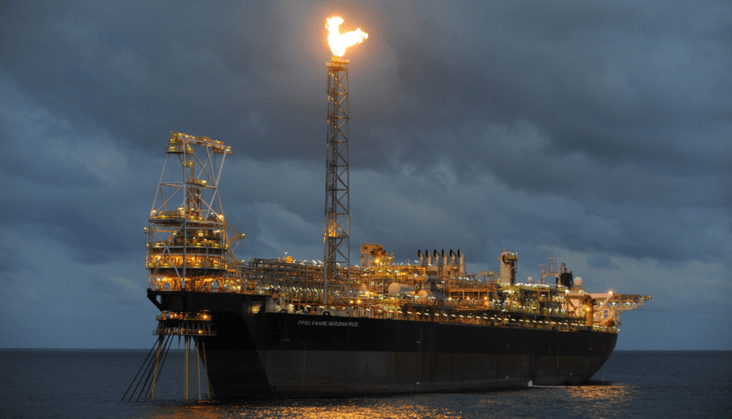

China National Offshore Oil Corporation’s (CNOOC) crude output jumped 11.5 per cent year on year to 233.9 million barrels in the nine month period. The rise in production over the nine-month period accounted for 90 per cent of China’s production increment of 26.79 million barrels during the period, the company’s recently released Q3 results showed.

Chinese Gov’t urges oil companies to raise output

Aside this, the Chinese government has been urging upstream companies to raise output and lift reserves to secure fossil energy supplies, while starting the nation’s energy transition journey.

Peng Li, research analyst at Rystad Energy noted that “as state-owned entities, China’s major operators are not solely profit-driven. “

He added that “they also play an important and integrated role in social economics. So even in a less favorable oil price environment, we expect Chinese NOCs to perform in line with government expectations and to continue to make an effort to shore up domestic supply.”

CNOOC has targeted its non-fossil resources to account for more than half of the company’s energy resource mix by 2050, and lift gas output to 35 per cent of its upstream production by 2025 from the current 21 per cent.

PetroChina is also aiming to meet its 2021 oil production target of 924 million barrels, or 2.53 million b/d. PetroChina produced 662.3 million barrels, or 2.43 million b/d, of crude over January-September, down 5.6 per cent year on year due to a 28.7 per cent slump in overseas output, the company’s results showed.

It is expected that China’s National oil companies will spend more than US$120 billion on drilling and well services in the 2021-2025 period, seeking to meet rising oil and gas demand.

Similarly, the country aims to supply more of its oil demand from domestic sources, after the share of imported crude oil has risen steadily from 2014 to a high of almost 75 per cent last year.

READ ALSO: Ghanacard to be recognized globally as an e-passport by 2022- Dr Bawumia