Ghanaians are grappling with rising fuel prices as petroleum costs surge for the third consecutive time this year, with Liquefied Petroleum Gas (LPG) experiencing the steepest increase.

This trend has raised concerns about inflationary pressures and economic strain on households and businesses. The implications of these hikes are far-reaching, particularly for those who rely heavily on fuel and Liquefied Petroleum Gas (LPG) for their daily operations.

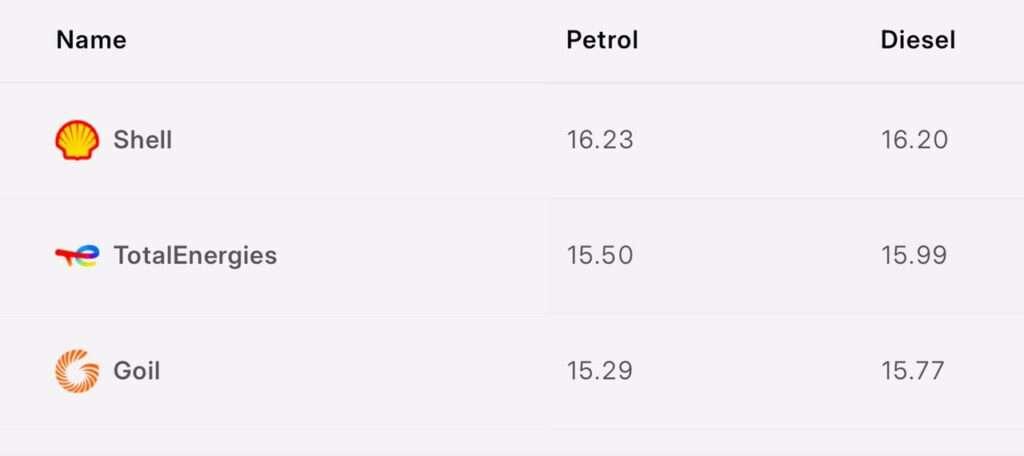

Recent data from Cedirates indicated the several Oil Marketing Companies (OMCs) have adjusted their prices upward in the first pricing window of February.

“The average price for Petrol is ₵14.60, compared to ₵13.96 three months ago.

“Today, it costs ₵730.00 to fill the tank of an average vehicle.”

Cedirates

The situation is compounded by the fact that petrol and diesel prices are expected to rise by approximately 2% per litre, while LPG could see an even steeper increase of 4.6% per kilogram.

Projections indicate that petrol prices could reach ₵15.72 per litre, while diesel may rise to ₵16.60 per litre. LPG, however, is set to witness the most significant hike, potentially reaching ₵18.20 per kilogram.

The adjustments made by Oil Marketing Companies (OMCs) reflect the broader trends in the global oil market, where fluctuations in crude oil prices and the depreciation of the Ghanaian Cedi have created a challenging environment for fuel pricing.

For instance, Shell has increased the price of petrol from GH₵15.59 per litre in late January to GH₵16.23, while diesel now sells at GH₵16.20 per litre, up from GH₵15.79.

In contrast, Star Oil has opted to maintain petrol prices at GH₵14.99 per litre but has raised diesel prices from GH₵14.99 to GH₵15.37 per litre.

This disparity in pricing strategies among OMCs highlights the competitive nature of the market, where companies may choose to absorb some costs to attract customers.

Factors Driving Fuel Price Hikes

The Chamber of Petroleum Consumers (COPEC) had previously predicted these slight price hikes, attributing them to rising global crude oil prices and the continued depreciation of the Cedi.

“The continued weakening of the Ghanaian Cedi against the US dollar means higher import costs for petroleum products.

“The currency devaluation has amplified the cost burden on both businesses and consumers.”

Chamber of Petroleum Consumers (COPEC)

As the cost of fuel rises, the implications for the average Ghanaian are profound. Households that rely on LPG for cooking and heating will feel the pinch, as the increased costs will likely lead to higher expenses in their monthly budgets.

For businesses, particularly those in the transportation and logistics sectors, the rising fuel prices could translate into increased operational costs, which may ultimately be passed on to consumers in the form of higher prices for goods and services.

Edudzi Tameklo, Acting CEO of the National Petroleum Authority (NPA), has assured consumers that measures are being implemented to stabilize fuel prices and mitigate the impact of future fluctuations. While this assurance is welcome, the effectiveness of these measures remains to be seen.

However, NPA’s ability to influence fuel prices is limited, particularly in a market that is heavily influenced by global oil prices and currency fluctuations.

As Ghanaians brace for the impact of rising fuel costs, it is essential for the government and relevant authorities to take proactive steps to address the underlying issues contributing to these price increases.

This includes exploring avenues for increasing domestic production of fuel, investing in alternative energy sources, and implementing policies that can help stabilize the Cedi against foreign currencies.

As fuel prices remain a central issue in Ghana’s economic landscape, sustained dialogue between stakeholders—including the government, OMCs, and consumer advocacy groups—will be essential in finding lasting solutions to mitigate the effects of these persistent price hikes.

READ ALSO: Bulls Retreat as Bears Lead First Session of February on GSE